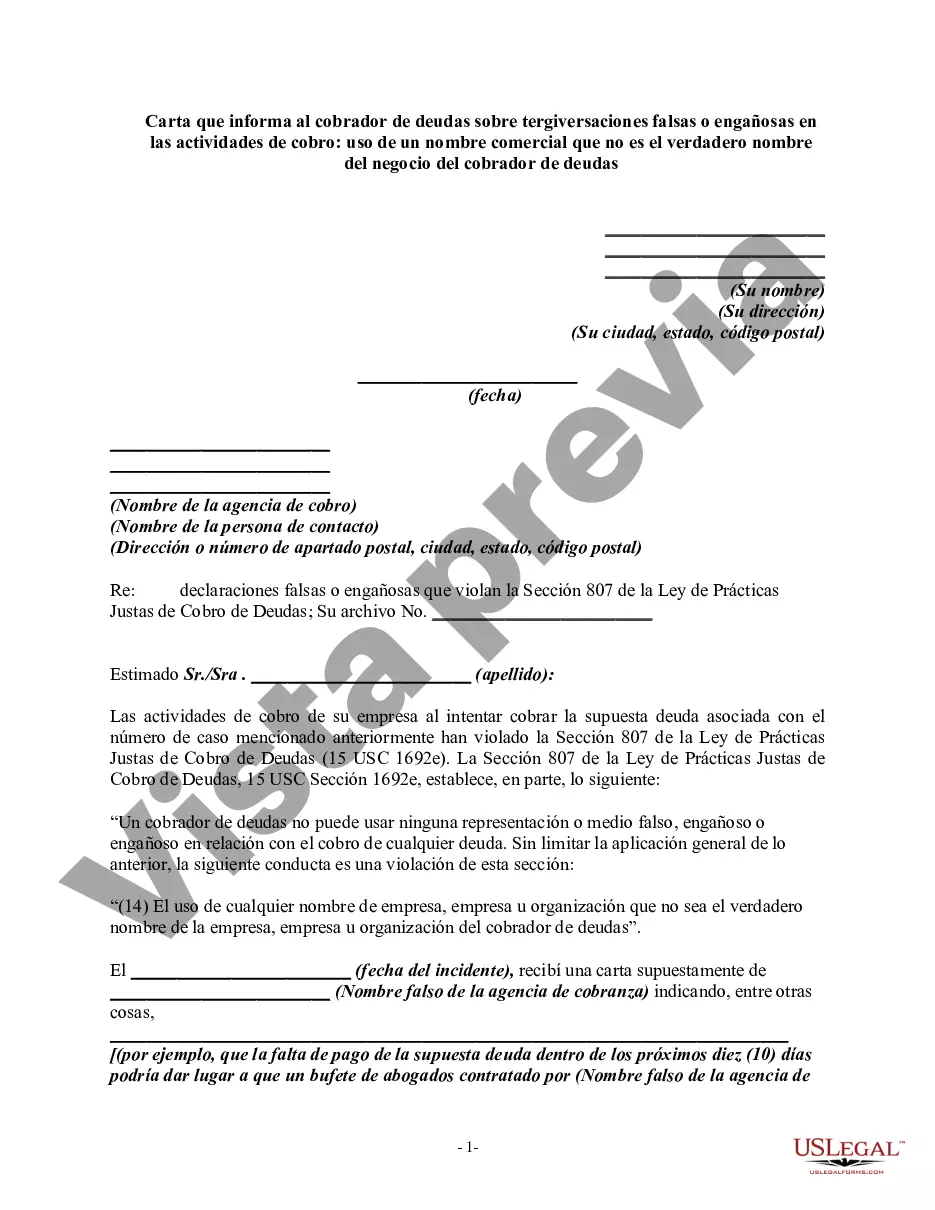

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(14) The use of any business, company, or organization name other than the true name of the debt collector's business, company, or organization."

Suffolk New York is a picturesque county located on Long Island, renowned for its diverse communities and stunning natural landscapes. It encompasses towns such as Babylon, Huntington, and Southampton, offering residents and visitors a mix of suburban charm and coastal beauty. With its rich history and abundance of recreational opportunities, Suffolk New York attracts tourists looking to explore its charming villages, sandy beaches, and exquisite wineries. In terms of legal matters, it is crucial to be aware of one's rights when dealing with debt collectors. One specific scenario that individuals may encounter involves debt collectors using a business name other than the true name of their organization, resulting in false or misleading misrepresentations during collection activities. In such cases, it is important to address the issue promptly and assertively. When drafting a letter informing a debt collector about false or misleading misrepresentations related to the use of a business name, it is important to provide specific details to support your claim. This letter should include the following components: 1. Introduction: — Clearly state your name, address, and contact information. — Provide the date of the letter— - Address the letter to the specific debt collector or collection agency involved, indicating their true name as accurately as possible. 2. Reference Information: — Identify the debt in question, including the amount owed and any relevant account numbers or reference details. — Mention any previous communication or correspondence that led to the discovery of the false or misleading misrepresentations. 3. Description of False or Misleading Misrepresentations: — Clearly explain the false or misleading misrepresentations made by the debt collector. — Provide specific instances, dates, and details to reinforce your allegations. — If possible, provide evidence such as recordings, written communications, or witness testimonies supporting your claims. 4. Legal Basis and Consequences: — Identify the applicable laws or regulations that prohibit such deceptive practices by debt collectors. — Highlight the potential legal consequences or penalties that can arise from engaging in false or misleading misrepresentations. — Emphasize your knowledge of your rights and the importance of fair and lawful debt collection practices. 5. Demands: — Clearly state your demands and expectations from the debt collector. — Request immediate cessation of the use of the false or misleading business name in all future collection activities. — Demand written confirmation of their compliance within a specific timeframe. 6. Closing: — Express your expectation for a prompt and cooperative resolution. — Provide your preferred contact method and address for further communication, if applicable. — Include your full name and signature at the end of the letter. Remember, it is essential to consult a legal professional or financial advisor who specializes in debt collection laws to ensure accuracy and to address any specific concerns related to your situation.Suffolk New York is a picturesque county located on Long Island, renowned for its diverse communities and stunning natural landscapes. It encompasses towns such as Babylon, Huntington, and Southampton, offering residents and visitors a mix of suburban charm and coastal beauty. With its rich history and abundance of recreational opportunities, Suffolk New York attracts tourists looking to explore its charming villages, sandy beaches, and exquisite wineries. In terms of legal matters, it is crucial to be aware of one's rights when dealing with debt collectors. One specific scenario that individuals may encounter involves debt collectors using a business name other than the true name of their organization, resulting in false or misleading misrepresentations during collection activities. In such cases, it is important to address the issue promptly and assertively. When drafting a letter informing a debt collector about false or misleading misrepresentations related to the use of a business name, it is important to provide specific details to support your claim. This letter should include the following components: 1. Introduction: — Clearly state your name, address, and contact information. — Provide the date of the letter— - Address the letter to the specific debt collector or collection agency involved, indicating their true name as accurately as possible. 2. Reference Information: — Identify the debt in question, including the amount owed and any relevant account numbers or reference details. — Mention any previous communication or correspondence that led to the discovery of the false or misleading misrepresentations. 3. Description of False or Misleading Misrepresentations: — Clearly explain the false or misleading misrepresentations made by the debt collector. — Provide specific instances, dates, and details to reinforce your allegations. — If possible, provide evidence such as recordings, written communications, or witness testimonies supporting your claims. 4. Legal Basis and Consequences: — Identify the applicable laws or regulations that prohibit such deceptive practices by debt collectors. — Highlight the potential legal consequences or penalties that can arise from engaging in false or misleading misrepresentations. — Emphasize your knowledge of your rights and the importance of fair and lawful debt collection practices. 5. Demands: — Clearly state your demands and expectations from the debt collector. — Request immediate cessation of the use of the false or misleading business name in all future collection activities. — Demand written confirmation of their compliance within a specific timeframe. 6. Closing: — Express your expectation for a prompt and cooperative resolution. — Provide your preferred contact method and address for further communication, if applicable. — Include your full name and signature at the end of the letter. Remember, it is essential to consult a legal professional or financial advisor who specializes in debt collection laws to ensure accuracy and to address any specific concerns related to your situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.