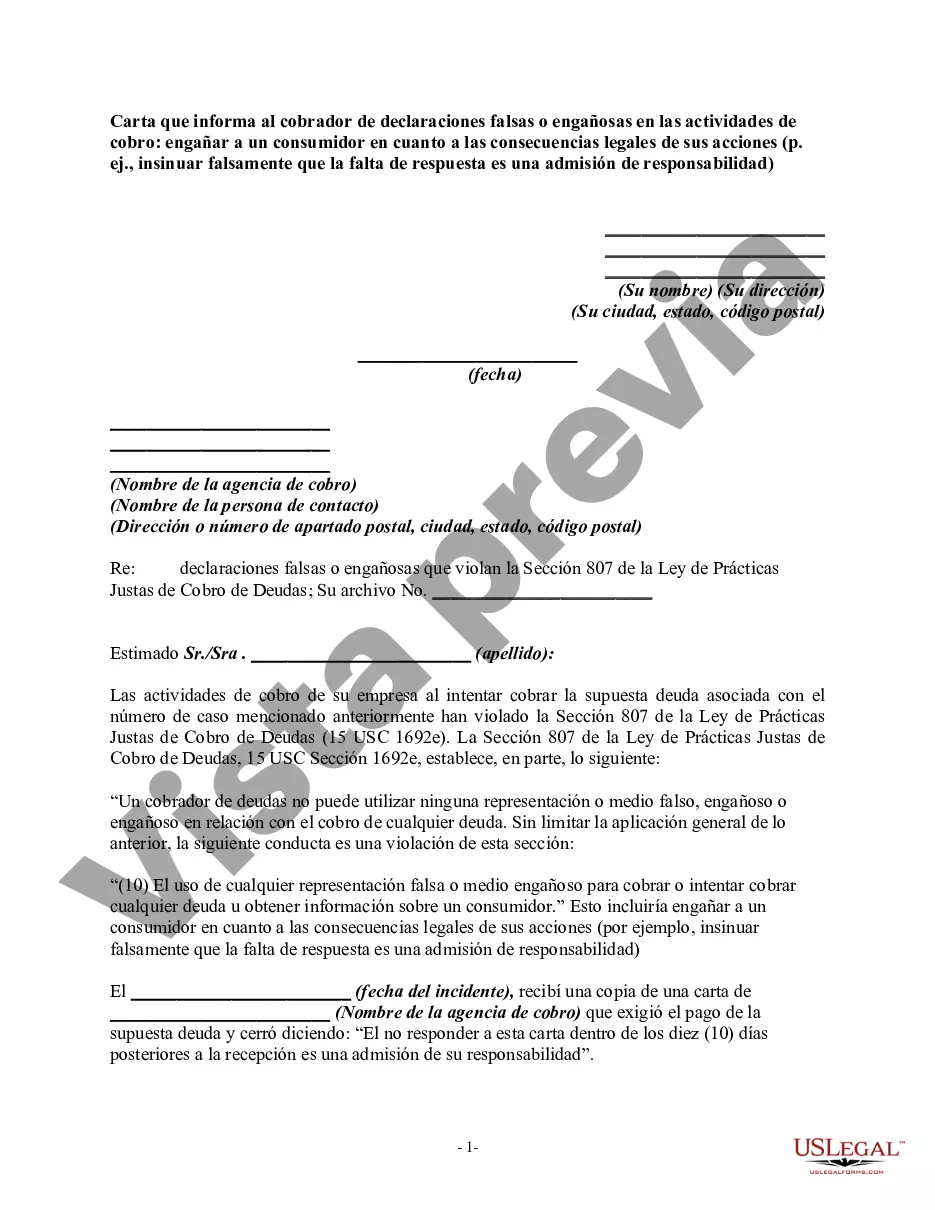

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include misleading a consumer as to the legal consequences of their actions (e.g., falsely implying that a failure to respond is an admission of liability).

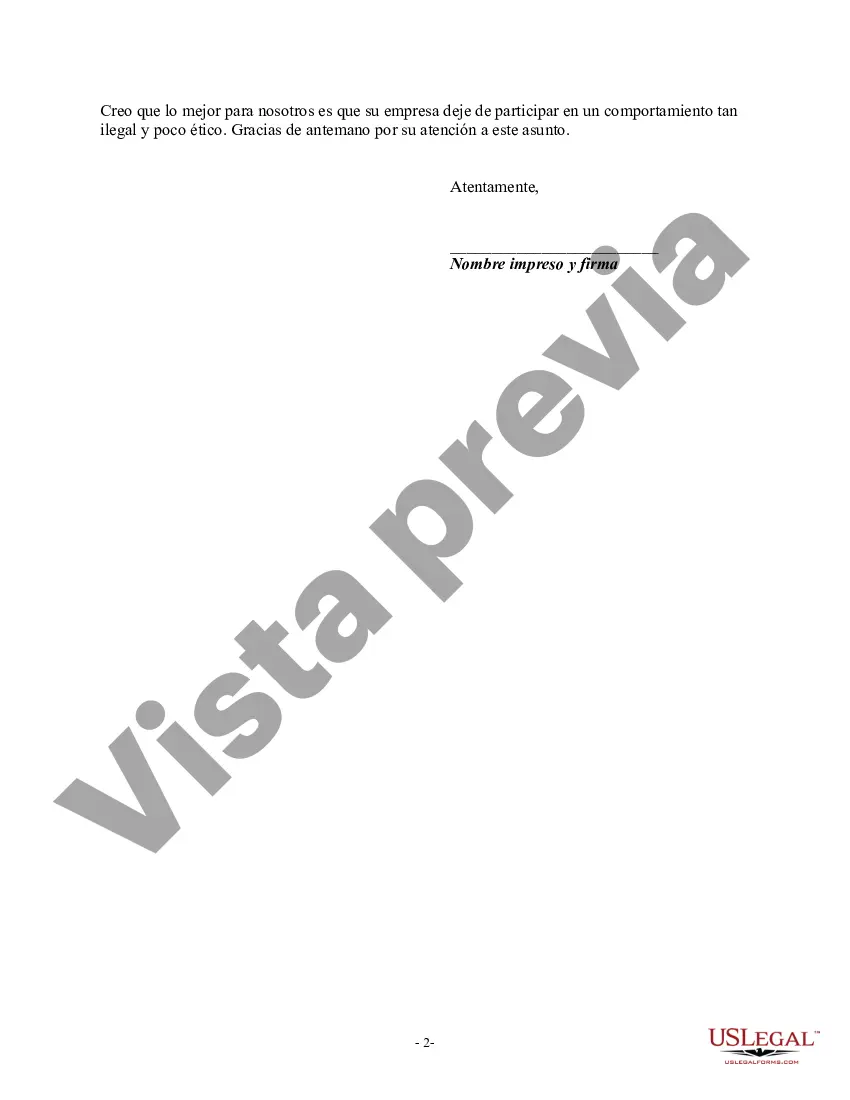

[Your Name] [Your Address] [City, State, ZIP] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, ZIP] Subject: [Account Number/ Reference Number] Dear [Debt Collector's Name], I am writing to bring to your attention certain false and misleading misrepresentations made by your agency in your collection activities regarding the debt associated with the above-referenced account. It has come to my attention that your company has engaged in deceptive practices, particularly misleading a consumer, myself, as to the legal consequences of my actions. One specific instance of this deceptive behavior involves the false implication that a failure to respond to your collection attempts constitutes an admission of liability. According to the Fair Debt Collection Practices Act (FD CPA) Section 807(10), debt collectors are prohibited from using false, deceptive, or misleading representations in connection with the collection of any debt. As a well-informed consumer, I am aware that a failure to respond to debt collection efforts does not automatically imply an admission of liability or guilt. It is essential for debt collectors to convey accurate information and refrain from presenting false legal consequences to coerce or deceive consumers into making monetary repayments. By engaging in this misleading practice, your agency is in direct violation of the FD CPA and other state and federal laws governing fair debt collection practices. Specifically, the FD CPA Section 807(10) states that "The false representation or implication that nonpayment of any debt will result in the arrest or imprisonment of any person or the seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action." I demand that your agency immediately ceases any further attempts to mislead or deceive me regarding the legal consequences of my actions. Failure to comply with this request will result in formal complaints being lodged with the Federal Trade Commission, the Consumer Financial Protection Bureau, and other applicable regulatory authorities. Furthermore, I hereby request that you provide written verification of the debt within thirty (30) days, as stipulated by the FD CPA Section 809(b). This verification should include the name and address of the original creditor, the original account number, the outstanding balance, and any supporting documentation establishing the debt's validity. Please take this matter seriously and respond promptly to rectify the deceptive practices employed by your agency. I expect your full cooperation and adherence to the laws governing debt collection activities moving forward. Thank you for your immediate attention to this matter. Sincerely, [Your Name][Your Name] [Your Address] [City, State, ZIP] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, ZIP] Subject: [Account Number/ Reference Number] Dear [Debt Collector's Name], I am writing to bring to your attention certain false and misleading misrepresentations made by your agency in your collection activities regarding the debt associated with the above-referenced account. It has come to my attention that your company has engaged in deceptive practices, particularly misleading a consumer, myself, as to the legal consequences of my actions. One specific instance of this deceptive behavior involves the false implication that a failure to respond to your collection attempts constitutes an admission of liability. According to the Fair Debt Collection Practices Act (FD CPA) Section 807(10), debt collectors are prohibited from using false, deceptive, or misleading representations in connection with the collection of any debt. As a well-informed consumer, I am aware that a failure to respond to debt collection efforts does not automatically imply an admission of liability or guilt. It is essential for debt collectors to convey accurate information and refrain from presenting false legal consequences to coerce or deceive consumers into making monetary repayments. By engaging in this misleading practice, your agency is in direct violation of the FD CPA and other state and federal laws governing fair debt collection practices. Specifically, the FD CPA Section 807(10) states that "The false representation or implication that nonpayment of any debt will result in the arrest or imprisonment of any person or the seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action." I demand that your agency immediately ceases any further attempts to mislead or deceive me regarding the legal consequences of my actions. Failure to comply with this request will result in formal complaints being lodged with the Federal Trade Commission, the Consumer Financial Protection Bureau, and other applicable regulatory authorities. Furthermore, I hereby request that you provide written verification of the debt within thirty (30) days, as stipulated by the FD CPA Section 809(b). This verification should include the name and address of the original creditor, the original account number, the outstanding balance, and any supporting documentation establishing the debt's validity. Please take this matter seriously and respond promptly to rectify the deceptive practices employed by your agency. I expect your full cooperation and adherence to the laws governing debt collection activities moving forward. Thank you for your immediate attention to this matter. Sincerely, [Your Name]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.