Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

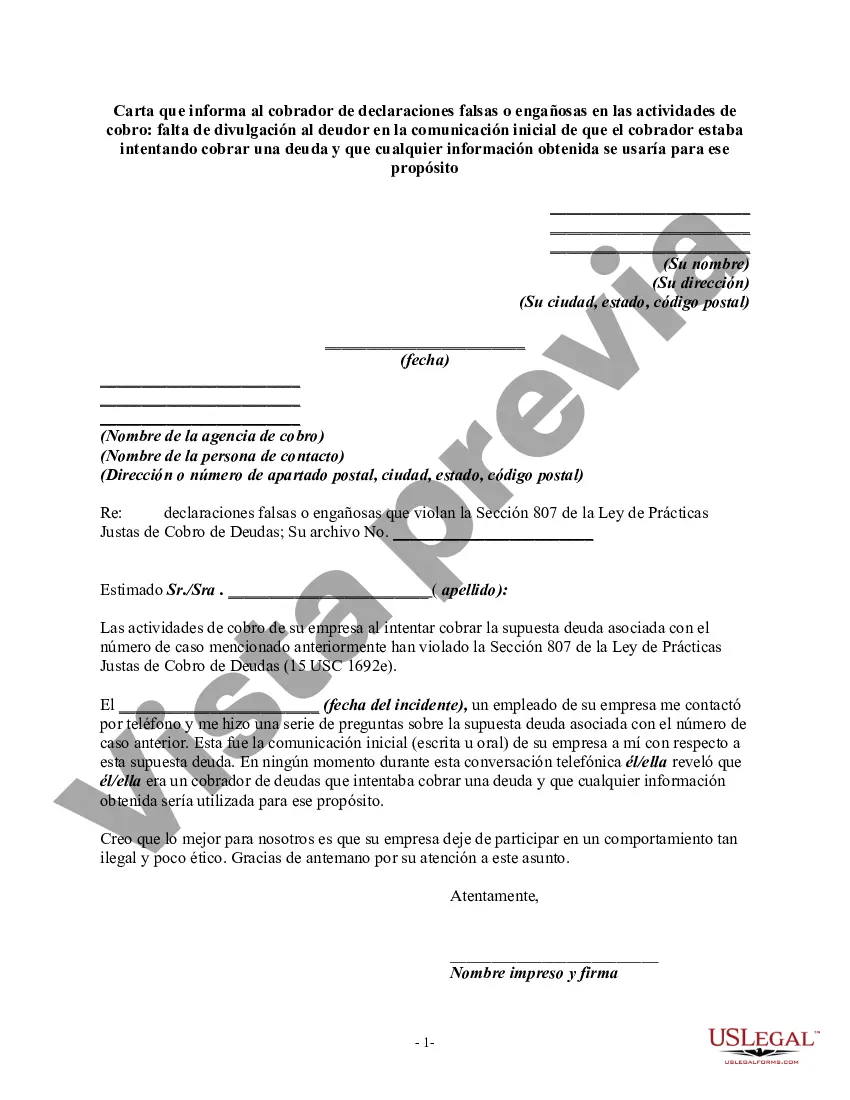

Title: Mecklenburg North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Intent Keywords: Mecklenburg North Carolina, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, attempting to collect a debt Introduction: In Mecklenburg County, North Carolina, debtors have certain rights when dealing with debt collectors who engage in false or misleading practices during collection activities. This article aims to provide a detailed description of the specific type of letter that debtors can use to inform debt collectors about such unethical behavior. The focus is on cases where the debt collector fails to disclose, in the initial communication, their intention to collect a debt. Types of Letters for Informing Debt Collector of False or Misleading Misrepresentations: 1. Standard Letter: This type of letter is a generic template that debtors can use to express their concerns about deceptive collection practices by the debt collector. It should include specific instances where the debt collector failed to disclose their debt collection intentions in the initial communication. 2. Cease and Desist Letter: A cease and desist letter can be utilized if the debtor wants to demand a halt to any further collection activities until the debt collector rectifies the false or misleading misrepresentations made during the initial communication. This letter serves as a warning to the debt collector, emphasizing that their conduct is unacceptable. 3. Validation of Debt Letter: A validation of debt letter seeks to obtain clarification on the validity of the debt and requests the debt collector to provide appropriate documentation supporting their claim. This type of letter can be sent in addition to informing the debt collector of false or misleading misrepresentations. 4. Dispute Letter: A dispute letter is used if the debtor disagrees with the claimed debt or the debt collector's actions. It outlines the reasons for disputing the debt, asks for additional supporting evidence, and requests that the debt collector cease collection activities until the dispute is resolved. Components of the Letter: 1. Sender's Contact Information: Include the debtor's full name, address, contact number, and any relevant account or reference numbers associated with the debt. 2. Date: Add the date when the letter is being written. 3. Recipient's Contact Information: Provide the debt collector's name, company name, address, and contact information. 4. Introduction and Purpose: Clearly state that the letter is being sent to address false or misleading misrepresentations made by the debt collector during their initial communication. 5. Detailed Description: Elaborate on the specific instances where the debt collector failed to disclose their intention to collect a debt, emphasizing the false or misleading information provided. 6. Request for Action: Formally request that the debt collector rectify their behavior, disclose the debt collection intent, and adhere to fair and honest collection practices. 7. Supporting Documentation: Include copies of any relevant documentation, such as the initial communication from the debt collector, which proves their failure to disclose their debt collection intention. 8. Deadline: Set a reasonable deadline by which the debt collector should respond and take appropriate action. 9. Closing: Sign off the letter with a polite closing, such as "Sincerely" or "Best regards," and include the debtor's full name. Conclusion: When dealing with debt collectors in Mecklenburg, North Carolina, debtors have the right to challenge false or misleading representations made during the collection process. By utilizing the appropriate type of letter and following the recommended structure, debtors can assert their rights and hold debt collectors accountable for their actions.Title: Mecklenburg North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Intent Keywords: Mecklenburg North Carolina, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, attempting to collect a debt Introduction: In Mecklenburg County, North Carolina, debtors have certain rights when dealing with debt collectors who engage in false or misleading practices during collection activities. This article aims to provide a detailed description of the specific type of letter that debtors can use to inform debt collectors about such unethical behavior. The focus is on cases where the debt collector fails to disclose, in the initial communication, their intention to collect a debt. Types of Letters for Informing Debt Collector of False or Misleading Misrepresentations: 1. Standard Letter: This type of letter is a generic template that debtors can use to express their concerns about deceptive collection practices by the debt collector. It should include specific instances where the debt collector failed to disclose their debt collection intentions in the initial communication. 2. Cease and Desist Letter: A cease and desist letter can be utilized if the debtor wants to demand a halt to any further collection activities until the debt collector rectifies the false or misleading misrepresentations made during the initial communication. This letter serves as a warning to the debt collector, emphasizing that their conduct is unacceptable. 3. Validation of Debt Letter: A validation of debt letter seeks to obtain clarification on the validity of the debt and requests the debt collector to provide appropriate documentation supporting their claim. This type of letter can be sent in addition to informing the debt collector of false or misleading misrepresentations. 4. Dispute Letter: A dispute letter is used if the debtor disagrees with the claimed debt or the debt collector's actions. It outlines the reasons for disputing the debt, asks for additional supporting evidence, and requests that the debt collector cease collection activities until the dispute is resolved. Components of the Letter: 1. Sender's Contact Information: Include the debtor's full name, address, contact number, and any relevant account or reference numbers associated with the debt. 2. Date: Add the date when the letter is being written. 3. Recipient's Contact Information: Provide the debt collector's name, company name, address, and contact information. 4. Introduction and Purpose: Clearly state that the letter is being sent to address false or misleading misrepresentations made by the debt collector during their initial communication. 5. Detailed Description: Elaborate on the specific instances where the debt collector failed to disclose their intention to collect a debt, emphasizing the false or misleading information provided. 6. Request for Action: Formally request that the debt collector rectify their behavior, disclose the debt collection intent, and adhere to fair and honest collection practices. 7. Supporting Documentation: Include copies of any relevant documentation, such as the initial communication from the debt collector, which proves their failure to disclose their debt collection intention. 8. Deadline: Set a reasonable deadline by which the debt collector should respond and take appropriate action. 9. Closing: Sign off the letter with a polite closing, such as "Sincerely" or "Best regards," and include the debtor's full name. Conclusion: When dealing with debt collectors in Mecklenburg, North Carolina, debtors have the right to challenge false or misleading representations made during the collection process. By utilizing the appropriate type of letter and following the recommended structure, debtors can assert their rights and hold debt collectors accountable for their actions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.