Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

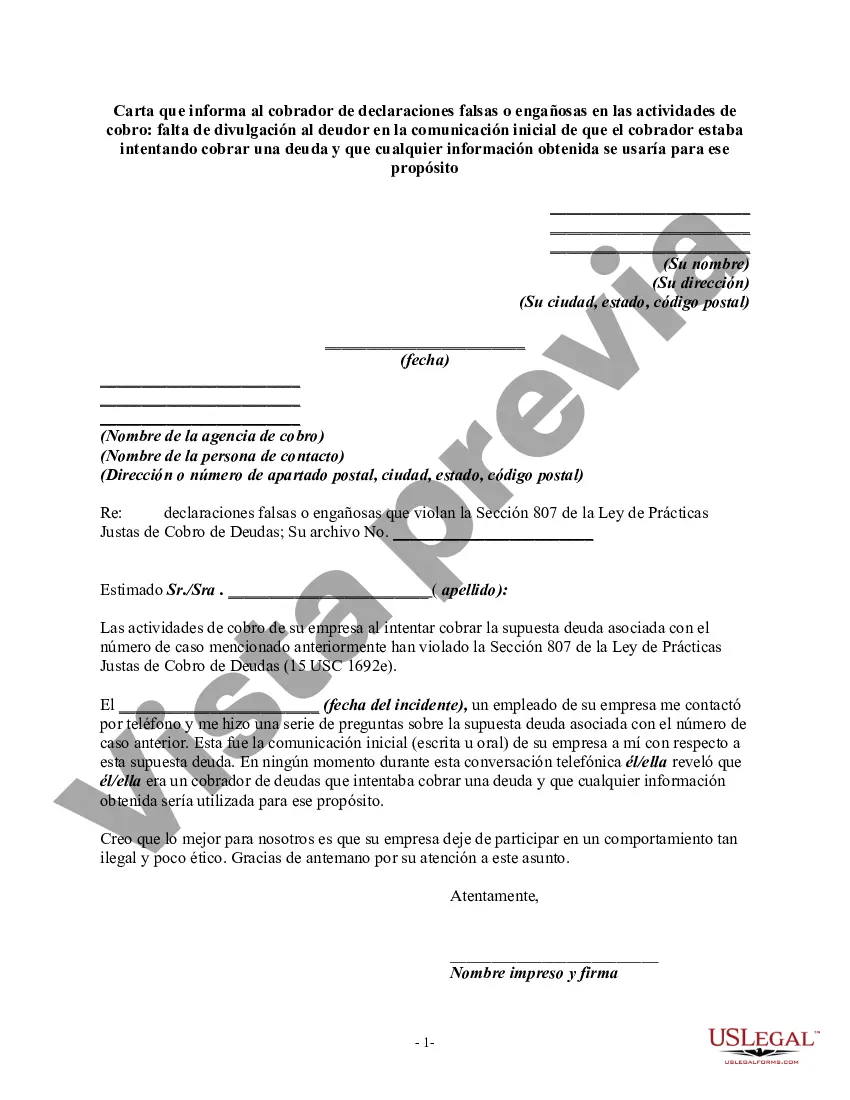

Title: San Diego California Letter for Adverse Collection Practices — Demanding Debt Collector's Compliance Introduction: In this article, we will explore the concept of a San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities. Specifically, we focus on a situation where a debt collector fails to disclose to the debtor in their initial communication that they are attempting to collect a debt. We will highlight the importance of addressing this issue promptly and provide an effective template for such a letter. Let's dive in! Keyword: San Diego, California, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt collection, debtor Types of San Diego California Letters Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities: 1. Basic San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations: This type of letter is a general template that can be used to inform the debt collector about their failure to disclose the debt collection attempt in the initial communication. It includes details such as the debtor's information, a description of the misrepresentations, a request for clarifications, and a demand for corrections. 2. Formal San Diego California Cease and Desist Letter Regarding Adverse Collection Practices: This type of letter carries a stronger tone, demanding that the debt collector immediately cease and desist all collection activities due to their failure to disclose the debt collection attempt. It may also include legal references, potential consequences, and a deadline for the debt collector to respond. 3. San Diego California Letter with Supporting Evidence of Misleading Misrepresentations: If a debtor has evidence to support their claim of false or misleading misrepresentations, this type of letter can be used to notify the debt collector while providing the evidence for their review. The letter should detail the evidence, explain how it contradicts the initial communication, and request immediate actions to rectify the situation. 4. San Diego California Letter Seeking Validation of Debt and Clarification: If a debtor is unsure about the collector's attempt to collect a debt, this letter can be used to request validation of the debt. It can seek clarification on the initial communication received and demand adherence to federal and state laws regarding debt collection practices. Conclusion: When facing false or misleading misrepresentations by a debt collector, it is crucial to take appropriate action to protect your rights. A well-drafted San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations can effectively prompt the debt collector to correct their practices and bring attention to their non-compliance with debt collection laws. Remember to personalize the letter according to your situation and consult legal advice if necessary.Title: San Diego California Letter for Adverse Collection Practices — Demanding Debt Collector's Compliance Introduction: In this article, we will explore the concept of a San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities. Specifically, we focus on a situation where a debt collector fails to disclose to the debtor in their initial communication that they are attempting to collect a debt. We will highlight the importance of addressing this issue promptly and provide an effective template for such a letter. Let's dive in! Keyword: San Diego, California, debt collector, false or misleading misrepresentations, collection activities, failure to disclose, initial communication, debt collection, debtor Types of San Diego California Letters Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities: 1. Basic San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations: This type of letter is a general template that can be used to inform the debt collector about their failure to disclose the debt collection attempt in the initial communication. It includes details such as the debtor's information, a description of the misrepresentations, a request for clarifications, and a demand for corrections. 2. Formal San Diego California Cease and Desist Letter Regarding Adverse Collection Practices: This type of letter carries a stronger tone, demanding that the debt collector immediately cease and desist all collection activities due to their failure to disclose the debt collection attempt. It may also include legal references, potential consequences, and a deadline for the debt collector to respond. 3. San Diego California Letter with Supporting Evidence of Misleading Misrepresentations: If a debtor has evidence to support their claim of false or misleading misrepresentations, this type of letter can be used to notify the debt collector while providing the evidence for their review. The letter should detail the evidence, explain how it contradicts the initial communication, and request immediate actions to rectify the situation. 4. San Diego California Letter Seeking Validation of Debt and Clarification: If a debtor is unsure about the collector's attempt to collect a debt, this letter can be used to request validation of the debt. It can seek clarification on the initial communication received and demand adherence to federal and state laws regarding debt collection practices. Conclusion: When facing false or misleading misrepresentations by a debt collector, it is crucial to take appropriate action to protect your rights. A well-drafted San Diego California Letter Informing Debt Collector of False or Misleading Misrepresentations can effectively prompt the debt collector to correct their practices and bring attention to their non-compliance with debt collection laws. Remember to personalize the letter according to your situation and consult legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.