Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

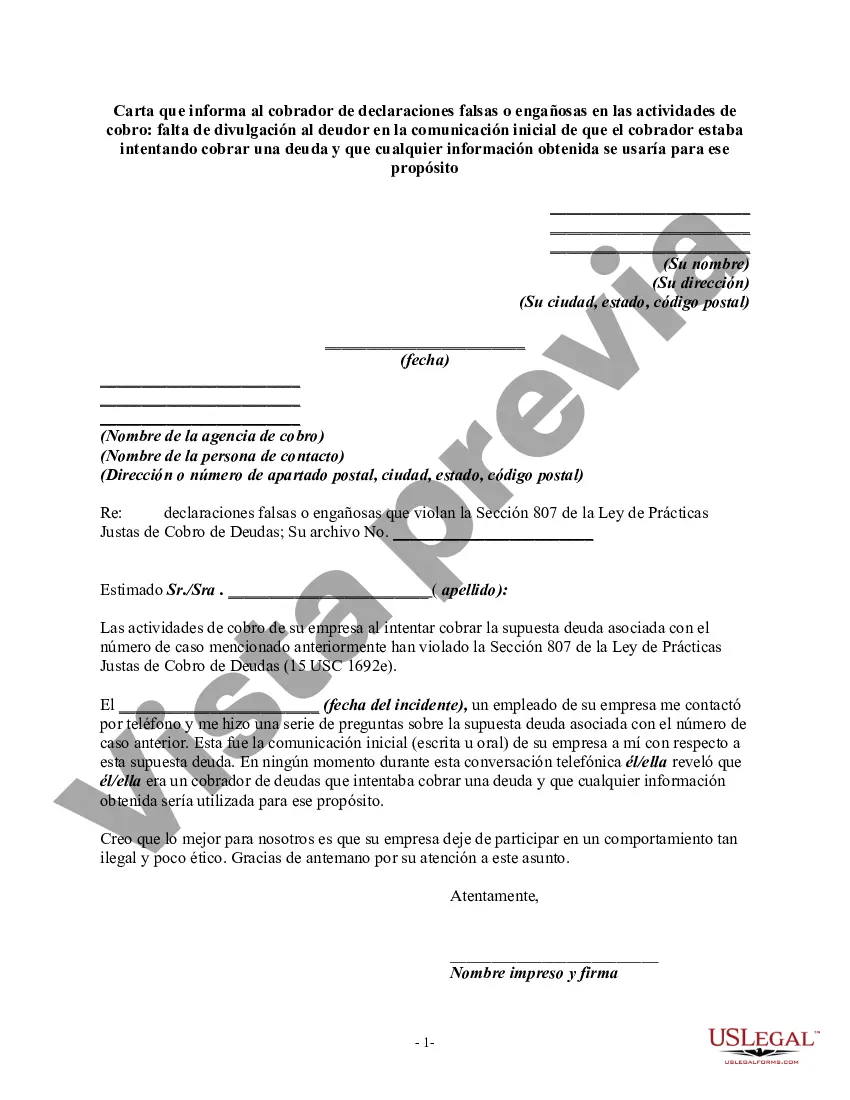

Subject: Sacramento, California: Important Notice Regarding Misleading Misrepresentations in Debt Collection Dear [Debt Collector's Name], I am writing to bring a serious matter to your attention concerning your recent debt collection activities. It has come to my knowledge that your initial communication failed to disclose that you were attempting to collect a debt, causing confusion and misleading representation regarding the true nature of your contact. This letter serves as a formal notification, as per the regulations and laws that govern debt collection practices in Sacramento, California. According to the Fair Debt Collection Practices Act (FD CPA), it is a requirement for debt collectors to clearly identify themselves as such in their initial communication with a debtor. This initial communication could be a phone call, letter, or any other form of contact used to notify the debtor about the existence of a debt. Failure to comply with this fundamental obligation is considered a serious violation of the FD CPA, and I feel compelled to bring your attention to this matter. I would like to highlight the following concerns: 1. Failure to disclose the purpose of contact: Your initial communication did not explicitly state that it was an attempt to collect a debt. This omission causes confusion for debtors who may not be aware of their rights and obligations in such matters. It is essential to disclose the true purpose of your contact from the outset. 2. Misleading or deceptive representation: By failing to disclose your intentions in collecting the debt, you may mislead debtors into thinking the communication is regarding a different matter or a personal inquiry. Providing misleading information can result in harm to debtors who may make misguided decisions based on such misrepresentation. Sacramento is committed to ensuring fair debt collection practices, protecting its residents from harassment, and upholding consumer rights. As a resident of Sacramento, California, I urge you to rectify this issue promptly and adjust your future communication practices complying with the FD CPA. I kindly request that you take the following actions: 1. Acknowledge receipt of this letter within [specify reasonable timeframe, e.g., 10 business days]. 2. Cease all debt collection activities related to the debt in question until you provide written evidence that you have amended your practices to adhere to the requirements of the FD CPA. 3. Provide me, within [specify reasonable timeframe, e.g., 30 calendar days], with a written statement confirming that you have ceased all collection activities linked to the debt and that you will no longer engage in misleading or deceptive representation in your communications. Please be aware that failure to comply with the aforementioned requests may result in my pursuing further legal action, seeking penalties under the FD CPA, and filing complaints with the appropriate regulatory entities. I trust that you will treat this matter with the seriousness it deserves and act promptly to rectify the situation. I look forward to your immediate response and resolution of this matter. Your prompt attention to this issue is greatly appreciated. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] Phone: [Your Phone Number] Email: [Your Email Address]Subject: Sacramento, California: Important Notice Regarding Misleading Misrepresentations in Debt Collection Dear [Debt Collector's Name], I am writing to bring a serious matter to your attention concerning your recent debt collection activities. It has come to my knowledge that your initial communication failed to disclose that you were attempting to collect a debt, causing confusion and misleading representation regarding the true nature of your contact. This letter serves as a formal notification, as per the regulations and laws that govern debt collection practices in Sacramento, California. According to the Fair Debt Collection Practices Act (FD CPA), it is a requirement for debt collectors to clearly identify themselves as such in their initial communication with a debtor. This initial communication could be a phone call, letter, or any other form of contact used to notify the debtor about the existence of a debt. Failure to comply with this fundamental obligation is considered a serious violation of the FD CPA, and I feel compelled to bring your attention to this matter. I would like to highlight the following concerns: 1. Failure to disclose the purpose of contact: Your initial communication did not explicitly state that it was an attempt to collect a debt. This omission causes confusion for debtors who may not be aware of their rights and obligations in such matters. It is essential to disclose the true purpose of your contact from the outset. 2. Misleading or deceptive representation: By failing to disclose your intentions in collecting the debt, you may mislead debtors into thinking the communication is regarding a different matter or a personal inquiry. Providing misleading information can result in harm to debtors who may make misguided decisions based on such misrepresentation. Sacramento is committed to ensuring fair debt collection practices, protecting its residents from harassment, and upholding consumer rights. As a resident of Sacramento, California, I urge you to rectify this issue promptly and adjust your future communication practices complying with the FD CPA. I kindly request that you take the following actions: 1. Acknowledge receipt of this letter within [specify reasonable timeframe, e.g., 10 business days]. 2. Cease all debt collection activities related to the debt in question until you provide written evidence that you have amended your practices to adhere to the requirements of the FD CPA. 3. Provide me, within [specify reasonable timeframe, e.g., 30 calendar days], with a written statement confirming that you have ceased all collection activities linked to the debt and that you will no longer engage in misleading or deceptive representation in your communications. Please be aware that failure to comply with the aforementioned requests may result in my pursuing further legal action, seeking penalties under the FD CPA, and filing complaints with the appropriate regulatory entities. I trust that you will treat this matter with the seriousness it deserves and act promptly to rectify the situation. I look forward to your immediate response and resolution of this matter. Your prompt attention to this issue is greatly appreciated. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] Phone: [Your Phone Number] Email: [Your Email Address]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.