Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

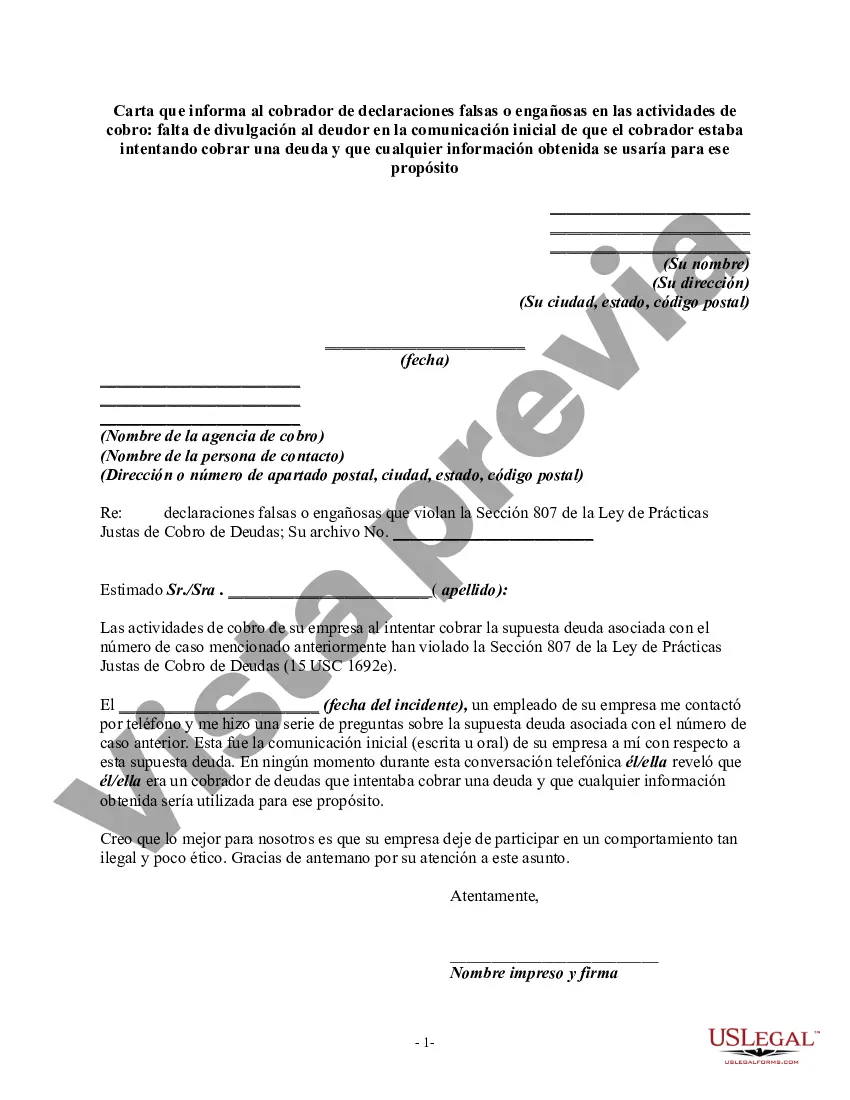

Title: San Antonio Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Intentions Introduction: Covering various types of letters that can be used in San Antonio, Texas to inform debt collectors about false or misleading claims made during collection activities, specifically related to the failure to disclose their intention to collect a debt in the initial communication. These letters are essential tools to assert debtors' rights and protect them against unfair or deceptive practices. In this article, we will delve into the details of these letters and provide examples of different types that can be used. 1. San Antonio Texas Letter Informing Debt Collector of False or Misleading Misrepresentations: This type of letter aims to notify the debt collector, located in San Antonio, Texas, about any false or misleading statements made during the collection process that violate the Fair Debt Collection Practices Act (FD CPA). Key points to address in this letter include the failure of the debt collector to initially communicate their intention to collect a debt and any specific misrepresentations made in subsequent communications. 2. San Antonio Texas Letter Asserting Failure to Disclose Debt Collection Intentions in Initial Communication: Focused on the lack of disclosure by the debt collector in their initial communication, this letter emphasizes the importance of confirming that the debtor has been made aware that the communication is an attempt to collect a debt. It requests the debt collector to provide evidence of such disclosure and warns of legal action if the issue is not rectified. 3. San Antonio Texas Letter Requesting Clarification on False or Misleading Representations: In cases where the debtor is uncertain about whether a debt collector has made false or misleading representations, this letter seeks clarification on any statements that may have caused confusion or appeared deceptive. By requesting the debt collector to clearly explain their intentions and provide accurate information about the debt, debtors can ensure compliance with the FD CPA. 4. San Antonio Texas Letter Reporting False or Misleading Statements to Regulatory Agencies: This type of letter alerts relevant regulatory authorities and agencies, such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB), about the debt collector's false or misleading representations. It provides detailed information about the deceptive practices while seeking their intervention in addressing the issue. 5. San Antonio Texas Letter Requesting Validation of Debt: Debtors can also use this letter to request the debt collector to validate the debt by providing specific information regarding the alleged debt, such as the original creditor's name, the amount owed, and any supporting documentation. This letter ensures debtors receive accurate and verifiable information about their debt before taking any further action. Conclusion: Creating awareness about San Antonio Texas letters informing debt collectors of false or misleading misrepresentations in collection activities, specifically related to the failure to disclose debt collection intentions in the initial communication, is crucial when dealing with unfair debt collection practices. Utilizing these letters empowers debtors to assert their rights, seek clarity, and report violations to appropriate regulatory agencies if required.Title: San Antonio Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose Debt Collection Intentions Introduction: Covering various types of letters that can be used in San Antonio, Texas to inform debt collectors about false or misleading claims made during collection activities, specifically related to the failure to disclose their intention to collect a debt in the initial communication. These letters are essential tools to assert debtors' rights and protect them against unfair or deceptive practices. In this article, we will delve into the details of these letters and provide examples of different types that can be used. 1. San Antonio Texas Letter Informing Debt Collector of False or Misleading Misrepresentations: This type of letter aims to notify the debt collector, located in San Antonio, Texas, about any false or misleading statements made during the collection process that violate the Fair Debt Collection Practices Act (FD CPA). Key points to address in this letter include the failure of the debt collector to initially communicate their intention to collect a debt and any specific misrepresentations made in subsequent communications. 2. San Antonio Texas Letter Asserting Failure to Disclose Debt Collection Intentions in Initial Communication: Focused on the lack of disclosure by the debt collector in their initial communication, this letter emphasizes the importance of confirming that the debtor has been made aware that the communication is an attempt to collect a debt. It requests the debt collector to provide evidence of such disclosure and warns of legal action if the issue is not rectified. 3. San Antonio Texas Letter Requesting Clarification on False or Misleading Representations: In cases where the debtor is uncertain about whether a debt collector has made false or misleading representations, this letter seeks clarification on any statements that may have caused confusion or appeared deceptive. By requesting the debt collector to clearly explain their intentions and provide accurate information about the debt, debtors can ensure compliance with the FD CPA. 4. San Antonio Texas Letter Reporting False or Misleading Statements to Regulatory Agencies: This type of letter alerts relevant regulatory authorities and agencies, such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB), about the debt collector's false or misleading representations. It provides detailed information about the deceptive practices while seeking their intervention in addressing the issue. 5. San Antonio Texas Letter Requesting Validation of Debt: Debtors can also use this letter to request the debt collector to validate the debt by providing specific information regarding the alleged debt, such as the original creditor's name, the amount owed, and any supporting documentation. This letter ensures debtors receive accurate and verifiable information about their debt before taking any further action. Conclusion: Creating awareness about San Antonio Texas letters informing debt collectors of false or misleading misrepresentations in collection activities, specifically related to the failure to disclose debt collection intentions in the initial communication, is crucial when dealing with unfair debt collection practices. Utilizing these letters empowers debtors to assert their rights, seek clarity, and report violations to appropriate regulatory agencies if required.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.