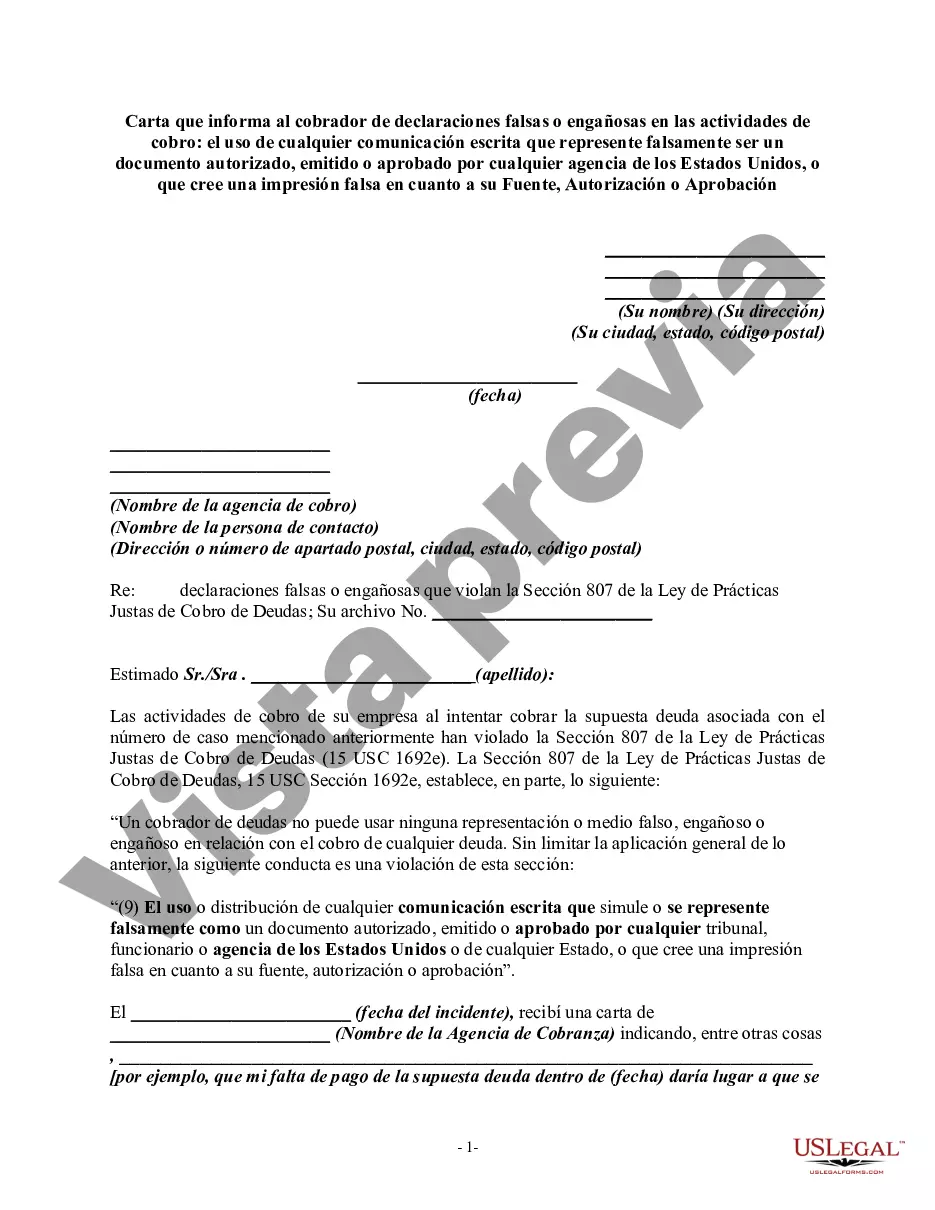

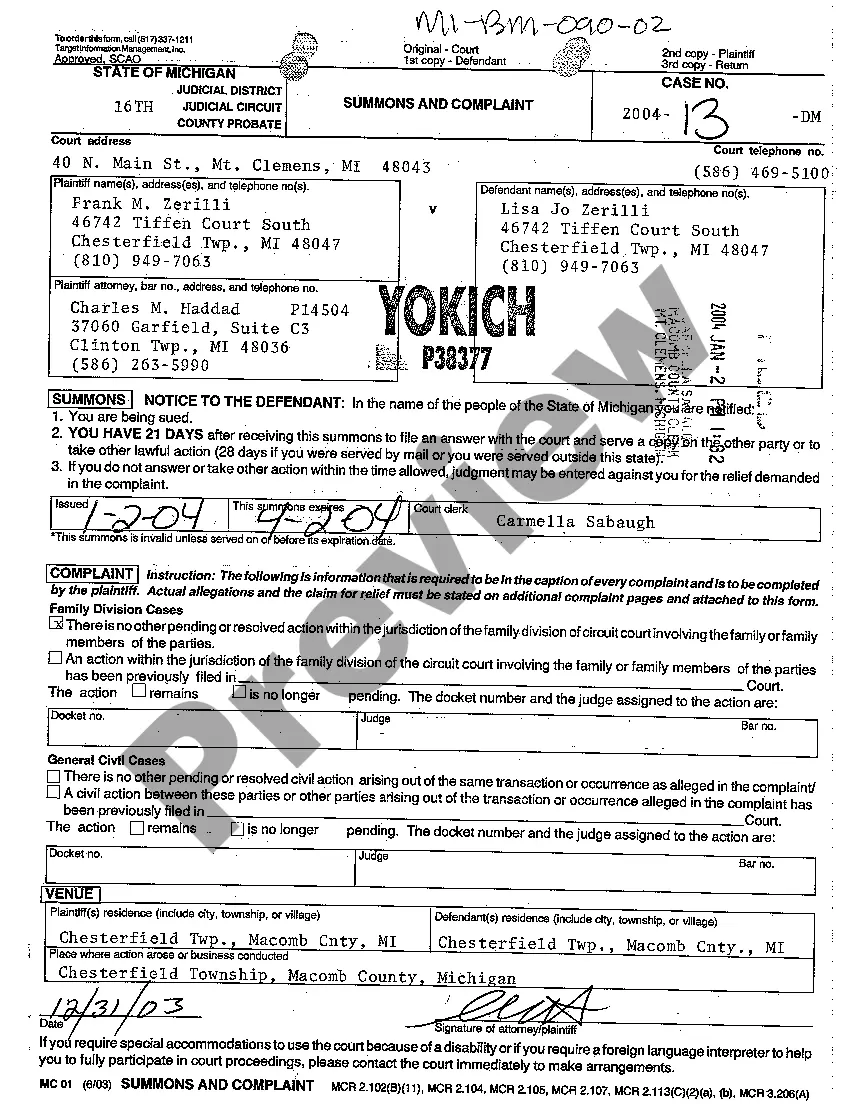

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(9) The use or distribution of any written communication which simulates or is falsely represented to be a document authorized, issued, or approved by any court, official, or agency of the United States or any State, or which creates a false impression as to its source, authorization, or approval."

San Diego, California, is a vibrant coastal city located in the southern part of the state. Known for its beautiful beaches, warm weather, and laid-back lifestyle, San Diego offers a plethora of attractions and activities for residents and tourists alike. Now, let's focus on the topic of a letter informing a debt collector of false or misleading misrepresentations in collection activities that involve the use of written communication falsely representing to be a document authorized, issued, or approved by any agency of the United States. One such type of letter is a "Cease and Desist Letter." This type of correspondence is typically sent to a debt collector informing them of their false or misleading misrepresentations in the collection process. A Cease and Desist Letter serves as a formal request for the debt collector to stop engaging in unlawful activities, such as falsely representing themselves as an agency of the United States. Another type of letter that can be used in this situation is a "Debt Validation Letter." This letter requests the debt collector to provide proof of the debt's validity and verification of their authorization to collect it. Within this letter, the sender can address any false or misleading misrepresentations made by the debt collector, specifically relating to the issue of falsely representing themselves as an agency of the United States. In both types of letters, it is essential to include relevant keywords to accurately describe the issue and establish a clear message. Some relevant keywords to consider include: debt collector, false misrepresentations, misleading information, written communication, document, authorized, issued, approved, agency, United States, unlawful activities, Cease and Desist Letter, and Debt Validation Letter. When drafting the letter, it is crucial to provide detailed information about the false or misleading misrepresentations encountered, highlighting specific instances or examples. This will help strengthen your case and emphasize the severity of the debt collector's actions. It is also recommended including supporting evidence, such as copies of any questionable written communication, to further substantiate your claims. In conclusion, if you find yourself dealing with a debt collector that falsely represents themselves as an agency of the United States, sending a letter informing them of their false or misleading misrepresentations is a crucial step in protecting your rights. Whether you choose to use a Cease and Desist Letter or a Debt Validation Letter, be sure to include relevant keywords that accurately convey the issue at hand.San Diego, California, is a vibrant coastal city located in the southern part of the state. Known for its beautiful beaches, warm weather, and laid-back lifestyle, San Diego offers a plethora of attractions and activities for residents and tourists alike. Now, let's focus on the topic of a letter informing a debt collector of false or misleading misrepresentations in collection activities that involve the use of written communication falsely representing to be a document authorized, issued, or approved by any agency of the United States. One such type of letter is a "Cease and Desist Letter." This type of correspondence is typically sent to a debt collector informing them of their false or misleading misrepresentations in the collection process. A Cease and Desist Letter serves as a formal request for the debt collector to stop engaging in unlawful activities, such as falsely representing themselves as an agency of the United States. Another type of letter that can be used in this situation is a "Debt Validation Letter." This letter requests the debt collector to provide proof of the debt's validity and verification of their authorization to collect it. Within this letter, the sender can address any false or misleading misrepresentations made by the debt collector, specifically relating to the issue of falsely representing themselves as an agency of the United States. In both types of letters, it is essential to include relevant keywords to accurately describe the issue and establish a clear message. Some relevant keywords to consider include: debt collector, false misrepresentations, misleading information, written communication, document, authorized, issued, approved, agency, United States, unlawful activities, Cease and Desist Letter, and Debt Validation Letter. When drafting the letter, it is crucial to provide detailed information about the false or misleading misrepresentations encountered, highlighting specific instances or examples. This will help strengthen your case and emphasize the severity of the debt collector's actions. It is also recommended including supporting evidence, such as copies of any questionable written communication, to further substantiate your claims. In conclusion, if you find yourself dealing with a debt collector that falsely represents themselves as an agency of the United States, sending a letter informing them of their false or misleading misrepresentations is a crucial step in protecting your rights. Whether you choose to use a Cease and Desist Letter or a Debt Validation Letter, be sure to include relevant keywords that accurately convey the issue at hand.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.