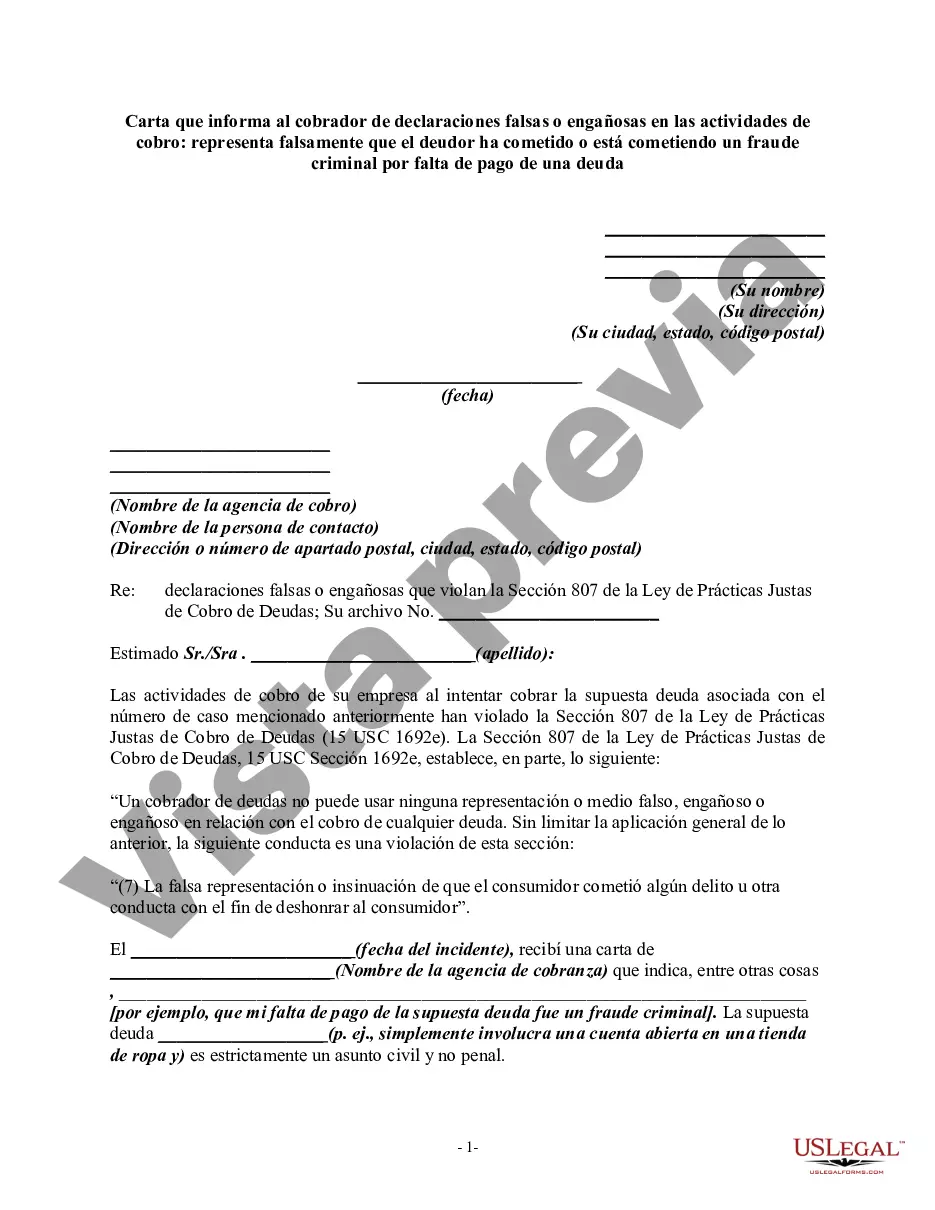

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(7) The false representation or implication that the consumer committed any crime or other conduct in order to disgrace the consumer."

Houston Texas is a vibrant and diverse city located in the southeastern part of the state. Known for its rich cultural heritage, world-class dining, and bustling energy industry, Houston offers a unique blend of urban sophistication and Texan charm. As the fourth largest city in the United States, it is a hub for business, education, and entertainment. When it comes to dealing with debt collectors, it is essential to be aware of your rights and protect yourself from false or misleading information. If a debt collector falsely represents that you have committed criminal fraud by nonpayment of a debt, you have the right to address this issue in writing to ensure your rights are protected. A Houston Texas letter informing a debt collector of false or misleading misrepresentations in collection activities involves communicating your concerns with the collector. The primary purpose of this letter is to assert that their claims of criminal fraud are baseless and untrue. By doing so, you are requesting that they cease making such misrepresentations and provide accurate information regarding your debt. Some key points to include in the letter are: 1. Your identification details: Begin the letter by providing your full name, current address, and any relevant account numbers or references related to the debt. 2. Debt collector's information: Include the name and contact details of the debt collector, such as their company name, mailing address, and phone number. 3. False or misleading misrepresentations: Clearly state the specific instances where the debt collector falsely represented that you have committed criminal fraud by not paying the debt. Back up your claims with any evidence or documentation supporting your position. 4. Reference to federal laws: Mention that their false or misleading representations violate the Fair Debt Collection Practices Act (FD CPA) and other applicable state and federal laws. Provide specific sections of the law that protect you against such deceptive collection practices. 5. Cease and desist request: Clearly state that you demand the debt collector immediately stop making any false or misleading representations regarding criminal fraud. Request written confirmation within a specified timeframe that they have ceased this conduct. 6. Proper debt verification: Request that the debt collector provide accurate and complete documentation verifying the debt owed. Remind them of their obligation under the FD CPA to provide this information upon your written request. 7. Legal consequences: Inform the debt collector that you are aware of your rights under the law and that their continued false or misleading misrepresentations may result in legal action against them. Remember, it is important to customize the letter according to your specific situation and consult with legal professionals if needed. It is advisable to send the letter via certified mail with a return receipt requested to ensure there is a record of your communication. Different variations of this letter might include specific details regarding the nature of the debt, references to state laws in Texas or additional federal laws like the Consumer Financial Protection Bureau guidelines, and a more detailed explanation or evidence refuting the false or misleading misrepresentations made by the debt collector.Houston Texas is a vibrant and diverse city located in the southeastern part of the state. Known for its rich cultural heritage, world-class dining, and bustling energy industry, Houston offers a unique blend of urban sophistication and Texan charm. As the fourth largest city in the United States, it is a hub for business, education, and entertainment. When it comes to dealing with debt collectors, it is essential to be aware of your rights and protect yourself from false or misleading information. If a debt collector falsely represents that you have committed criminal fraud by nonpayment of a debt, you have the right to address this issue in writing to ensure your rights are protected. A Houston Texas letter informing a debt collector of false or misleading misrepresentations in collection activities involves communicating your concerns with the collector. The primary purpose of this letter is to assert that their claims of criminal fraud are baseless and untrue. By doing so, you are requesting that they cease making such misrepresentations and provide accurate information regarding your debt. Some key points to include in the letter are: 1. Your identification details: Begin the letter by providing your full name, current address, and any relevant account numbers or references related to the debt. 2. Debt collector's information: Include the name and contact details of the debt collector, such as their company name, mailing address, and phone number. 3. False or misleading misrepresentations: Clearly state the specific instances where the debt collector falsely represented that you have committed criminal fraud by not paying the debt. Back up your claims with any evidence or documentation supporting your position. 4. Reference to federal laws: Mention that their false or misleading representations violate the Fair Debt Collection Practices Act (FD CPA) and other applicable state and federal laws. Provide specific sections of the law that protect you against such deceptive collection practices. 5. Cease and desist request: Clearly state that you demand the debt collector immediately stop making any false or misleading representations regarding criminal fraud. Request written confirmation within a specified timeframe that they have ceased this conduct. 6. Proper debt verification: Request that the debt collector provide accurate and complete documentation verifying the debt owed. Remind them of their obligation under the FD CPA to provide this information upon your written request. 7. Legal consequences: Inform the debt collector that you are aware of your rights under the law and that their continued false or misleading misrepresentations may result in legal action against them. Remember, it is important to customize the letter according to your specific situation and consult with legal professionals if needed. It is advisable to send the letter via certified mail with a return receipt requested to ensure there is a record of your communication. Different variations of this letter might include specific details regarding the nature of the debt, references to state laws in Texas or additional federal laws like the Consumer Financial Protection Bureau guidelines, and a more detailed explanation or evidence refuting the false or misleading misrepresentations made by the debt collector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.