Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(14) The use of any business, company, or organization name other than the true name of the debt collector's business, company, or organization."

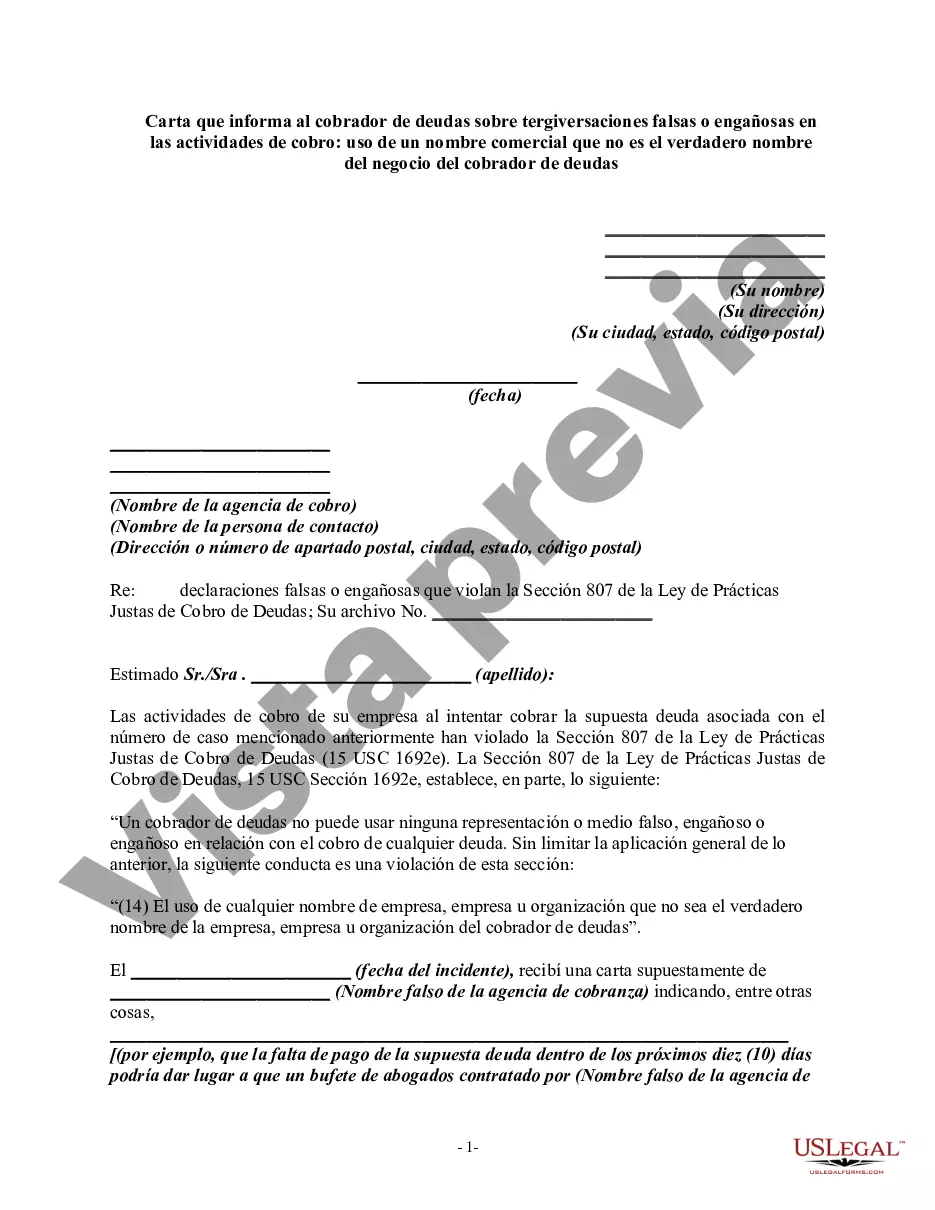

Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business In Contra Costa, California, individuals facing debt collection activities have legal rights and protections. One such protection is the right to address and report any false or misleading representations made by debt collectors while using a business name other than their true name. It is important to understand your rights in such situations and take appropriate action to ensure fair treatment. A Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business can be a powerful tool to address these issues. The letter serves as a formal notification to the debt collector, informing them of their violation and urging them to rectify the situation promptly. It is crucial to include relevant keywords and points in the letter to effectively communicate your concerns. Here are some key elements that can be included in the letter: 1. Your information: Start by providing your name, address, phone number, and any relevant account or reference numbers associated with the debt. 2. Debt collector's information: Include the debt collector's name, address, and contact details. Mention the business name they are using, if it differs from their true name, and clearly state that they have misrepresented themselves. 3. Misleading representations: Describe the false or misleading statements or actions made by the debt collector while using a business name other than their true name. Be specific and provide as much detail as possible. 4. Legal rights: Mention that under the Fair Debt Collection Practices Act (FD CPA) and other applicable laws, debt collectors are prohibited from using false, deceptive, or misleading representations in the collection of debts. 5. Request for corrective action: Clearly state that you expect the debt collector to cease and desist from using misleading business names immediately. Request that they provide written confirmation of their compliance within a specified timeframe. 6. Documentation: Emphasize the importance of providing evidence of their compliance, such as a written acknowledgement stating the discontinuation of misleading representations. 7. Consequences of non-compliance: It may be appropriate to mention that non-compliance with the request may result in further legal action or reporting their actions to relevant authorities. 8. Keep a copy: Advise the recipient to keep a copy of the letter for their records and consider sending it via certified mail to ensure proof of delivery. Remember, it is essential to consult with a legal professional who specializes in debt collection practices or consumer protection laws to ensure your letter effectively addresses the specific situation you are facing. Each case can be unique, and professional advice will help tailor the letter to your circumstances.Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business In Contra Costa, California, individuals facing debt collection activities have legal rights and protections. One such protection is the right to address and report any false or misleading representations made by debt collectors while using a business name other than their true name. It is important to understand your rights in such situations and take appropriate action to ensure fair treatment. A Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business can be a powerful tool to address these issues. The letter serves as a formal notification to the debt collector, informing them of their violation and urging them to rectify the situation promptly. It is crucial to include relevant keywords and points in the letter to effectively communicate your concerns. Here are some key elements that can be included in the letter: 1. Your information: Start by providing your name, address, phone number, and any relevant account or reference numbers associated with the debt. 2. Debt collector's information: Include the debt collector's name, address, and contact details. Mention the business name they are using, if it differs from their true name, and clearly state that they have misrepresented themselves. 3. Misleading representations: Describe the false or misleading statements or actions made by the debt collector while using a business name other than their true name. Be specific and provide as much detail as possible. 4. Legal rights: Mention that under the Fair Debt Collection Practices Act (FD CPA) and other applicable laws, debt collectors are prohibited from using false, deceptive, or misleading representations in the collection of debts. 5. Request for corrective action: Clearly state that you expect the debt collector to cease and desist from using misleading business names immediately. Request that they provide written confirmation of their compliance within a specified timeframe. 6. Documentation: Emphasize the importance of providing evidence of their compliance, such as a written acknowledgement stating the discontinuation of misleading representations. 7. Consequences of non-compliance: It may be appropriate to mention that non-compliance with the request may result in further legal action or reporting their actions to relevant authorities. 8. Keep a copy: Advise the recipient to keep a copy of the letter for their records and consider sending it via certified mail to ensure proof of delivery. Remember, it is essential to consult with a legal professional who specializes in debt collection practices or consumer protection laws to ensure your letter effectively addresses the specific situation you are facing. Each case can be unique, and professional advice will help tailor the letter to your circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.