Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

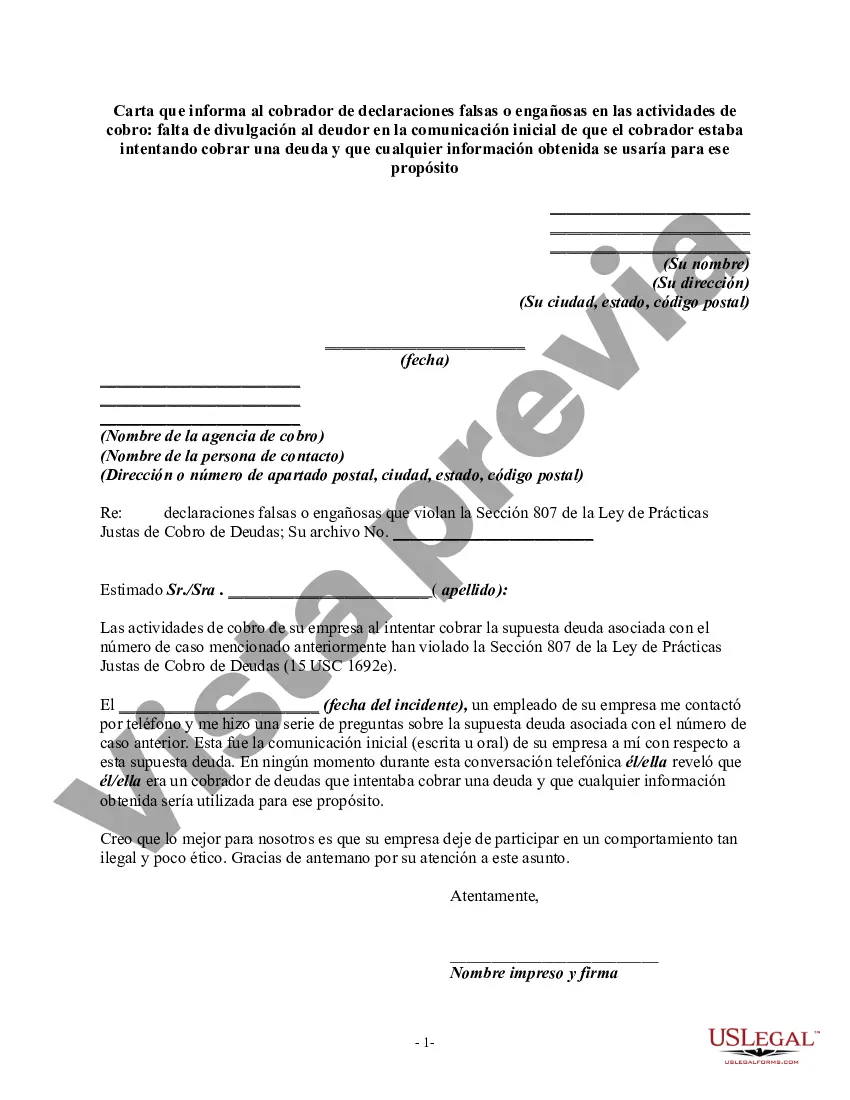

Title: Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt Introduction: Dealing with debt collectors can be a challenging and intimidating experience. However, it is important for debtors in Harris, Texas, to understand their rights and take appropriate action if they believe a debt collector has engaged in false or misleading misrepresentations during collection activities. In this article, we will provide a detailed description of the Harris Texas Letter that debtors can use to inform debt collectors of such misrepresentations, specifically focusing on the failure to disclose that the collector is attempting to collect a debt. Keywords: Harris Texas, debt collectors, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt collection. Types of Harris Texas Letters Informing Debt Collector of False or Misleading Misrepresentations: 1. Debt Collector's Failure to Disclose the Collection Purpose: This type of letter addresses situations where debt collectors fail to clearly state in their initial communication that they are attempting to collect a debt. The letter highlights the debtor's rights and requests the debt collector to rectify the misleading representation promptly. 2. False Statements or Misleading Information: This letter specifically addresses instances where the debt collector has presented false or misleading information to the debtor during the collection process. It aims to address and rectify any incorrect statements made regarding the debt in question. 3. Misleading Communication Techniques: This type of letter focuses on situations where debt collectors employ deceptive or coercive practices during communication with the debtor. It highlights specific misleading techniques used by the collector and asserts the debtor's rights to fair and honest treatment during the debt collection process. 4. Failure to Provide Required Disclosures: In some cases, debt collectors fail to provide the debtor with certain mandated disclosures or notices, as required by federal or state laws. This letter addresses such situations, emphasizing the collector's obligation to provide accurate information and necessary disclosures within the initial communication. Content of a Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations: 1. Introduction: Clearly state your name, address, and contact information. Address the letter to the debt collector and include their name, address, and any relevant account or reference numbers. 2. Explanation of Misrepresentation: Explain the false or misleading misrepresentation made by the debt collector during the collection process, focusing on their failure to disclose that they were attempting to collect a debt in their initial communication. 3. Asserting Legal Rights: Refer to specific federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA), and emphasize your rights as a debtor. State that the debt collector's misrepresentations are a violation of your rights and that you are prepared to take appropriate action if necessary. 4. Request for Action: Clearly state your expectations from the debt collector, such as correcting the misrepresentation, providing accurate information, and ceasing any further misleading activities. Request written confirmation of their actions within a specific timeframe. 5. Documentation of Misrepresentations: Include copies of any relevant documents, such as collection letters, phone call records, or conversations, that support your claim of false or misleading representations. 6. Conclusion: Express your willingness to cooperate and resolve the matter amicably, as long as the debt collector meets your demands and adheres to the law. Reiterate the potential consequences they may face if they fail to rectify the misrepresentations. Remember to consult legal counsel or relevant authorities to ensure compliance with specific regulations and to tailor the letter to your specific situation. By utilizing a Harris Texas Letter to inform debt collectors of false or misleading misrepresentations, debtors can assert their rights and potentially rectify improper collection activities.Title: Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt Introduction: Dealing with debt collectors can be a challenging and intimidating experience. However, it is important for debtors in Harris, Texas, to understand their rights and take appropriate action if they believe a debt collector has engaged in false or misleading misrepresentations during collection activities. In this article, we will provide a detailed description of the Harris Texas Letter that debtors can use to inform debt collectors of such misrepresentations, specifically focusing on the failure to disclose that the collector is attempting to collect a debt. Keywords: Harris Texas, debt collectors, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt collection. Types of Harris Texas Letters Informing Debt Collector of False or Misleading Misrepresentations: 1. Debt Collector's Failure to Disclose the Collection Purpose: This type of letter addresses situations where debt collectors fail to clearly state in their initial communication that they are attempting to collect a debt. The letter highlights the debtor's rights and requests the debt collector to rectify the misleading representation promptly. 2. False Statements or Misleading Information: This letter specifically addresses instances where the debt collector has presented false or misleading information to the debtor during the collection process. It aims to address and rectify any incorrect statements made regarding the debt in question. 3. Misleading Communication Techniques: This type of letter focuses on situations where debt collectors employ deceptive or coercive practices during communication with the debtor. It highlights specific misleading techniques used by the collector and asserts the debtor's rights to fair and honest treatment during the debt collection process. 4. Failure to Provide Required Disclosures: In some cases, debt collectors fail to provide the debtor with certain mandated disclosures or notices, as required by federal or state laws. This letter addresses such situations, emphasizing the collector's obligation to provide accurate information and necessary disclosures within the initial communication. Content of a Harris Texas Letter Informing Debt Collector of False or Misleading Misrepresentations: 1. Introduction: Clearly state your name, address, and contact information. Address the letter to the debt collector and include their name, address, and any relevant account or reference numbers. 2. Explanation of Misrepresentation: Explain the false or misleading misrepresentation made by the debt collector during the collection process, focusing on their failure to disclose that they were attempting to collect a debt in their initial communication. 3. Asserting Legal Rights: Refer to specific federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA), and emphasize your rights as a debtor. State that the debt collector's misrepresentations are a violation of your rights and that you are prepared to take appropriate action if necessary. 4. Request for Action: Clearly state your expectations from the debt collector, such as correcting the misrepresentation, providing accurate information, and ceasing any further misleading activities. Request written confirmation of their actions within a specific timeframe. 5. Documentation of Misrepresentations: Include copies of any relevant documents, such as collection letters, phone call records, or conversations, that support your claim of false or misleading representations. 6. Conclusion: Express your willingness to cooperate and resolve the matter amicably, as long as the debt collector meets your demands and adheres to the law. Reiterate the potential consequences they may face if they fail to rectify the misrepresentations. Remember to consult legal counsel or relevant authorities to ensure compliance with specific regulations and to tailor the letter to your specific situation. By utilizing a Harris Texas Letter to inform debt collectors of false or misleading misrepresentations, debtors can assert their rights and potentially rectify improper collection activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.