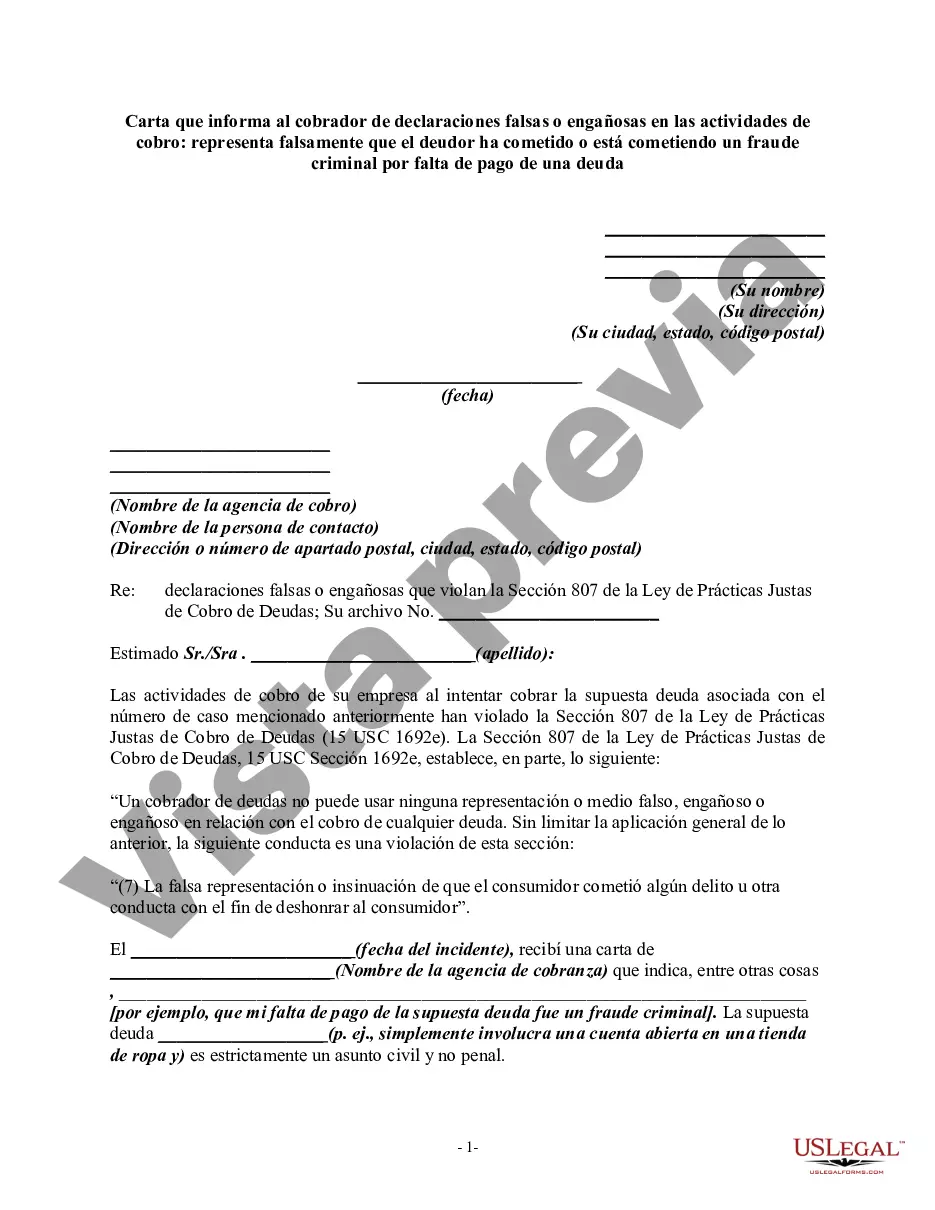

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(7) The false representation or implication that the consumer committed any crime or other conduct in order to disgrace the consumer."

Hennepin County, Minnesota is the most populous county in the state and home to the city of Minneapolis. If you are facing false or misleading misrepresentations from a debt collector in Hennepin County, it is essential to understand your rights and take action to protect yourself. One type of letter you may consider sending is a "Hennepin Minnesota Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing that Debtor has or is Committing Criminal Fraud by Nonpayment of a Debt." This letter aims to address situations where the debt collector falsely accuses you of engaging in criminal fraud due to nonpayment. In this letter, it is crucial to include the following key elements: 1. Your identification: Begin the letter by clearly stating your full name, address, and contact information. This will ensure that the debt collector can accurately identify you and respond accordingly. 2. Debt details: Specify the debt in question, including the original creditor's name, the amount owed, and any relevant account or reference numbers. Also, clearly state the date when you received the debt collector's misleading communication. 3. False or misleading misrepresentations: Provide a detailed account of the false or misleading statements made by the debt collector, specifically emphasizing their representation that you have committed or are engaging in criminal fraud due to nonpayment. Be as specific as possible, quoting any relevant statements made by the debt collector. 4. Legal rights and violations: Highlight your rights as a consumer under the Fair Debt Collection Practices Act (FD CPA) and any applicable state laws in Minnesota. Explain how the debt collector's false or misleading misrepresentations violate these rights. Mention that their actions are unfair, deceptive, and violate the FD CPA's provisions against false, deceptive, or misleading practices. 5. Demand for corrective action: Request that the debt collector immediately cease making false or misleading statements about your criminal behavior due to nonpayment of the debt. Ask them to confirm in writing that they will no longer engage in such misrepresentation. Additionally, demand that they provide a written acknowledgment of their violations and any corrective measures they will take. 6. Consequences: State that failure to comply with your request may result in a formal complaint filed with the Consumer Financial Protection Bureau (CFPB), the Minnesota Attorney General's office, and potentially legal action. Make it clear that you are serious about protecting your rights and will pursue all available remedies if necessary. Remember to keep a copy of the letter for your records and consider sending it via certified mail with a return receipt to ensure proof of delivery. Keeping accurate documentation of your interactions with the debt collector is vital should you need it for any future legal proceedings. By sending a detailed and informative letter addressing the false or misleading misrepresentations, you are taking an important step in defending your rights and holding debt collectors accountable for their actions.Hennepin County, Minnesota is the most populous county in the state and home to the city of Minneapolis. If you are facing false or misleading misrepresentations from a debt collector in Hennepin County, it is essential to understand your rights and take action to protect yourself. One type of letter you may consider sending is a "Hennepin Minnesota Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing that Debtor has or is Committing Criminal Fraud by Nonpayment of a Debt." This letter aims to address situations where the debt collector falsely accuses you of engaging in criminal fraud due to nonpayment. In this letter, it is crucial to include the following key elements: 1. Your identification: Begin the letter by clearly stating your full name, address, and contact information. This will ensure that the debt collector can accurately identify you and respond accordingly. 2. Debt details: Specify the debt in question, including the original creditor's name, the amount owed, and any relevant account or reference numbers. Also, clearly state the date when you received the debt collector's misleading communication. 3. False or misleading misrepresentations: Provide a detailed account of the false or misleading statements made by the debt collector, specifically emphasizing their representation that you have committed or are engaging in criminal fraud due to nonpayment. Be as specific as possible, quoting any relevant statements made by the debt collector. 4. Legal rights and violations: Highlight your rights as a consumer under the Fair Debt Collection Practices Act (FD CPA) and any applicable state laws in Minnesota. Explain how the debt collector's false or misleading misrepresentations violate these rights. Mention that their actions are unfair, deceptive, and violate the FD CPA's provisions against false, deceptive, or misleading practices. 5. Demand for corrective action: Request that the debt collector immediately cease making false or misleading statements about your criminal behavior due to nonpayment of the debt. Ask them to confirm in writing that they will no longer engage in such misrepresentation. Additionally, demand that they provide a written acknowledgment of their violations and any corrective measures they will take. 6. Consequences: State that failure to comply with your request may result in a formal complaint filed with the Consumer Financial Protection Bureau (CFPB), the Minnesota Attorney General's office, and potentially legal action. Make it clear that you are serious about protecting your rights and will pursue all available remedies if necessary. Remember to keep a copy of the letter for your records and consider sending it via certified mail with a return receipt to ensure proof of delivery. Keeping accurate documentation of your interactions with the debt collector is vital should you need it for any future legal proceedings. By sending a detailed and informative letter addressing the false or misleading misrepresentations, you are taking an important step in defending your rights and holding debt collectors accountable for their actions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.