Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

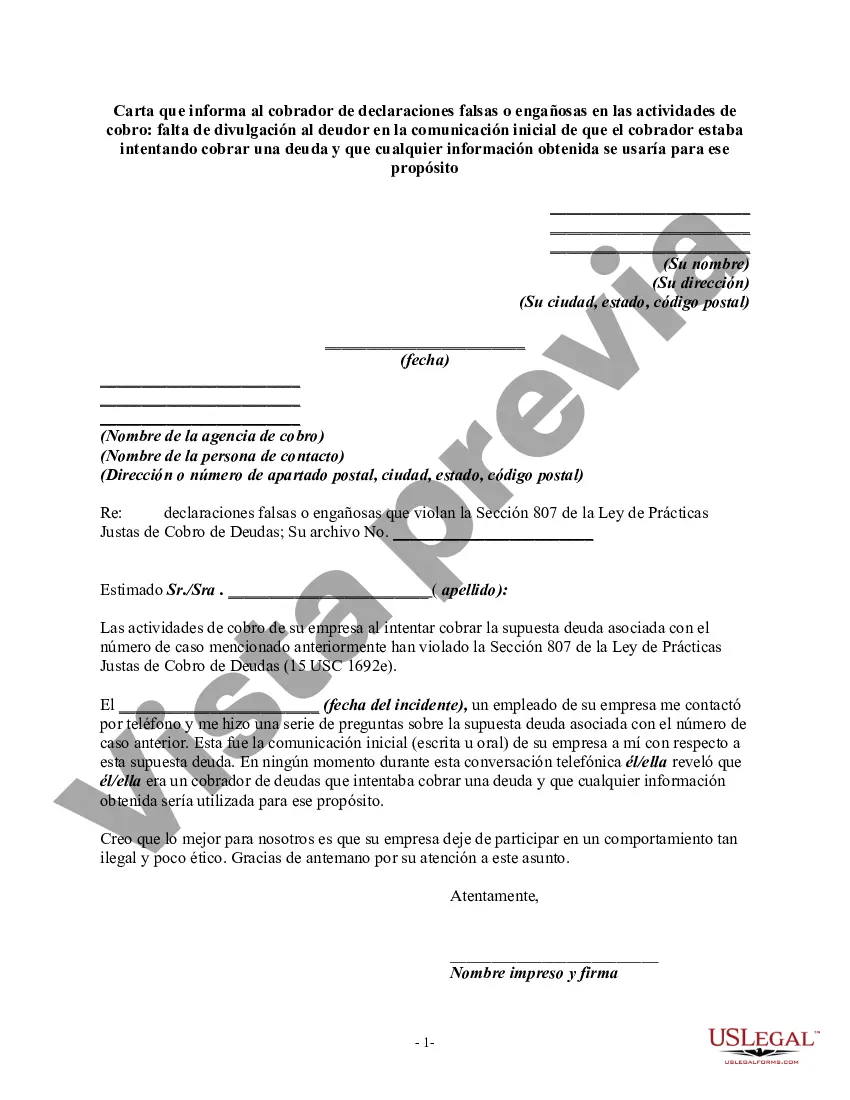

Title: Los Angeles California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt keyword: Los Angeles, California, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt, informing letter Introduction: In cases where a debt collector fails to disclose their motive to collect a debt in the initial communication with a debtor, it is crucial for individuals in Los Angeles, California to take action against such deceptive practices. This article will provide a detailed overview of writing a Los Angeles California letter informing debt collectors about false or misleading misrepresentations in their collection activities, emphasizing their failure to disclose their intentions to collect the debt in the initial communication. Content: 1. Understanding False or Misleading Misrepresentations: Debtors must comprehend what qualifies as false or misleading misrepresentations by debt collectors. This could include making false statements about the amount owed, omitting crucial information, providing incorrect legal consequences, or engaging in any other deceptive practices. 2. The Importance of Initial Communication Disclosure: Highlight the significance of disclosure in the initial communication from a debt collector. Debtors must be informed explicitly that the communication aims to collect a debt. Any failure to disclose this information reflects noncompliance with the Fair Debt Collection Practices Act (FD CPA). 3. Determining the Violation: Encourage individuals to review their initial communication from the debt collector carefully. Identify specific instances where the debt collector failed to disclose their motive to collect the debt. This might include situations where they portrayed the communication as an account update or friendly contact rather than an attempt to collect a debt. 4. Legal Rights and Protections: Inform debtors in Los Angeles, California about their rights and protections under the FD CPA. Emphasize that debt collectors must adhere to certain rules and guidelines and that debtors have the right to challenge any violations through appropriate channels. 5. Crafting the Informing Letter: Outline the key elements to include in the informing letter to the debt collector. This should encompass the debtor's intent to dispute the debt collector's false or misleading misrepresentations, reference to the initial communication, and a clear demand for appropriate action to rectify the situation. 6. Supporting Documents: Advise debtors to gather supporting documents such as copies of the initial communication, records of subsequent interactions, and any evidence that substantiates false or misleading misrepresentations by the debt collector. This documentation can strengthen their case against the debt collector. Conclusion: Writing a well-crafted Los Angeles California letter informing debt collectors of false or misleading misrepresentations in their collection activities is vital to protect debtors' rights and prevent further deceptive practices. By promptly addressing such violations, individuals in Los Angeles, California can take a stand against unfair debt collection practices.Title: Los Angeles California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt keyword: Los Angeles, California, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt, informing letter Introduction: In cases where a debt collector fails to disclose their motive to collect a debt in the initial communication with a debtor, it is crucial for individuals in Los Angeles, California to take action against such deceptive practices. This article will provide a detailed overview of writing a Los Angeles California letter informing debt collectors about false or misleading misrepresentations in their collection activities, emphasizing their failure to disclose their intentions to collect the debt in the initial communication. Content: 1. Understanding False or Misleading Misrepresentations: Debtors must comprehend what qualifies as false or misleading misrepresentations by debt collectors. This could include making false statements about the amount owed, omitting crucial information, providing incorrect legal consequences, or engaging in any other deceptive practices. 2. The Importance of Initial Communication Disclosure: Highlight the significance of disclosure in the initial communication from a debt collector. Debtors must be informed explicitly that the communication aims to collect a debt. Any failure to disclose this information reflects noncompliance with the Fair Debt Collection Practices Act (FD CPA). 3. Determining the Violation: Encourage individuals to review their initial communication from the debt collector carefully. Identify specific instances where the debt collector failed to disclose their motive to collect the debt. This might include situations where they portrayed the communication as an account update or friendly contact rather than an attempt to collect a debt. 4. Legal Rights and Protections: Inform debtors in Los Angeles, California about their rights and protections under the FD CPA. Emphasize that debt collectors must adhere to certain rules and guidelines and that debtors have the right to challenge any violations through appropriate channels. 5. Crafting the Informing Letter: Outline the key elements to include in the informing letter to the debt collector. This should encompass the debtor's intent to dispute the debt collector's false or misleading misrepresentations, reference to the initial communication, and a clear demand for appropriate action to rectify the situation. 6. Supporting Documents: Advise debtors to gather supporting documents such as copies of the initial communication, records of subsequent interactions, and any evidence that substantiates false or misleading misrepresentations by the debt collector. This documentation can strengthen their case against the debt collector. Conclusion: Writing a well-crafted Los Angeles California letter informing debt collectors of false or misleading misrepresentations in their collection activities is vital to protect debtors' rights and prevent further deceptive practices. By promptly addressing such violations, individuals in Los Angeles, California can take a stand against unfair debt collection practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.