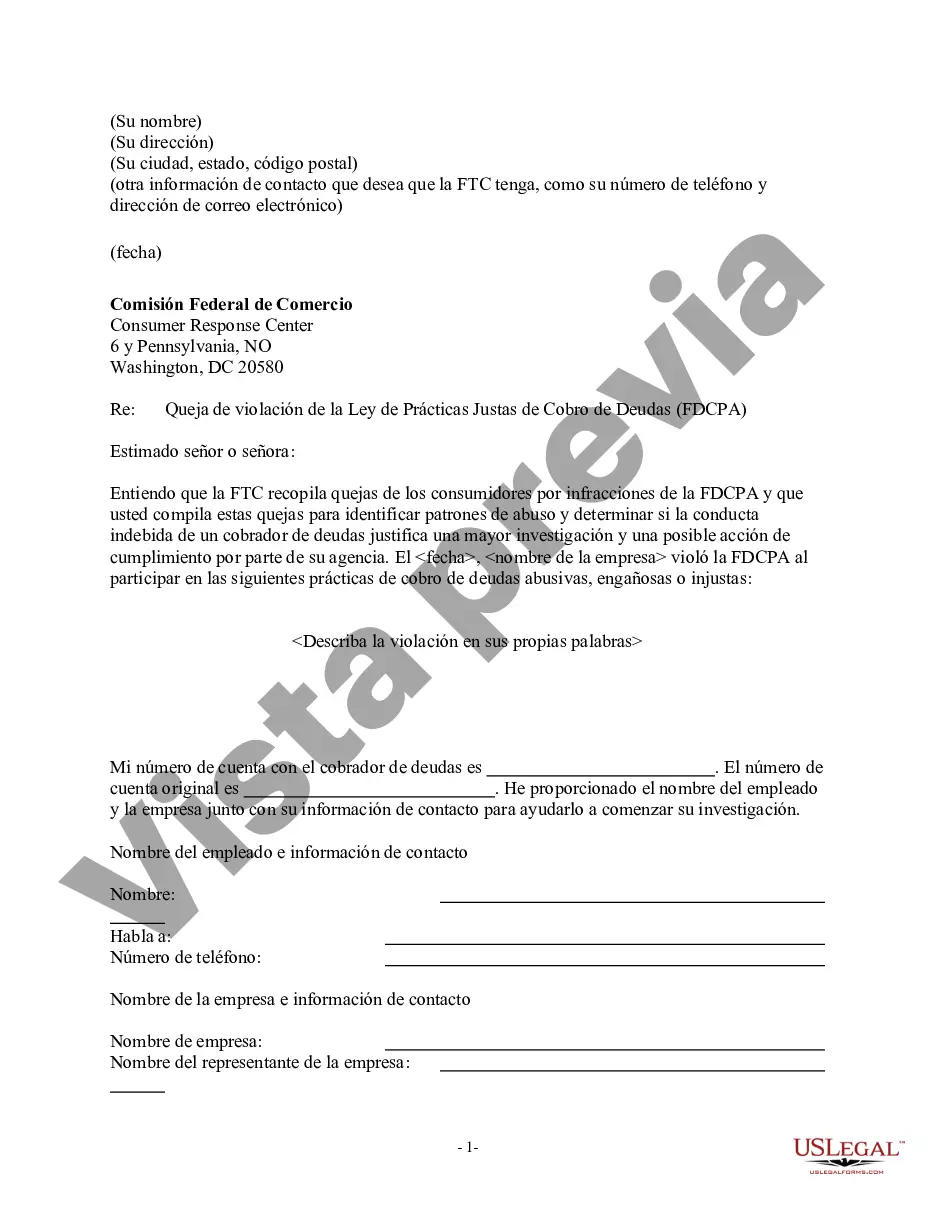

Title: Understanding Chicago, Illinois Notice of Violation of Fair Debt Act — Letter To The Federal Trade Commission Introduction: Chicago, Illinois Notice of Violation of Fair Debt Act (FD CPA) is a formal letter addressed to the Federal Trade Commission (FTC). The FD CPA is an essential federal law enacted to protect consumers from unfair debt collection practices. This comprehensive description will shed light on the purpose, types, and potential consequences of receiving such a notice in the Chicago, Illinois area. Keywords: Chicago, Illinois, Notice of Violation, Fair Debt Act, Letter, Federal Trade Commission, FTC, FD CPA 1. Purpose of Chicago, Illinois Notice of Violation of Fair Debt Act: The primary purpose of the notice is to alert the FTC about any potential violations of the FD CPA by debt collectors or collection agencies operating in the Chicago, Illinois region. By reporting these violations, consumers aim to seek protection and ensure fair treatment from debt collectors. This letter acts as evidence to support their claims and initiates the FTC's investigation into the matter. 2. Types of Chicago, Illinois Notice of Violation of Fair Debt Act: a. Individual Consumer Complaint: This type of notice refers to a situation where an individual consumer suspects that a debt collector or collection agency has violated their rights under the FD CPA. The consumer files a formal complaint with the FTC, outlining the details of the alleged violation. b. Class Action Complaint: In some cases, multiple consumers may have experienced similar unfair debt collection practices from the same debt collector or collection agency. These consumers may join forces and file a class action complaint through a Chicago-based attorney or organization. This notice highlights the collective grievances of the affected consumers. 3. Contents of the Letter: a. Consumer Information: The letter typically includes the complainant's personal information, such as name, contact details, and account number, ensuring their identity and connection to the alleged violation. b. Violation Details: The letter outlines the specific actions or practices that consumers believe violate their rights under the FD CPA. This could include harassment, misrepresentation, threats, or other prohibited conduct initiated by debt collectors or collection agencies. c. Supporting Evidence: Consumers are encouraged to provide any available evidence to strengthen their claim. This may include audio recordings, letters, emails, or witness testimonials that substantiate the alleged violations. d. Requested Actions: The complainant may include a list of desired actions, such as a cease and desist order against the debt collector, damages, or sanctions against the violating party. 4. Potential Consequences of a Chicago, Illinois Notice of Violation of Fair Debt Act: a. FTC Investigation: Upon receipt of the notice, the FTC initiates an investigation to determine the validity of the complaint. They may request additional evidence, conduct interviews, and communicate with both the complainant and the accused party. b. Legal Action: If the FTC finds evidence supporting the violation claim, legal action may be taken against the debt collector or collection agency. This may result in fines, penalties, and court orders stopping further unfair debt collection practices. c. Remedies for the Complainant: In cases where violations are substantiated, the complainant may be entitled to remedies such as monetary damages, debt forgiveness or reduction, and compensation for emotional distress caused by the unfair debt collection practices. Conclusion: The Chicago, Illinois Notice of Violation of Fair Debt Act letter to the Federal Trade Commission serves as an important tool to safeguard consumer rights and hold debt collectors accountable to fair debt collection practices. By reporting violations, consumers contribute to the protection of their rights and the ongoing efforts to regulate the debt collection industry in Chicago, Illinois.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Aviso de violación de la Ley de Deuda Justa - Carta a la Comisión Federal de Comercio - Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Chicago Illinois Aviso De Violación De La Ley De Deuda Justa - Carta A La Comisión Federal De Comercio?

Creating paperwork, like Chicago Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission, to take care of your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for a variety of cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Chicago Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Chicago Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission:

- Ensure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Chicago Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our website and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!