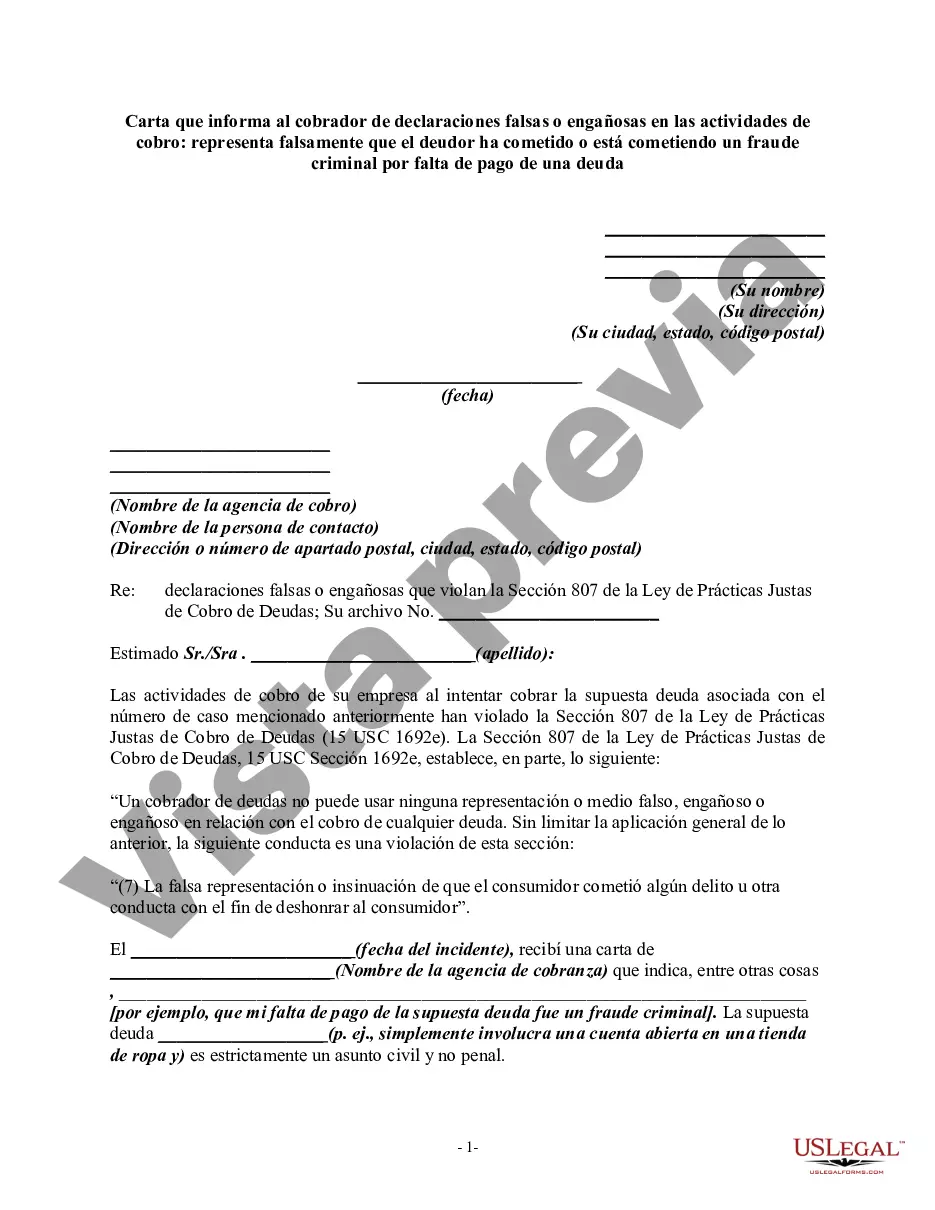

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(7) The false representation or implication that the consumer committed any crime or other conduct in order to disgrace the consumer."

Fulton Georgia is a county located in the state of Georgia, known for its vibrant community and diverse population. With a rich history and a thriving economy, Fulton Georgia is home to many businesses and residents. However, like any other place, debt collection activities can sometimes be misleading or falsely represent a debtor's actions. If you have been subjected to such false or misleading misrepresentations by a debt collector in Fulton Georgia, it's important to address the issue appropriately. One way to do so is by sending a letter informing the debt collector of their inaccurate claims regarding criminal fraud committed through nonpayment of a debt. This type of communication seeks to correct their misrepresentation and uphold your rights as a debtor. The letter should clearly outline the specific instances where the debt collector has made false or misleading statements regarding criminal fraud. It may be helpful to provide examples, such as specific dates and times of such representations, to strengthen your case. Be sure to point out how these misrepresentations have harmed your reputation and caused emotional distress. In Fulton Georgia, there might be various types of letters informing debt collectors of false or misleading misrepresentations related to criminal fraud by nonpayment of a debt. These can include: 1. Cease and Desist Letter: This type of letter demands that the debt collector immediately ceases any false or misleading representations regarding criminal fraud. It serves as a formal warning that legal action may be pursued if the behavior continues. 2. Dispute Letter: If the debt collector has inaccurately represented criminal fraud in an attempt to intimidate or coerce you into payment, a dispute letter can be sent to challenge these claims. This letter seeks to clarify the true nature of the debt and request proof of your alleged criminal actions. 3. Fair Debt Collection Practices Act (FD CPA) Violation Letter: If the debt collector's misrepresentations violate the FD CPA, a letter can be sent to notify them of their failure to comply with federal law. This letter may urge the debt collector to rectify their actions and provide compensation for any damages caused. Remember, it is essential to consult with a legal professional or Debt Collection Practices attorney familiar with the laws in Fulton Georgia to ensure your letter accurately reflects your situation and addresses any potential legal concerns.Fulton Georgia is a county located in the state of Georgia, known for its vibrant community and diverse population. With a rich history and a thriving economy, Fulton Georgia is home to many businesses and residents. However, like any other place, debt collection activities can sometimes be misleading or falsely represent a debtor's actions. If you have been subjected to such false or misleading misrepresentations by a debt collector in Fulton Georgia, it's important to address the issue appropriately. One way to do so is by sending a letter informing the debt collector of their inaccurate claims regarding criminal fraud committed through nonpayment of a debt. This type of communication seeks to correct their misrepresentation and uphold your rights as a debtor. The letter should clearly outline the specific instances where the debt collector has made false or misleading statements regarding criminal fraud. It may be helpful to provide examples, such as specific dates and times of such representations, to strengthen your case. Be sure to point out how these misrepresentations have harmed your reputation and caused emotional distress. In Fulton Georgia, there might be various types of letters informing debt collectors of false or misleading misrepresentations related to criminal fraud by nonpayment of a debt. These can include: 1. Cease and Desist Letter: This type of letter demands that the debt collector immediately ceases any false or misleading representations regarding criminal fraud. It serves as a formal warning that legal action may be pursued if the behavior continues. 2. Dispute Letter: If the debt collector has inaccurately represented criminal fraud in an attempt to intimidate or coerce you into payment, a dispute letter can be sent to challenge these claims. This letter seeks to clarify the true nature of the debt and request proof of your alleged criminal actions. 3. Fair Debt Collection Practices Act (FD CPA) Violation Letter: If the debt collector's misrepresentations violate the FD CPA, a letter can be sent to notify them of their failure to comply with federal law. This letter may urge the debt collector to rectify their actions and provide compensation for any damages caused. Remember, it is essential to consult with a legal professional or Debt Collection Practices attorney familiar with the laws in Fulton Georgia to ensure your letter accurately reflects your situation and addresses any potential legal concerns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.