Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

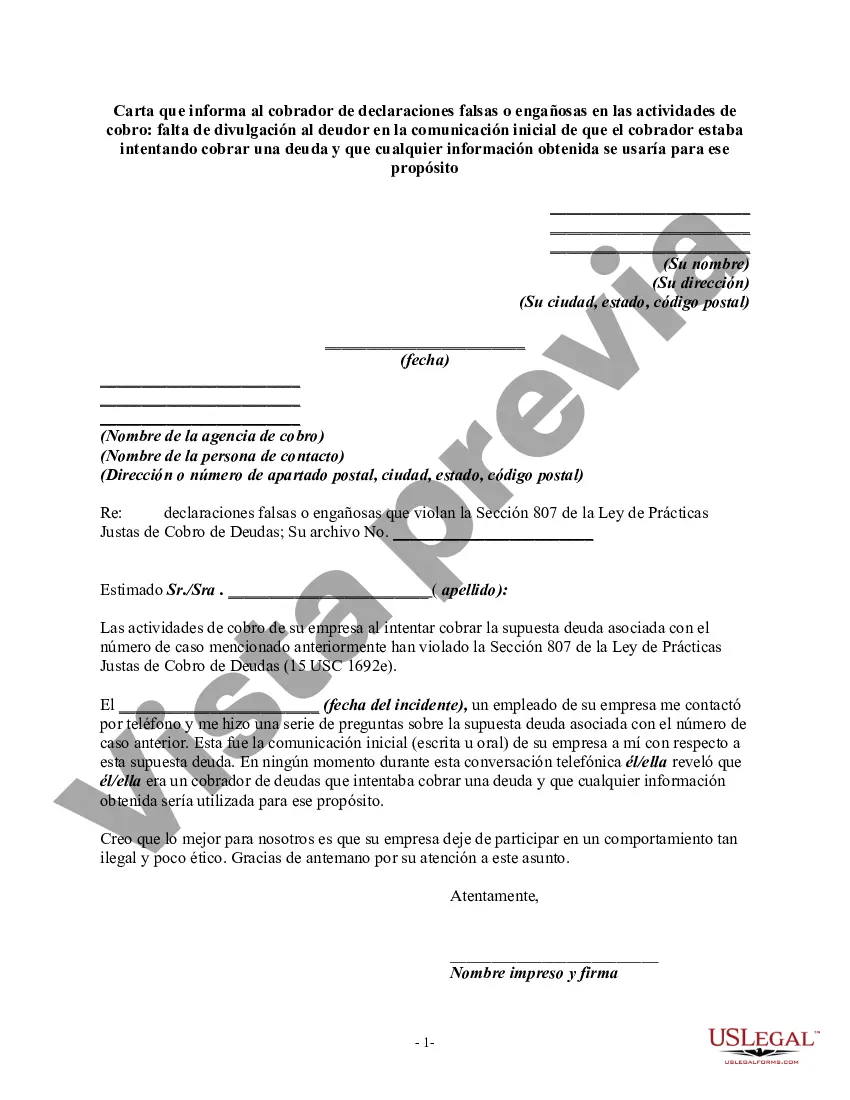

Chicago, Illinois Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt keyword: Chicago, Illinois, letter, debt collector, false, misleading, misrepresentations, collection activities, failure to disclose, debtor, initial communication, collect a debt. Title: Chicago, Illinois Letter Addressing False or Misleading Debt Collection Practices Introduction: In the state of Illinois, debt collection agencies are required to abide by strict regulations to protect consumers from deceptive or unfair practices. If you believe that a debt collector in Chicago, Illinois, has engaged in false or misleading misrepresentations in their collection activities, particularly by failing to disclose their intention to collect a debt in their initial communication, it is important to take action. This article provides a detailed description of a letter template that can be used to inform the debt collector of their violation and demand corrective actions. 1. Understanding False or Misleading Misrepresentations in Collection Activities: Debt collectors may employ various tactics that are deceptive or misleading when attempting to collect a debt. Such practices can include false statements about the debt's amount, nature, or the consequences of non-payment. A particularly egregious violation occurs when the debt collector fails to disclose their intention to collect a debt in their initial communication with the debtor. 2. Importance of the Initial Communication: The initial communication from a debt collector is crucial as it sets the tone for the entire debt collection process. It is required by law that debt collectors clearly state their purpose to collect a debt and include the debtor's rights to dispute or request validation of the debt within a specified timeframe. Failure to do so constitutes a violation of the Fair Debt Collection Practices Act (FD CPA) in Chicago, Illinois. 3. Drafting a Letter Informing the Debt Collector: To address false or misleading misrepresentations in collection activities, a letter should be sent to the debt collector, highlighting their violation and demanding immediate corrective actions. While there may not be a specific template available for this exact scenario, we can provide a general outline to include the following: — Begin with a professional and courteous tone, addressing the debt collector by name and their agency. — Clearly state that the purpose of the letter is to notify them of their false or misleading misrepresentations in collection activities and their failure to disclose their intention to collect a debt in the initial communication. — Reference the specific details of the initial communication, including the date, content, and lack of disclosure. — Explain how the debt collector's actions violate the FD CPA laws and regulations in Chicago, Illinois, and mention the potential legal consequences they may face. — Demand immediate corrective actions, including ceasing collection activities, providing a written acknowledgment of their violation, and removing any negative reporting from credit agencies. — State that failure to rectify the situation within a reasonable timeframe will result in the filing of complaints with the appropriate regulatory bodies and potential legal action. — Close the letter by requesting a written response within a specified time period and providing your contact information. Conclusion: If you encounter a debt collector in Chicago, Illinois, engaging in false or misleading misrepresentations in collection activities, it is crucial to actively address the situation. By sending a well-crafted letter outlining the violations and demanding corrective actions, you can assert your rights as a debtor and ensure that the debt collector adheres to the law. Remember to consult with a legal professional if you require further guidance in dealing with this issue.Chicago, Illinois Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt keyword: Chicago, Illinois, letter, debt collector, false, misleading, misrepresentations, collection activities, failure to disclose, debtor, initial communication, collect a debt. Title: Chicago, Illinois Letter Addressing False or Misleading Debt Collection Practices Introduction: In the state of Illinois, debt collection agencies are required to abide by strict regulations to protect consumers from deceptive or unfair practices. If you believe that a debt collector in Chicago, Illinois, has engaged in false or misleading misrepresentations in their collection activities, particularly by failing to disclose their intention to collect a debt in their initial communication, it is important to take action. This article provides a detailed description of a letter template that can be used to inform the debt collector of their violation and demand corrective actions. 1. Understanding False or Misleading Misrepresentations in Collection Activities: Debt collectors may employ various tactics that are deceptive or misleading when attempting to collect a debt. Such practices can include false statements about the debt's amount, nature, or the consequences of non-payment. A particularly egregious violation occurs when the debt collector fails to disclose their intention to collect a debt in their initial communication with the debtor. 2. Importance of the Initial Communication: The initial communication from a debt collector is crucial as it sets the tone for the entire debt collection process. It is required by law that debt collectors clearly state their purpose to collect a debt and include the debtor's rights to dispute or request validation of the debt within a specified timeframe. Failure to do so constitutes a violation of the Fair Debt Collection Practices Act (FD CPA) in Chicago, Illinois. 3. Drafting a Letter Informing the Debt Collector: To address false or misleading misrepresentations in collection activities, a letter should be sent to the debt collector, highlighting their violation and demanding immediate corrective actions. While there may not be a specific template available for this exact scenario, we can provide a general outline to include the following: — Begin with a professional and courteous tone, addressing the debt collector by name and their agency. — Clearly state that the purpose of the letter is to notify them of their false or misleading misrepresentations in collection activities and their failure to disclose their intention to collect a debt in the initial communication. — Reference the specific details of the initial communication, including the date, content, and lack of disclosure. — Explain how the debt collector's actions violate the FD CPA laws and regulations in Chicago, Illinois, and mention the potential legal consequences they may face. — Demand immediate corrective actions, including ceasing collection activities, providing a written acknowledgment of their violation, and removing any negative reporting from credit agencies. — State that failure to rectify the situation within a reasonable timeframe will result in the filing of complaints with the appropriate regulatory bodies and potential legal action. — Close the letter by requesting a written response within a specified time period and providing your contact information. Conclusion: If you encounter a debt collector in Chicago, Illinois, engaging in false or misleading misrepresentations in collection activities, it is crucial to actively address the situation. By sending a well-crafted letter outlining the violations and demanding corrective actions, you can assert your rights as a debtor and ensure that the debt collector adheres to the law. Remember to consult with a legal professional if you require further guidance in dealing with this issue.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.