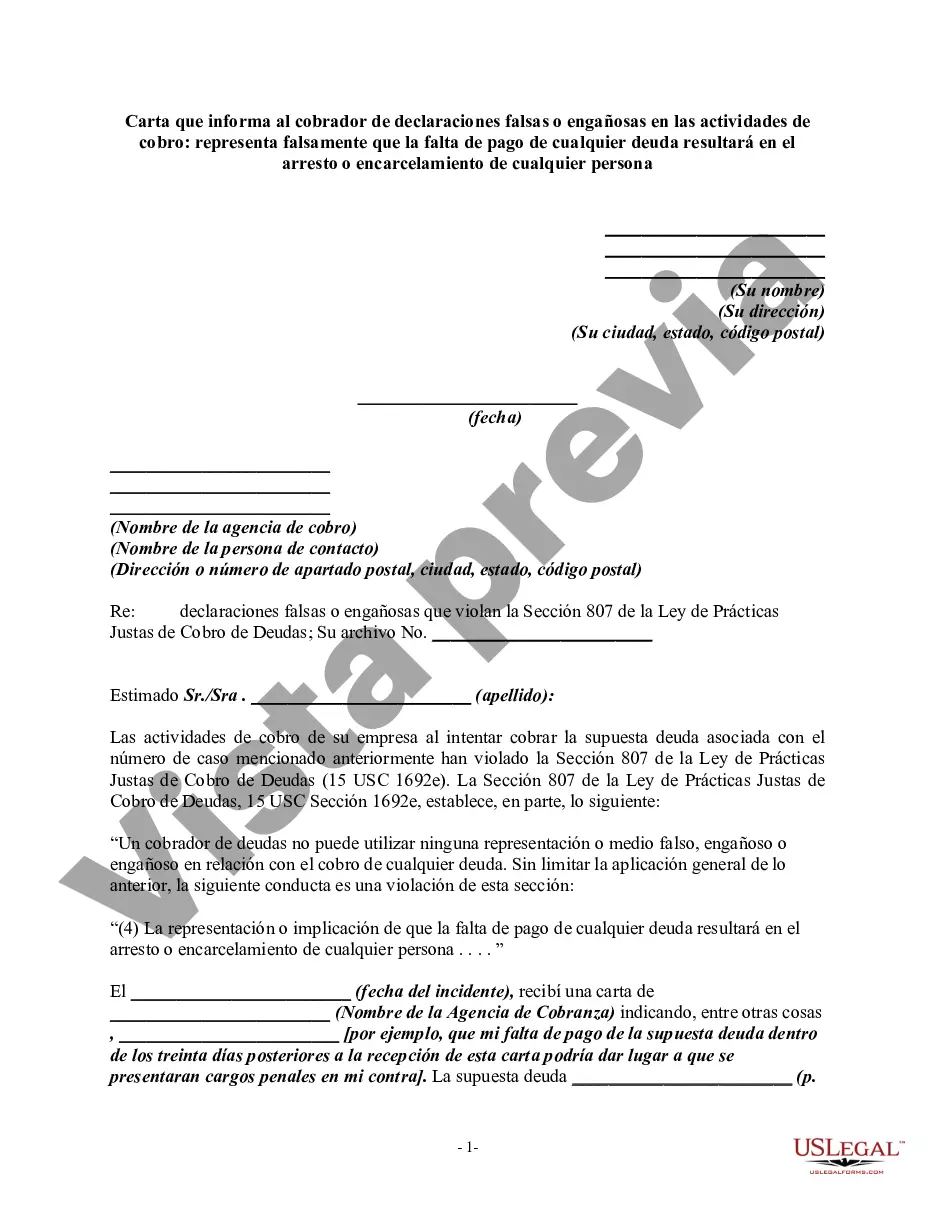

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) The representation or implication that nonpayment of any debt will result in the arrest or imprisonment of any person . . . ."

Title: Wayne, Michigan — Drafting an Effective Letter to Inform Debt Collector of False and Misleading Misrepresentations in Collection Activities Introduction: In Wayne, Michigan, as in other states, individuals are protected by various consumer protection laws, including the Fair Debt Collection Practices Act (FD CPA). These laws prohibit debt collectors from making false or misleading representations in their collection activities. One specific prohibition is the false representation that nonpayment of any debt will result in the arrest or imprisonment of any person. If you believe a debt collector has engaged in such misleading practices, it's important to address the issue promptly and assert your rights. This article aims to guide you on writing an effective letter informing the debt collector of these false or misleading representations. 1. Overview of the Situation: Provide a brief description of the situation that led to the debt collector's false or misleading representation. Explain the context, any previous correspondence or interactions with the debt collector, and how their actions violated the FD CPA. 2. Clearly State the Violation: In a precise and concise manner, explicitly state the particular violation(s) committed by the debt collector. Focus on the false representation that nonpayment of any debt will result in arrest or imprisonment, as this is the key issue being addressed in the letter. 3. Reference Relevant Laws and Regulations: Cite the relevant sections of the FD CPA and other applicable laws and regulations that protect consumers from such misleading practices. By mentioning these provisions, you help the debt collector understand the seriousness of the matter and your knowledge of your rights. 4. Provide Supporting Evidence and Documentation: Include copies of any previous correspondence, such as letters or emails, where the false or misleading representation was made. Attach any relevant documentation that can assist in proving your claim, such as recordings of phone conversations or witness statements, if available. 5. Demand Compliance and Cease Misleading Practices: Clearly state that the debt collector's actions are in violation of the law and demand that the misleading practices cease immediately. Emphasize that you are aware of your rights as a consumer and that you expect appropriate actions to be taken to rectify the situation. 6. Request Written Confirmation and a Cease-and-Desist: Ask the debt collector to provide written confirmation that they have received your letter and that they will comply with your request to cease engaging in false or misleading representations. Assert your right to have them stop all communication with you, except for essential legal notifications, as per the FD CPA. 7. Preserve Your Rights: Remind the debt collector that failure to cease the misleading practices could result in legal action being taken against them. Inform them that you are prepared to report their actions to the relevant consumer protection agencies, such as the Consumer Financial Protection Bureau (CFPB) or the Attorney General's office, if necessary. 8. Closing: Express your expectation of a prompt response and urge the debt collector to take the matter seriously. Provide your contact information and reiterate your request for written confirmation of their compliance. Conclusion: By effectively and clearly addressing the issue of false or misleading representations made by a debt collector in Wayne, Michigan, you can protect your rights as a consumer and reinforce compliance with the FD CPA. Stay vigilant in monitoring any future actions by the debt collector and be prepared to take further steps if necessary. Remember, knowledge and prompt action are key to ensuring fair treatment as a debtor.Title: Wayne, Michigan — Drafting an Effective Letter to Inform Debt Collector of False and Misleading Misrepresentations in Collection Activities Introduction: In Wayne, Michigan, as in other states, individuals are protected by various consumer protection laws, including the Fair Debt Collection Practices Act (FD CPA). These laws prohibit debt collectors from making false or misleading representations in their collection activities. One specific prohibition is the false representation that nonpayment of any debt will result in the arrest or imprisonment of any person. If you believe a debt collector has engaged in such misleading practices, it's important to address the issue promptly and assert your rights. This article aims to guide you on writing an effective letter informing the debt collector of these false or misleading representations. 1. Overview of the Situation: Provide a brief description of the situation that led to the debt collector's false or misleading representation. Explain the context, any previous correspondence or interactions with the debt collector, and how their actions violated the FD CPA. 2. Clearly State the Violation: In a precise and concise manner, explicitly state the particular violation(s) committed by the debt collector. Focus on the false representation that nonpayment of any debt will result in arrest or imprisonment, as this is the key issue being addressed in the letter. 3. Reference Relevant Laws and Regulations: Cite the relevant sections of the FD CPA and other applicable laws and regulations that protect consumers from such misleading practices. By mentioning these provisions, you help the debt collector understand the seriousness of the matter and your knowledge of your rights. 4. Provide Supporting Evidence and Documentation: Include copies of any previous correspondence, such as letters or emails, where the false or misleading representation was made. Attach any relevant documentation that can assist in proving your claim, such as recordings of phone conversations or witness statements, if available. 5. Demand Compliance and Cease Misleading Practices: Clearly state that the debt collector's actions are in violation of the law and demand that the misleading practices cease immediately. Emphasize that you are aware of your rights as a consumer and that you expect appropriate actions to be taken to rectify the situation. 6. Request Written Confirmation and a Cease-and-Desist: Ask the debt collector to provide written confirmation that they have received your letter and that they will comply with your request to cease engaging in false or misleading representations. Assert your right to have them stop all communication with you, except for essential legal notifications, as per the FD CPA. 7. Preserve Your Rights: Remind the debt collector that failure to cease the misleading practices could result in legal action being taken against them. Inform them that you are prepared to report their actions to the relevant consumer protection agencies, such as the Consumer Financial Protection Bureau (CFPB) or the Attorney General's office, if necessary. 8. Closing: Express your expectation of a prompt response and urge the debt collector to take the matter seriously. Provide your contact information and reiterate your request for written confirmation of their compliance. Conclusion: By effectively and clearly addressing the issue of false or misleading representations made by a debt collector in Wayne, Michigan, you can protect your rights as a consumer and reinforce compliance with the FD CPA. Stay vigilant in monitoring any future actions by the debt collector and be prepared to take further steps if necessary. Remember, knowledge and prompt action are key to ensuring fair treatment as a debtor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.