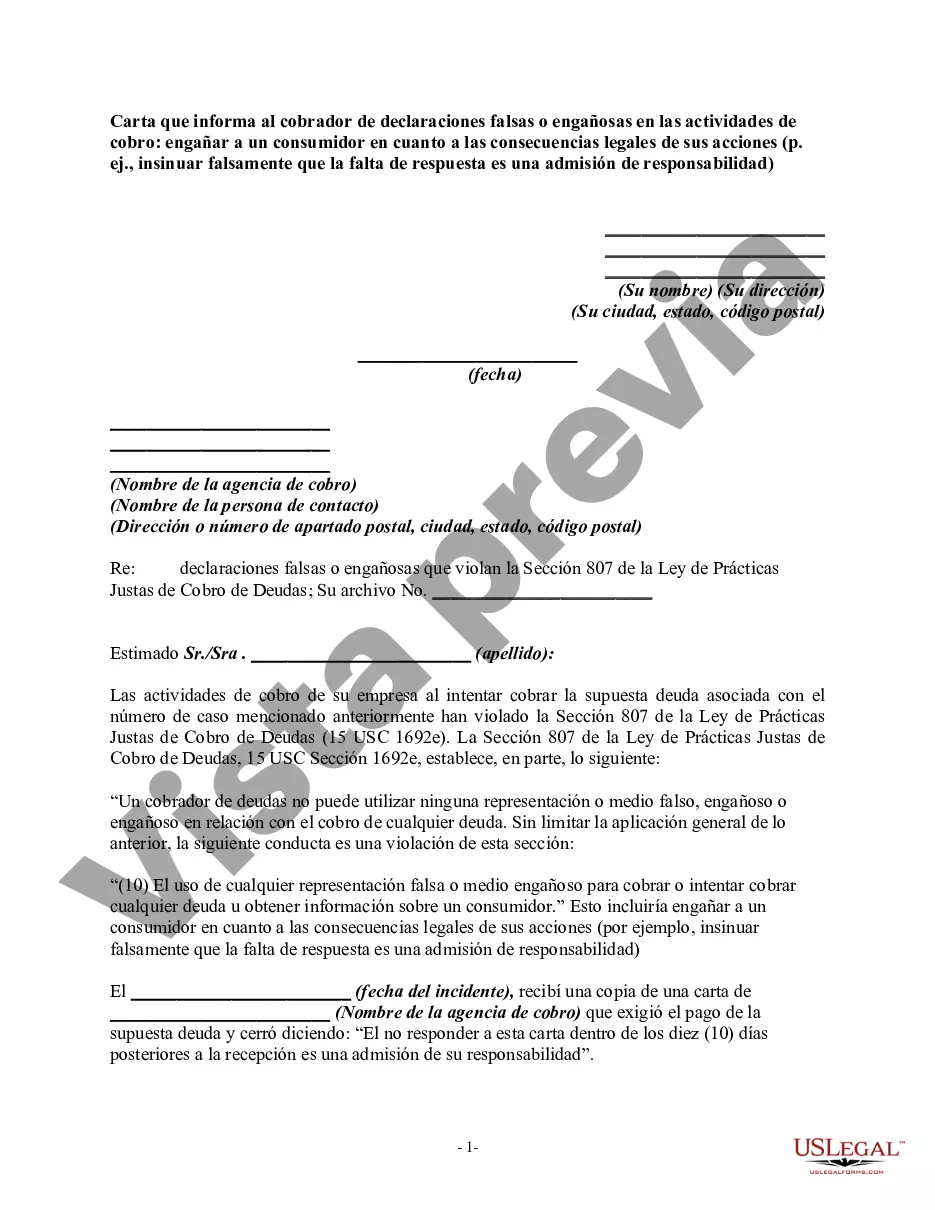

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include misleading a consumer as to the legal consequences of their actions (e.g., falsely implying that a failure to respond is an admission of liability).

Subject: Concerns Regarding False or Misleading Misrepresentations by Debt Collector in Riverside, California Dear [Debt Collector's Name], I am writing to bring to your attention some serious concerns regarding the collection activities conducted by your agency in Riverside, California. It has come to my attention that there have been instances where false or misleading information has been provided to consumers regarding the legal consequences of their actions or inaction. This communication aims to highlight and rectify such misleading practices in accordance with the applicable laws and regulations. It has been brought to my attention that your agency has, on occasion, falsely implied that a failure to respond to collection attempts is an admission of liability. Such misleading misrepresentations can create unnecessary confusion and place a burden on consumers who may not be aware of their rights and responsibilities in debt collection matters. This kind of misinformation is not only unethical but may also violate various consumer protection laws established to safeguard individuals from unfair and deceptive practices. As a responsible consumer, I feel the need to bring these issues to your attention to ensure fair and transparent debt collection practices while respecting the rights of individuals. I kindly request that your agency takes immediate steps to address the following concerns: 1. Cease Misleading Representations: Your collectors should refrain from making false or misleading statements, including implying that the failure to respond is an admission of liability, in any communication with consumers regarding debt collection matters. 2. Provide Accurate Information: Ensure that all information provided to consumers is accurate and clearly conveys the legal consequences, rights, and obligations associated with their specific debt situation. Avoid any language or statement that may confuse or intimidate the consumer. 3. Reevaluate Collection Procedures: Conduct a thorough review of your agency's collection procedures to identify any misleading practices and implement corrective measures that comply with relevant federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA) and the California Fair Debt Collection Practices Act (CFD CPA). 4. Training and Education: Provide comprehensive training to your employees, specifically emphasizing compliance with applicable laws and regulations, including ethical debt collection practices and avoiding false or misleading representations. By addressing these concerns promptly and diligently, your agency can demonstrate its commitment to fair and lawful debt collection practices, furthering the protection of consumers' rights and building trust within the community. Please consider this letter as a formal notification of these issues, and I expect a timely response outlining the steps your agency will take to rectify the situation. Failure to do so may result in the necessary escalation of this matter to the appropriate legal authorities, as well as the filing of a formal complaint with relevant regulatory bodies. I trust that you will give this matter the attention it deserves and take the necessary corrective actions to ensure compliance with the law. I look forward to receiving your prompt response. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address]Subject: Concerns Regarding False or Misleading Misrepresentations by Debt Collector in Riverside, California Dear [Debt Collector's Name], I am writing to bring to your attention some serious concerns regarding the collection activities conducted by your agency in Riverside, California. It has come to my attention that there have been instances where false or misleading information has been provided to consumers regarding the legal consequences of their actions or inaction. This communication aims to highlight and rectify such misleading practices in accordance with the applicable laws and regulations. It has been brought to my attention that your agency has, on occasion, falsely implied that a failure to respond to collection attempts is an admission of liability. Such misleading misrepresentations can create unnecessary confusion and place a burden on consumers who may not be aware of their rights and responsibilities in debt collection matters. This kind of misinformation is not only unethical but may also violate various consumer protection laws established to safeguard individuals from unfair and deceptive practices. As a responsible consumer, I feel the need to bring these issues to your attention to ensure fair and transparent debt collection practices while respecting the rights of individuals. I kindly request that your agency takes immediate steps to address the following concerns: 1. Cease Misleading Representations: Your collectors should refrain from making false or misleading statements, including implying that the failure to respond is an admission of liability, in any communication with consumers regarding debt collection matters. 2. Provide Accurate Information: Ensure that all information provided to consumers is accurate and clearly conveys the legal consequences, rights, and obligations associated with their specific debt situation. Avoid any language or statement that may confuse or intimidate the consumer. 3. Reevaluate Collection Procedures: Conduct a thorough review of your agency's collection procedures to identify any misleading practices and implement corrective measures that comply with relevant federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA) and the California Fair Debt Collection Practices Act (CFD CPA). 4. Training and Education: Provide comprehensive training to your employees, specifically emphasizing compliance with applicable laws and regulations, including ethical debt collection practices and avoiding false or misleading representations. By addressing these concerns promptly and diligently, your agency can demonstrate its commitment to fair and lawful debt collection practices, furthering the protection of consumers' rights and building trust within the community. Please consider this letter as a formal notification of these issues, and I expect a timely response outlining the steps your agency will take to rectify the situation. Failure to do so may result in the necessary escalation of this matter to the appropriate legal authorities, as well as the filing of a formal complaint with relevant regulatory bodies. I trust that you will give this matter the attention it deserves and take the necessary corrective actions to ensure compliance with the law. I look forward to receiving your prompt response. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.