Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

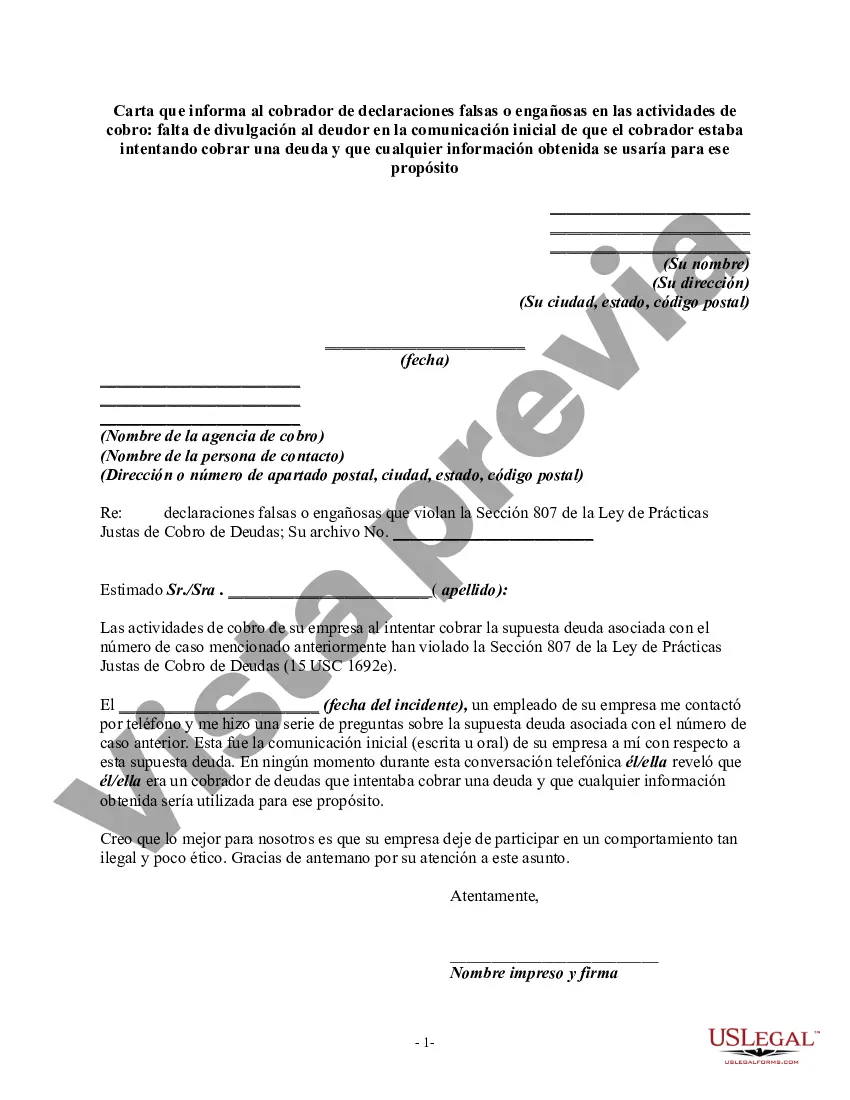

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

Title: Franklin Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt keyword: Franklin Ohio, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, collect a debt Introduction: In Franklin Ohio, debt collection practices are governed by strict guidelines to protect the rights of debtors. One such violation is when a debt collector fails to disclose in their initial communication that they are attempting to collect a debt, leading to false or misleading misrepresentations. This letter serves as a formal complaint to address the issue and provide evidence of the violation. Below are different types of letters that can be used to inform a debt collector of misleading practices: 1. Franklin Ohio Letter Addressing False or Misleading Representation: Dear [Debt Collector's Name], I am writing this letter to bring to your attention a serious violation of the Fair Debt Collection Practices Act (FD CPA) regarding the initial communication in reference to my alleged outstanding debt. Upon reviewing your correspondence, I discovered several false or misleading misrepresentations that breach the obligations outlined under state and federal laws. 2. Franklin Ohio Letter Demanding Accurate Disclosure: Dear [Debt Collector's Name], I am writing to express my concern about your failure to disclose in your initial communication your intention to collect a debt. By not providing clear and accurate information, you have misled and deceived me with your false representation. This violation of the FD CPA has compromised my trust and burdened me with unwarranted stress and anxiety. 3. Franklin Ohio Letter Requesting a Cease and Desist: Dear [Debt Collector's Name], I am writing to formally demand that you cease and desist all collection activities related to the alleged debt until you can provide accurate documentation confirming the validity and ownership of the debt. Your failure to disclose your intention to collect a debt in the initial communication raises concerns about the accuracy and legitimacy of your claims. 4. Franklin Ohio Letter Requesting Removal of Negative Reporting: Dear [Debt Collector's Name], This letter is to inform you that your failure to disclose your intent to collect a debt in the initial communication violates the FD CPA regulations. Consequently, I demand that you immediately remove any negative reporting associated with this alleged debt from any credit reporting agencies, as such reporting is both false and misleading. Conclusion: It is crucial for debt collectors in Franklin Ohio to adhere to the FD CPA guidelines, ensuring accurate disclosures in their initial communication and avoiding any false or misleading representations. These sample letters can be customized to inform debt collectors about their violation and demand appropriate corrective actions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.