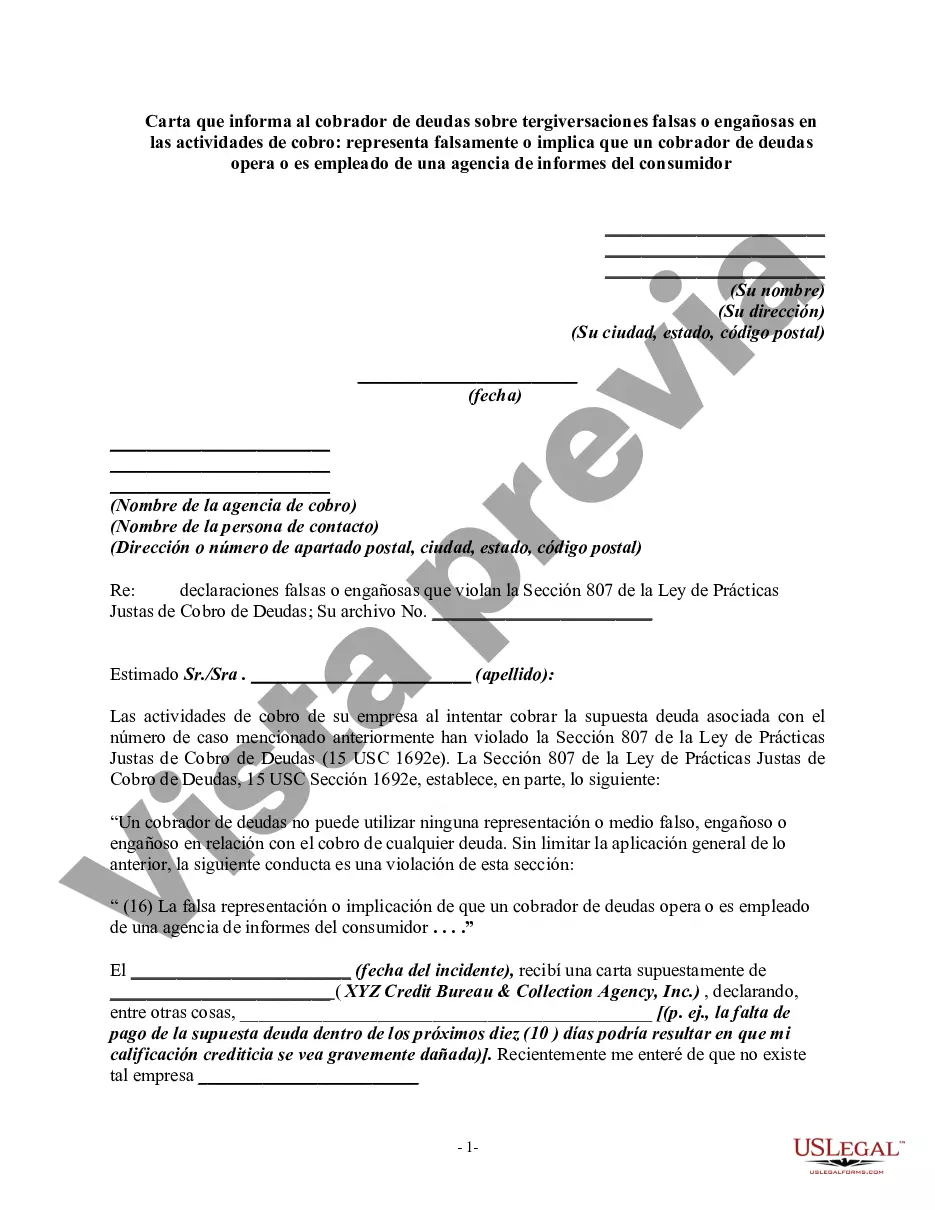

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section: "(16) The false representation or implication that a debt collector operates or is employed by a consumer reporting agency . . . ."

Palm Beach, Florida, located on Florida's southeast coast, is a beautiful and affluent area known for its pristine beaches, upscale shopping districts, and luxurious resorts. It is a popular tourist destination and home to many wealthy residents. In recent years, Palm Beach has also become a hotbed for various fraudulent activities, including debt collection scams. These scams often involve debt collectors falsely representing or implying that they operate or are employed by a consumer reporting agency in an attempt to deceive and intimidate consumers into paying debts they may not owe or have already settled. If you have been targeted by such misleading misrepresentations in collection activities, it is crucial to take action to protect your rights and financial well-being. One way to address this issue is by sending a letter to the debt collector, informing them of their false or misleading misrepresentations and demanding that they cease such activities immediately. A "Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing or Implying that a Debt Collector Operates or is Employed by a Consumer Reporting Agency" can help you assert your rights and hold the debt collector accountable for their unlawful actions. By clearly outlining the deceptive tactics they have employed and referencing the relevant laws and regulations, you can express your intent to take legal action if the behavior continues. Different versions of this letter may exist, tailored to specific situations or legal requirements. Some specific types or variations of the "Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities" may include: 1. General Template: This letter template provides a comprehensive and straightforward approach to addressing the debt collector's false or misleading claims regarding their affiliation with a consumer reporting agency. 2. Cease and Desist Letter: A cease and desist letter is a more formal approach, demanding that the debt collector immediately stops their deceptive practices and refrains from contacting you further regarding the alleged debt. 3. Dispute Letter: If you have already disputed the debt in question or believe that it is fraudulent, this type of letter can assert your rights and demand that the debt collector provide evidence of the debt's validity or remove it from your credit report. 4. Notice of Intent to Sue: In situations where the debt collector continues their deceptive practices despite your previous attempts to address the issue, a notice of intent to sue can be an effective tool to convey your seriousness about pursuing legal action if necessary. Remember, it is essential to consult with a qualified attorney or financial professional to ensure that your specific circumstances are addressed appropriately and in compliance with applicable laws and regulations.Palm Beach, Florida, located on Florida's southeast coast, is a beautiful and affluent area known for its pristine beaches, upscale shopping districts, and luxurious resorts. It is a popular tourist destination and home to many wealthy residents. In recent years, Palm Beach has also become a hotbed for various fraudulent activities, including debt collection scams. These scams often involve debt collectors falsely representing or implying that they operate or are employed by a consumer reporting agency in an attempt to deceive and intimidate consumers into paying debts they may not owe or have already settled. If you have been targeted by such misleading misrepresentations in collection activities, it is crucial to take action to protect your rights and financial well-being. One way to address this issue is by sending a letter to the debt collector, informing them of their false or misleading misrepresentations and demanding that they cease such activities immediately. A "Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing or Implying that a Debt Collector Operates or is Employed by a Consumer Reporting Agency" can help you assert your rights and hold the debt collector accountable for their unlawful actions. By clearly outlining the deceptive tactics they have employed and referencing the relevant laws and regulations, you can express your intent to take legal action if the behavior continues. Different versions of this letter may exist, tailored to specific situations or legal requirements. Some specific types or variations of the "Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities" may include: 1. General Template: This letter template provides a comprehensive and straightforward approach to addressing the debt collector's false or misleading claims regarding their affiliation with a consumer reporting agency. 2. Cease and Desist Letter: A cease and desist letter is a more formal approach, demanding that the debt collector immediately stops their deceptive practices and refrains from contacting you further regarding the alleged debt. 3. Dispute Letter: If you have already disputed the debt in question or believe that it is fraudulent, this type of letter can assert your rights and demand that the debt collector provide evidence of the debt's validity or remove it from your credit report. 4. Notice of Intent to Sue: In situations where the debt collector continues their deceptive practices despite your previous attempts to address the issue, a notice of intent to sue can be an effective tool to convey your seriousness about pursuing legal action if necessary. Remember, it is essential to consult with a qualified attorney or financial professional to ensure that your specific circumstances are addressed appropriately and in compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.