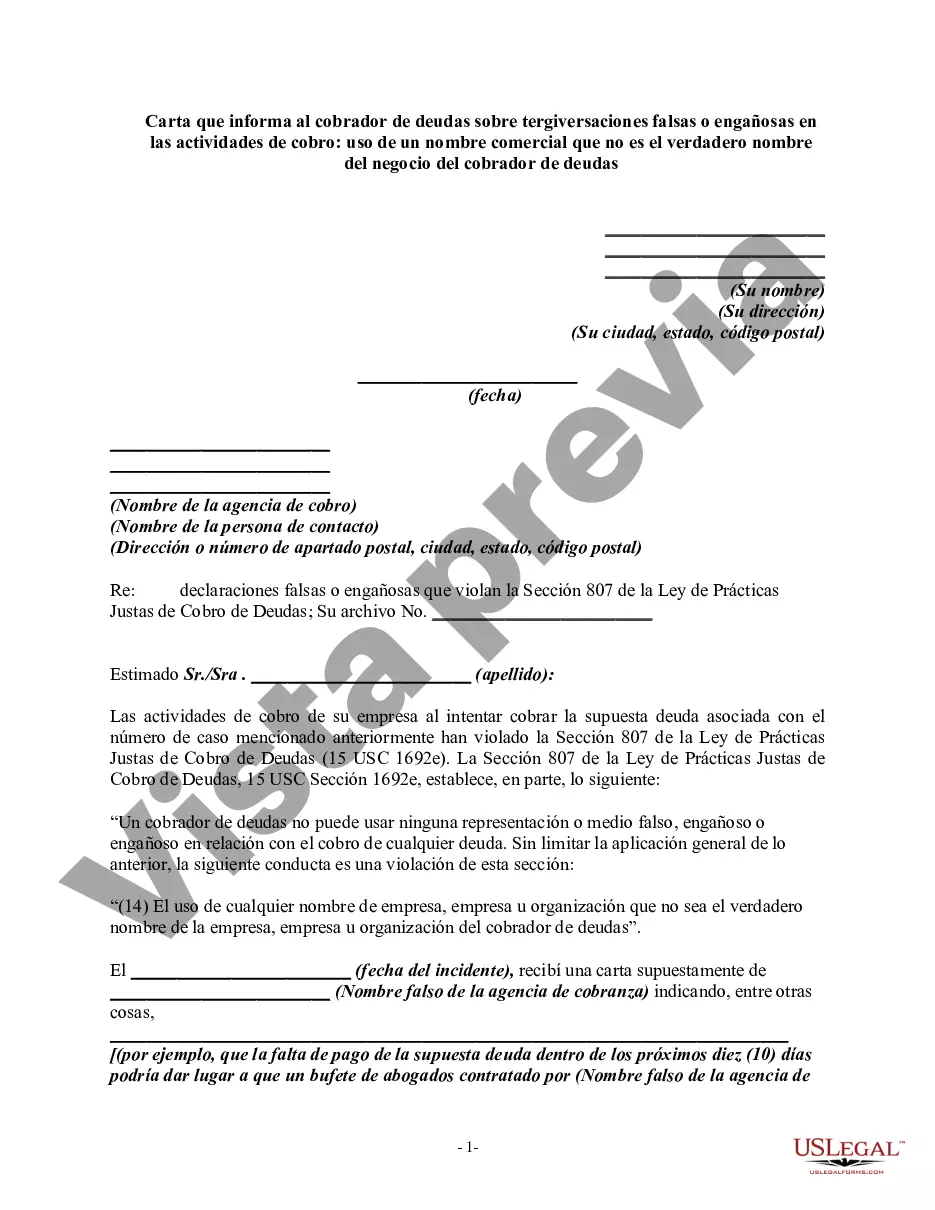

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(14) The use of any business, company, or organization name other than the true name of the debt collector's business, company, or organization."

Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business: In the state of Ohio, specifically in Cuyahoga County, debtors have certain rights and protections when it comes to debt collection activities. One particular issue that can arise is when a debt collector uses a business name other than their true name, potentially misleading or misrepresenting themselves during the collection process. This deceptive practice can confuse debtors and hinder their ability to make informed decisions regarding their debts. If you find yourself in a situation where a debt collector in Cuyahoga Ohio is using a business name different from their true name, it is important to address this false or misleading representation promptly. Being aware of your rights as a debtor is crucial in standing up against unlawful practices. When drafting a letter to inform the debt collector of their false or misleading actions, it is essential to include key details and adhere to certain guidelines. Here are some crucial points to consider: 1. Contact Information: Clearly state your full name, address, phone number, and email address at the beginning of the letter. This ensures accurate communication and helps the debt collector identify your account. 2. Date and Reference Numbers: Include the date of writing the letter and any reference numbers associated with the debt or collection account. This aids in tracking and ensures proper handling of your case. 3. Debt Collector's Information: Provide the debt collector's true full name, address, and phone number. If available, include any license or registration numbers associated with their business. This information will be crucial for legal purposes, verifying their true identity, and holding them accountable. 4. Explain the Misrepresentation: Clearly describe how the debt collector's usage of a business name other than their true name has deceived or misled you. For instance, highlight any confusion caused by their misleading representation, such as false affiliations, misstated responsibilities, or inaccurate statements regarding their authority. 5. Reference Applicable Laws and Regulations: Cite relevant state and federal laws that protect consumers against deceptive and misleading debt collection practices. In Ohio, you may refer to Ohio Revised Code section 1319.05 and the federal Fair Debt Collection Practices Act (FD CPA), which provide guidelines for lawful debt collection activities. 6. Request Clarification and Resolution: Explicitly state that you expect the debt collector to cease using misleading business names and provide accurate information regarding their true identity. Demand that they rectify any false or misleading statements previously made. Additionally, request written confirmation of their compliance with these demands within a specific timeframe. 7. Preserve Documentation: Advise the debt collector that you will retain copies of all correspondence, including your original letter and their response, to support any potential legal action or complaints filed with regulatory authorities. Remember, it is vital to consult an attorney or professional familiar with debt collection laws if you require further guidance or encounter persistent issues with the debt collector's misrepresentations. By addressing false or misleading misrepresentations in collection activities, Cuyahoga Ohio residents can protect their rights as debtors and further promote fair and ethical debt collection practices.Cuyahoga Ohio Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business: In the state of Ohio, specifically in Cuyahoga County, debtors have certain rights and protections when it comes to debt collection activities. One particular issue that can arise is when a debt collector uses a business name other than their true name, potentially misleading or misrepresenting themselves during the collection process. This deceptive practice can confuse debtors and hinder their ability to make informed decisions regarding their debts. If you find yourself in a situation where a debt collector in Cuyahoga Ohio is using a business name different from their true name, it is important to address this false or misleading representation promptly. Being aware of your rights as a debtor is crucial in standing up against unlawful practices. When drafting a letter to inform the debt collector of their false or misleading actions, it is essential to include key details and adhere to certain guidelines. Here are some crucial points to consider: 1. Contact Information: Clearly state your full name, address, phone number, and email address at the beginning of the letter. This ensures accurate communication and helps the debt collector identify your account. 2. Date and Reference Numbers: Include the date of writing the letter and any reference numbers associated with the debt or collection account. This aids in tracking and ensures proper handling of your case. 3. Debt Collector's Information: Provide the debt collector's true full name, address, and phone number. If available, include any license or registration numbers associated with their business. This information will be crucial for legal purposes, verifying their true identity, and holding them accountable. 4. Explain the Misrepresentation: Clearly describe how the debt collector's usage of a business name other than their true name has deceived or misled you. For instance, highlight any confusion caused by their misleading representation, such as false affiliations, misstated responsibilities, or inaccurate statements regarding their authority. 5. Reference Applicable Laws and Regulations: Cite relevant state and federal laws that protect consumers against deceptive and misleading debt collection practices. In Ohio, you may refer to Ohio Revised Code section 1319.05 and the federal Fair Debt Collection Practices Act (FD CPA), which provide guidelines for lawful debt collection activities. 6. Request Clarification and Resolution: Explicitly state that you expect the debt collector to cease using misleading business names and provide accurate information regarding their true identity. Demand that they rectify any false or misleading statements previously made. Additionally, request written confirmation of their compliance with these demands within a specific timeframe. 7. Preserve Documentation: Advise the debt collector that you will retain copies of all correspondence, including your original letter and their response, to support any potential legal action or complaints filed with regulatory authorities. Remember, it is vital to consult an attorney or professional familiar with debt collection laws if you require further guidance or encounter persistent issues with the debt collector's misrepresentations. By addressing false or misleading misrepresentations in collection activities, Cuyahoga Ohio residents can protect their rights as debtors and further promote fair and ethical debt collection practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.