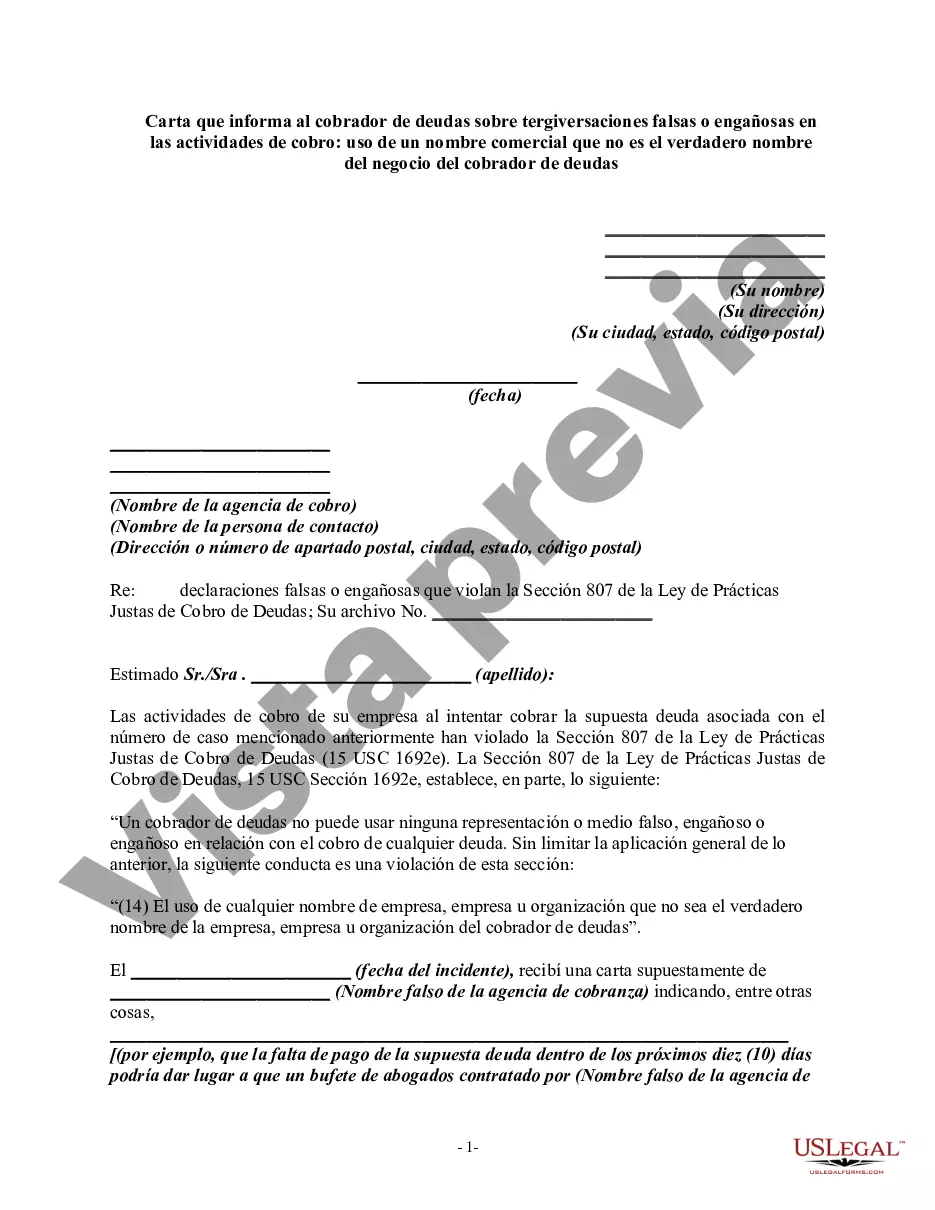

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows:

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(14) The use of any business, company, or organization name other than the true name of the debt collector's business, company, or organization."

Tarrant Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business In Tarrant, Texas, individuals are protected by laws that prohibit debt collectors from engaging in unfair or misleading practices when attempting to collect a debt. One such practice is using a business name other than the true name of the debt collector's business, which can be considered false or misleading misrepresentations in collection activities. When faced with such an issue, it is crucial to address it promptly to ensure your rights are protected. Composing a letter to inform the debt collector of their false or misleading misrepresentation is an effective way to assert your rights and seek resolution. The letter should include essential elements to convey your concerns clearly and vividly. I. Introduction Begins the letter by addressing it to the specific debt collector responsible for the misleading misrepresentation. Clearly state your name, address, and contact information. State the purpose of the letter, which is to inform them of false or misleading misrepresentations in their collection activities. II. Description of the Misrepresentation Provide detailed information about the misrepresentation, such as the business name the debt collector presented and the true name of their business. Explain how this misrepresentation has caused confusion or led you to believe the collection activities were conducted by a different entity. III. Explanation of Legal Violation Cite the specific laws and regulations on debt collection practices that prohibit using a business name other than the true name of the debt collector's business. Clearly state that such practices are considered false or misleading misrepresentations, undermining your rights as a consumer. IV. Supporting Evidence If available, include any evidence that confirms the misrepresentation, such as collection letters, call records, or other correspondence you have received from the debt collector. Attach copies of these documents to strengthen your case. V. Request for Action Clearly state your expectation for the debt collector to rectify the situation promptly. Request that they cease using false or misleading business names in their collection activities relating to your debt specifically. Additionally, demand written confirmation that the debt collector has ceased such practices and will not engage in them again in the future. VI. Consequence for Non-Compliance Inform the debt collector that failure to comply with your request may lead to further actions, such as filing a complaint with relevant regulatory bodies, pursuing legal remedies, or seeking damages for any harm caused by their deceptive practices. VII. Closing End the letter by specifying a deadline by which you expect a response from the debt collector. Provide your preferred method of contact, whether it be by phone, email, or postal mail. Sign the letter with your name and date it accordingly. Remember to keep a copy of the letter for your records and consider sending it via certified mail with a return receipt requested to ensure proof of delivery. By addressing the issue of false or misleading misrepresentations accurately, you are taking an important step towards protecting your rights as a consumer.Tarrant Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using a Business Name Other Than the True Name of the Debt Collector's Business In Tarrant, Texas, individuals are protected by laws that prohibit debt collectors from engaging in unfair or misleading practices when attempting to collect a debt. One such practice is using a business name other than the true name of the debt collector's business, which can be considered false or misleading misrepresentations in collection activities. When faced with such an issue, it is crucial to address it promptly to ensure your rights are protected. Composing a letter to inform the debt collector of their false or misleading misrepresentation is an effective way to assert your rights and seek resolution. The letter should include essential elements to convey your concerns clearly and vividly. I. Introduction Begins the letter by addressing it to the specific debt collector responsible for the misleading misrepresentation. Clearly state your name, address, and contact information. State the purpose of the letter, which is to inform them of false or misleading misrepresentations in their collection activities. II. Description of the Misrepresentation Provide detailed information about the misrepresentation, such as the business name the debt collector presented and the true name of their business. Explain how this misrepresentation has caused confusion or led you to believe the collection activities were conducted by a different entity. III. Explanation of Legal Violation Cite the specific laws and regulations on debt collection practices that prohibit using a business name other than the true name of the debt collector's business. Clearly state that such practices are considered false or misleading misrepresentations, undermining your rights as a consumer. IV. Supporting Evidence If available, include any evidence that confirms the misrepresentation, such as collection letters, call records, or other correspondence you have received from the debt collector. Attach copies of these documents to strengthen your case. V. Request for Action Clearly state your expectation for the debt collector to rectify the situation promptly. Request that they cease using false or misleading business names in their collection activities relating to your debt specifically. Additionally, demand written confirmation that the debt collector has ceased such practices and will not engage in them again in the future. VI. Consequence for Non-Compliance Inform the debt collector that failure to comply with your request may lead to further actions, such as filing a complaint with relevant regulatory bodies, pursuing legal remedies, or seeking damages for any harm caused by their deceptive practices. VII. Closing End the letter by specifying a deadline by which you expect a response from the debt collector. Provide your preferred method of contact, whether it be by phone, email, or postal mail. Sign the letter with your name and date it accordingly. Remember to keep a copy of the letter for your records and consider sending it via certified mail with a return receipt requested to ensure proof of delivery. By addressing the issue of false or misleading misrepresentations accurately, you are taking an important step towards protecting your rights as a consumer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.