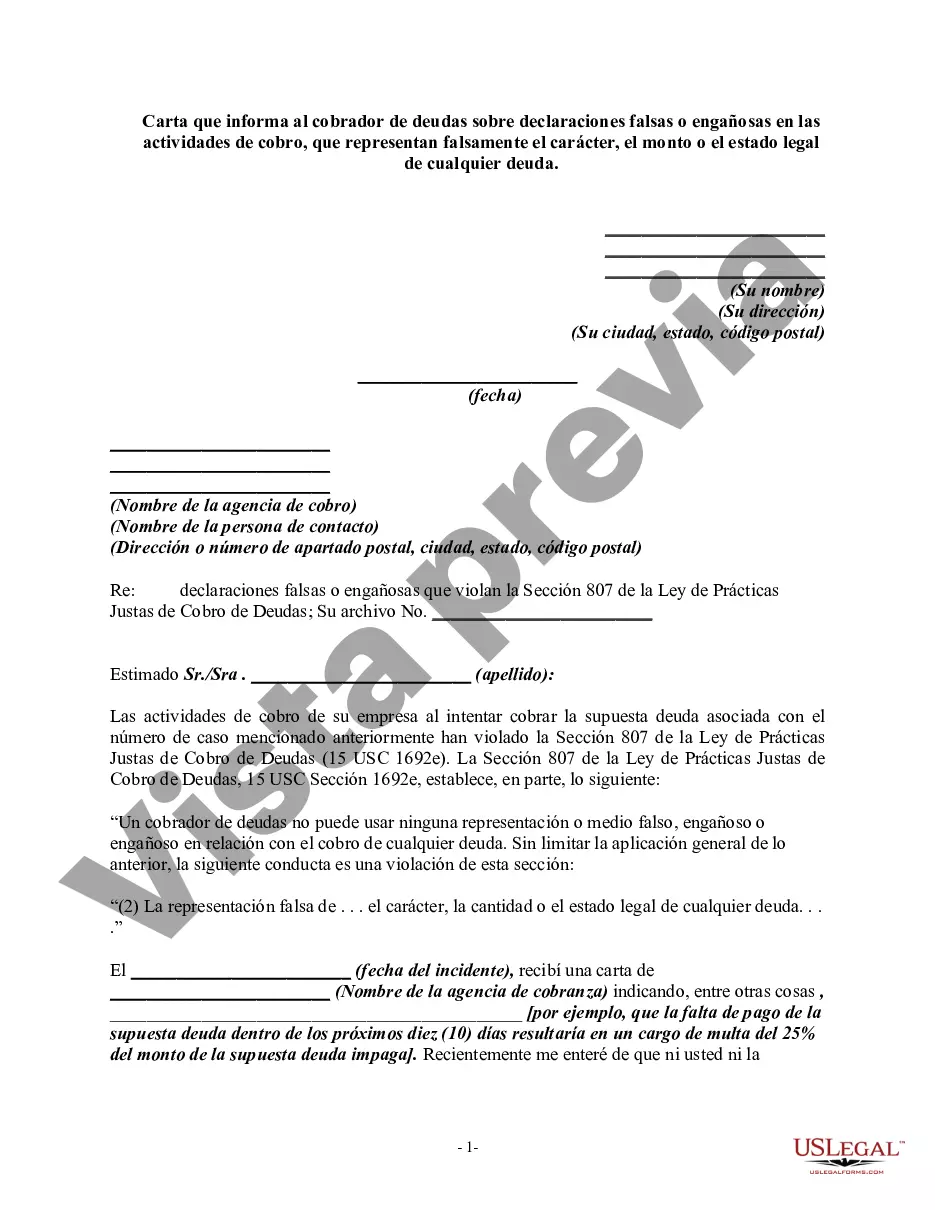

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(2) The false representation of . . . the character, amount, or legal status of any debt . . . ."

Title: Riverside California: Crafting an Effective Letter to Address False or Misleading Misrepresentations in Debt Collection Activities Introduction: In the Riverside, California area, residents may encounter situations where debt collectors engage in unfair or deceptive practices, such as falsely representing the character, amount, or legal status of a debt. It is crucial to address these issues promptly and appropriately. This article provides a detailed description of what Riverside California residents should consider when writing a Letter Informing a Debt Collector of False or Misleading Misrepresentations in Collection Activities. 1. Importance of Accurate Debt Collection Representation: The first section emphasizes the significance of accurate representation by debt collectors. It explains that debt collectors should not mislead individuals regarding the nature, amount, or legality of a debt. This sets the context for the subsequent discussion on drafting an effective letter to address such misrepresentations. 2. Key Elements of a Riverside California Letter Informing Debt Collector of False or Misleading Misrepresentations: This section provides an overview of essential elements to include in the letter informing a debt collector of misleading actions. It emphasizes the importance of documenting specific instances of misrepresentation, maintaining a professional tone, and referencing relevant laws and regulations. 3. Detailed Description of False or Misleading Misrepresentations: To address different types of misrepresentations regarding the character, amount, or legal status of a debt, this section provides specific examples and discusses the potential consequences for debt collectors engaging in such practices. Common misrepresentations may include falsely inflating the amount owed, misrepresenting the individual's obligation to pay, or mischaracterizing the legal status of the debt. 4. Steps to Draft an Effective Letter: In this section, a step-by-step guide is provided to help Riverside California residents draft a compelling and concise letter. It includes starting with a clear statement of the purpose of the letter, documenting instances of misleading representation, referencing applicable laws (such as the Fair Debt Collection Practices Act), and requesting immediate corrective actions. 5. Seeking Legal Counsel and Reporting Misleading Practices: For individuals facing persistent or serious misrepresentations from debt collectors, this section encourages seeking legal counsel to navigate the complex legal aspects of debt collection. Additionally, it provides guidance on reporting such practices to relevant regulatory bodies, such as the Consumer Financial Protection Bureau or the California Department of Business Oversight. Conclusion: This article summarizes the importance of addressing false or misleading misrepresentations in debt collection activities in Riverside, California. It highlights the variety of misrepresentations that individuals may encounter and provides guidance on crafting a well-written letter to inform debt collectors of such practices. By taking action and asserting their rights, individuals in Riverside, California can protect themselves from deceptive debt collection practices, ensuring fair treatment and compliance with applicable laws.Title: Riverside California: Crafting an Effective Letter to Address False or Misleading Misrepresentations in Debt Collection Activities Introduction: In the Riverside, California area, residents may encounter situations where debt collectors engage in unfair or deceptive practices, such as falsely representing the character, amount, or legal status of a debt. It is crucial to address these issues promptly and appropriately. This article provides a detailed description of what Riverside California residents should consider when writing a Letter Informing a Debt Collector of False or Misleading Misrepresentations in Collection Activities. 1. Importance of Accurate Debt Collection Representation: The first section emphasizes the significance of accurate representation by debt collectors. It explains that debt collectors should not mislead individuals regarding the nature, amount, or legality of a debt. This sets the context for the subsequent discussion on drafting an effective letter to address such misrepresentations. 2. Key Elements of a Riverside California Letter Informing Debt Collector of False or Misleading Misrepresentations: This section provides an overview of essential elements to include in the letter informing a debt collector of misleading actions. It emphasizes the importance of documenting specific instances of misrepresentation, maintaining a professional tone, and referencing relevant laws and regulations. 3. Detailed Description of False or Misleading Misrepresentations: To address different types of misrepresentations regarding the character, amount, or legal status of a debt, this section provides specific examples and discusses the potential consequences for debt collectors engaging in such practices. Common misrepresentations may include falsely inflating the amount owed, misrepresenting the individual's obligation to pay, or mischaracterizing the legal status of the debt. 4. Steps to Draft an Effective Letter: In this section, a step-by-step guide is provided to help Riverside California residents draft a compelling and concise letter. It includes starting with a clear statement of the purpose of the letter, documenting instances of misleading representation, referencing applicable laws (such as the Fair Debt Collection Practices Act), and requesting immediate corrective actions. 5. Seeking Legal Counsel and Reporting Misleading Practices: For individuals facing persistent or serious misrepresentations from debt collectors, this section encourages seeking legal counsel to navigate the complex legal aspects of debt collection. Additionally, it provides guidance on reporting such practices to relevant regulatory bodies, such as the Consumer Financial Protection Bureau or the California Department of Business Oversight. Conclusion: This article summarizes the importance of addressing false or misleading misrepresentations in debt collection activities in Riverside, California. It highlights the variety of misrepresentations that individuals may encounter and provides guidance on crafting a well-written letter to inform debt collectors of such practices. By taking action and asserting their rights, individuals in Riverside, California can protect themselves from deceptive debt collection practices, ensuring fair treatment and compliance with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.