Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

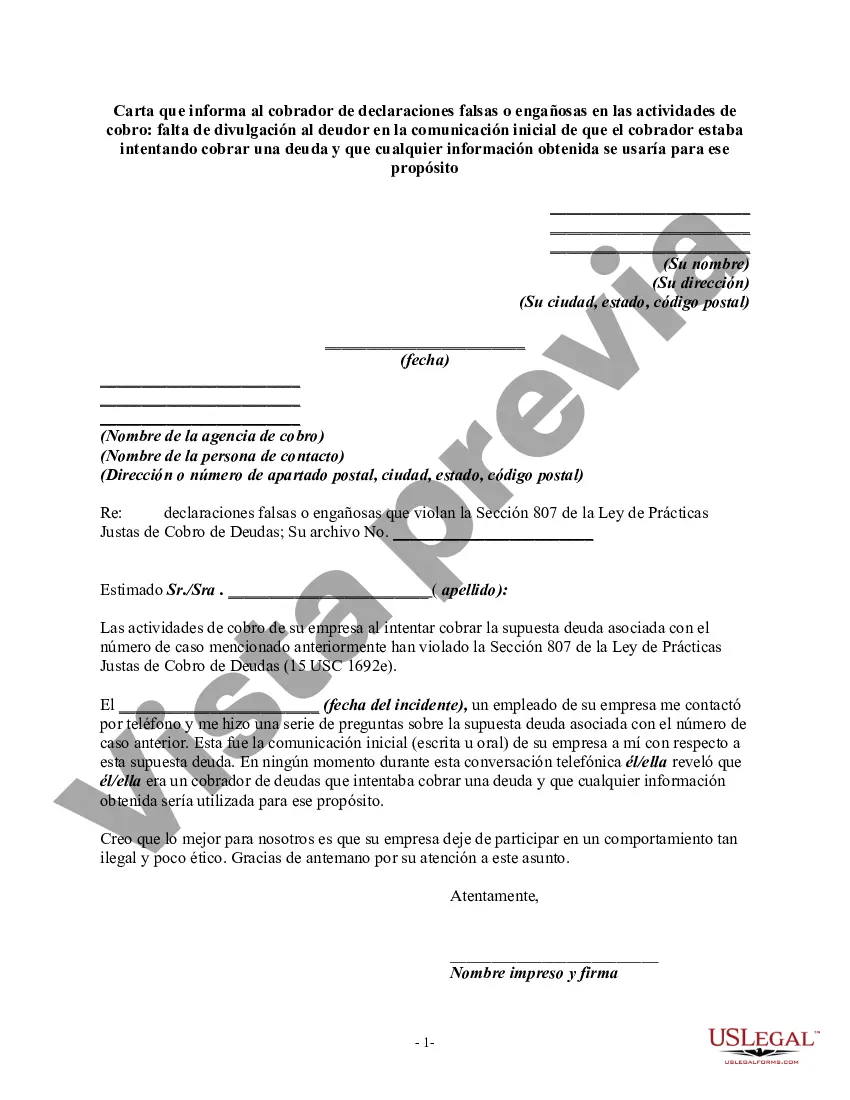

Title: Cook Illinois Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Purpose in Initial Communication Introduction: The purpose of this letter is to address the issue of false or misleading misrepresentations made by a debt collector during collection activities, specifically, the failure to disclose to the debtor in the initial communication that the debt collector was attempting to collect a debt. This violation goes against the guidelines set by the Federal Fair Debt Collection Practices Act (FD CPA) and can lead to legal consequences for the debt collector. Cook Illinois is taking this opportunity to inform and rectify the situation, ensuring fair and legally compliant debt collection practices. Key Points to Consider: 1. Legal Obligations and Importance of Initial Communication Disclosure: 2. Types of False or Misleading Misrepresentations: a. Non-disclosure of debt collection purpose b. Misleading or deceptive statements made to induce payment c. Failure to disclose the debtor's right to dispute the debt d. Impersonating a government entity or law enforcement agency e. False threats of legal action, wage garnishment, or asset seizure f. Misrepresentation of the debt amount or interest charges g. Misleading documents or fabricated documents to support the collection. 3. Ramifications of Violating FD CPA Guidelines: a. Potential liability for the debt collector b. Possible penalties and fines c. Negative impact on the debt collector's reputation d. Legal recourse available to the affected debtor 4. Cook Illinois' Expectations: a. Immediate cessation of false or misleading misrepresentations by the debt collector b. Clear disclosure of the debt collection purpose in future communications c. Accurate and transparent documentation of the debt amount and supporting information d. Respect for debtor rights as outlined by FD CPA e. Cooperation with Cook Illinois in addressing and rectifying any past violations 5. Request for Documentation: a. Provide copies of any misleading or false documents used during the collection process b. Furnish clear evidence of the debtor's notification about the attempt to collect a debt 6. Deadline for Compliance and Response: a. Specify a reasonable timeframe for the debt collector to comply with requested actions b. Mention possible legal action if compliance is not achieved within the given timeframe c. Request written confirmation of the debt collector's acknowledgment, compliance, and planned corrective measures. Conclusion: This detailed letter addresses the issue of false or misleading misrepresentations made by the debt collector during collection activities, specifically the failure to disclose the debt collection purpose to the debtor in the initial communication. Cook Illinois emphasizes the importance of adhering to FD CPA guidelines and expects immediate rectification of these violations. Compliance with the requested actions and a written confirmation of acknowledgment are crucial for the resolution of this matter, ensuring fair and transparent debt collection practices moving forward.Title: Cook Illinois Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Purpose in Initial Communication Introduction: The purpose of this letter is to address the issue of false or misleading misrepresentations made by a debt collector during collection activities, specifically, the failure to disclose to the debtor in the initial communication that the debt collector was attempting to collect a debt. This violation goes against the guidelines set by the Federal Fair Debt Collection Practices Act (FD CPA) and can lead to legal consequences for the debt collector. Cook Illinois is taking this opportunity to inform and rectify the situation, ensuring fair and legally compliant debt collection practices. Key Points to Consider: 1. Legal Obligations and Importance of Initial Communication Disclosure: 2. Types of False or Misleading Misrepresentations: a. Non-disclosure of debt collection purpose b. Misleading or deceptive statements made to induce payment c. Failure to disclose the debtor's right to dispute the debt d. Impersonating a government entity or law enforcement agency e. False threats of legal action, wage garnishment, or asset seizure f. Misrepresentation of the debt amount or interest charges g. Misleading documents or fabricated documents to support the collection. 3. Ramifications of Violating FD CPA Guidelines: a. Potential liability for the debt collector b. Possible penalties and fines c. Negative impact on the debt collector's reputation d. Legal recourse available to the affected debtor 4. Cook Illinois' Expectations: a. Immediate cessation of false or misleading misrepresentations by the debt collector b. Clear disclosure of the debt collection purpose in future communications c. Accurate and transparent documentation of the debt amount and supporting information d. Respect for debtor rights as outlined by FD CPA e. Cooperation with Cook Illinois in addressing and rectifying any past violations 5. Request for Documentation: a. Provide copies of any misleading or false documents used during the collection process b. Furnish clear evidence of the debtor's notification about the attempt to collect a debt 6. Deadline for Compliance and Response: a. Specify a reasonable timeframe for the debt collector to comply with requested actions b. Mention possible legal action if compliance is not achieved within the given timeframe c. Request written confirmation of the debt collector's acknowledgment, compliance, and planned corrective measures. Conclusion: This detailed letter addresses the issue of false or misleading misrepresentations made by the debt collector during collection activities, specifically the failure to disclose the debt collection purpose to the debtor in the initial communication. Cook Illinois emphasizes the importance of adhering to FD CPA guidelines and expects immediate rectification of these violations. Compliance with the requested actions and a written confirmation of acknowledgment are crucial for the resolution of this matter, ensuring fair and transparent debt collection practices moving forward.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.