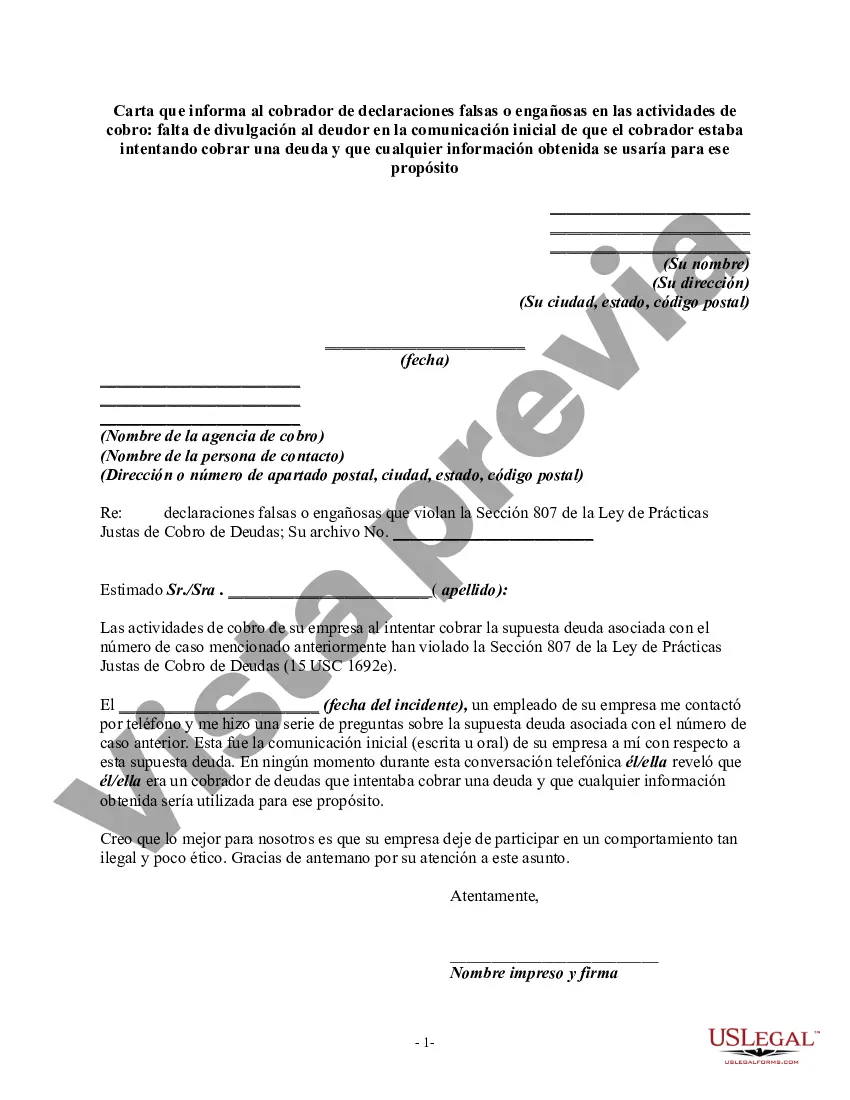

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Sec. 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"11) The failure to disclose in the initial written communication with the consumer and, in addition, if the initial communication with the consumer is oral, in that initial oral communication, that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose . . . ."

Title: Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt Introduction: In Wake County, North Carolina, individuals have legal rights and protections under the Fair Debt Collection Practices Act (FD CPA) when dealing with debt collectors. This detailed letter aims to inform debt collectors of their false or misleading misrepresentations in collection activities, specifically addressing the failure to disclose to debtors in their initial communication that they are attempting to collect a debt. By leveraging the FD CPA, debtors can assert their rights and demand proper adherence to the law. Key Points to Include in the Letter: 1. Addressing the Violation: Clearly state that the debt collector's initial communication failed to disclose their purpose of collecting a debt, thus violating the FD CPA regulations. Highlight specific instances where this violation occurred, such as misleading language or incomplete information. 2. Request for Verification: Demand that the debt collector provide written verification of the debt within the 30-day validation period mandated by the FD CPA. Emphasize that without proper validation, the debtor cannot be held accountable for any alleged debt. 3. Documentation Requests: Encourage the debt collector to provide all relevant documentation related to the alleged debt, including the original creditor, the amount owed, and a detailed account history. These requests will ensure transparency and allow the debtor to assess the accuracy and legitimacy of the debt. 4. Cease and Desist Communications: Assert the debtor's right to cease and desist communications from the debt collector. State that all further communication should be through written correspondence only and that any phone calls or other forms of harassment will be considered a violation of the FD CPA. 5. Threats and Legal Actions: Address any false or misleading threats made by the debt collector. Clearly state that any misrepresentation regarding legal actions or the potential consequences of failing to pay the debt will not be tolerated. Remind the debt collector that such actions are prohibited under the FD CPA. 6. Retaining Legal Representation: If deemed necessary, inform the debt collector that the debtor has sought legal counsel or intends to do so. This reinforces the debtor's seriousness regarding any potential violations and emphasizes their intent to protect their rights. 7. Notification of Intent to File Complaint: Lastly, inform the debt collector of the debtor's intention to file a complaint with relevant authorities, such as the Consumer Financial Protection Bureau (CFPB) and the North Carolina Attorney General's Office, if the violations persist or appropriate remedial actions are not taken. Different Types of Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities: 1. Wake North Carolina Letter Informing Debt Collector of Failure to Disclose Purpose of Communication in Initial Communication. 2. Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Amount Owed. 3. Wake North Carolina Letter Informing Debt Collector of Misleading Threats of Legal Actions. 4. Wake North Carolina Letter Informing Debt Collector of Harassment or Violations of Communication Restrictions. 5. Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Account History.Title: Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt Introduction: In Wake County, North Carolina, individuals have legal rights and protections under the Fair Debt Collection Practices Act (FD CPA) when dealing with debt collectors. This detailed letter aims to inform debt collectors of their false or misleading misrepresentations in collection activities, specifically addressing the failure to disclose to debtors in their initial communication that they are attempting to collect a debt. By leveraging the FD CPA, debtors can assert their rights and demand proper adherence to the law. Key Points to Include in the Letter: 1. Addressing the Violation: Clearly state that the debt collector's initial communication failed to disclose their purpose of collecting a debt, thus violating the FD CPA regulations. Highlight specific instances where this violation occurred, such as misleading language or incomplete information. 2. Request for Verification: Demand that the debt collector provide written verification of the debt within the 30-day validation period mandated by the FD CPA. Emphasize that without proper validation, the debtor cannot be held accountable for any alleged debt. 3. Documentation Requests: Encourage the debt collector to provide all relevant documentation related to the alleged debt, including the original creditor, the amount owed, and a detailed account history. These requests will ensure transparency and allow the debtor to assess the accuracy and legitimacy of the debt. 4. Cease and Desist Communications: Assert the debtor's right to cease and desist communications from the debt collector. State that all further communication should be through written correspondence only and that any phone calls or other forms of harassment will be considered a violation of the FD CPA. 5. Threats and Legal Actions: Address any false or misleading threats made by the debt collector. Clearly state that any misrepresentation regarding legal actions or the potential consequences of failing to pay the debt will not be tolerated. Remind the debt collector that such actions are prohibited under the FD CPA. 6. Retaining Legal Representation: If deemed necessary, inform the debt collector that the debtor has sought legal counsel or intends to do so. This reinforces the debtor's seriousness regarding any potential violations and emphasizes their intent to protect their rights. 7. Notification of Intent to File Complaint: Lastly, inform the debt collector of the debtor's intention to file a complaint with relevant authorities, such as the Consumer Financial Protection Bureau (CFPB) and the North Carolina Attorney General's Office, if the violations persist or appropriate remedial actions are not taken. Different Types of Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities: 1. Wake North Carolina Letter Informing Debt Collector of Failure to Disclose Purpose of Communication in Initial Communication. 2. Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Amount Owed. 3. Wake North Carolina Letter Informing Debt Collector of Misleading Threats of Legal Actions. 4. Wake North Carolina Letter Informing Debt Collector of Harassment or Violations of Communication Restrictions. 5. Wake North Carolina Letter Informing Debt Collector of False or Misleading Misrepresentations in Account History.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.