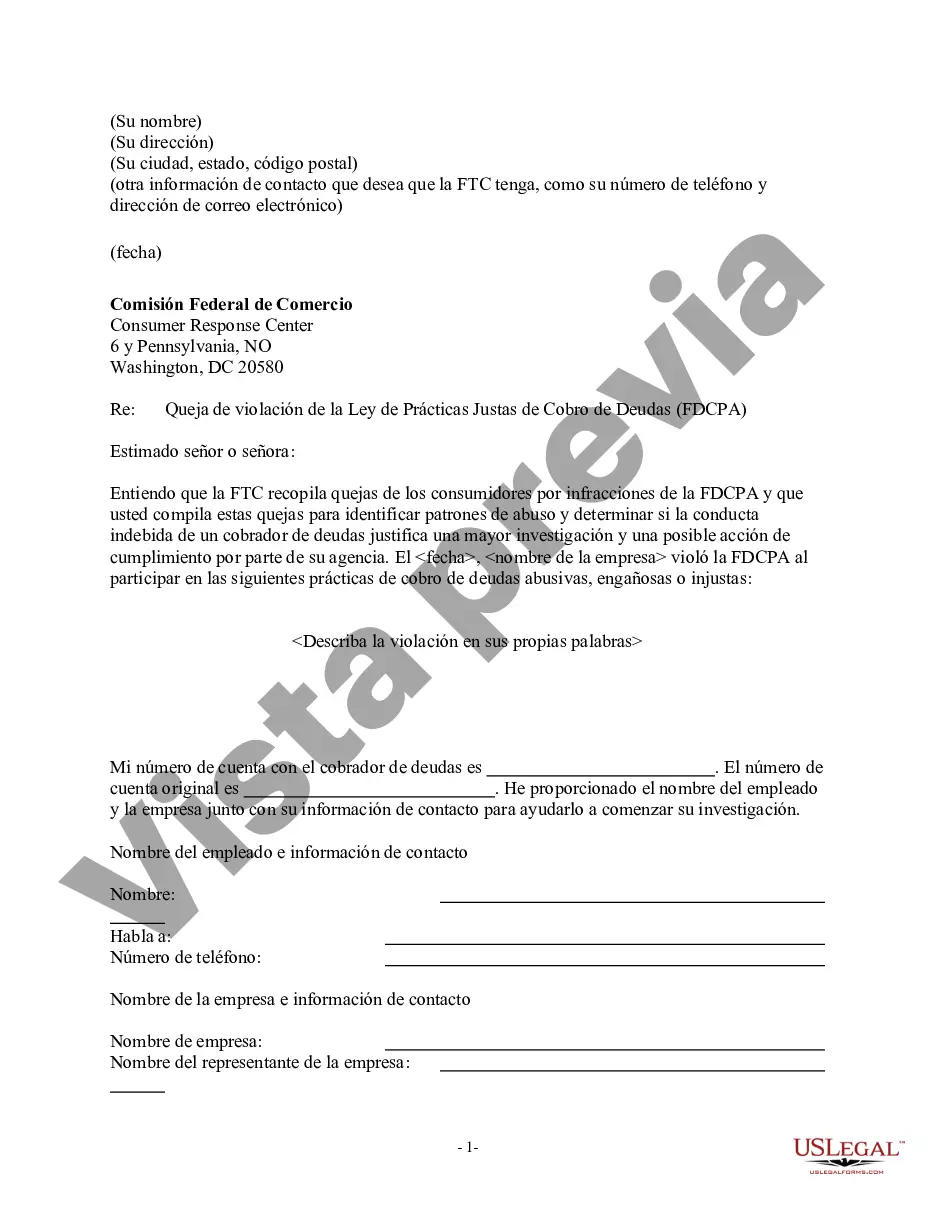

Title: Exploring Fulton Georgia's Notice of Violation of Fair Debt Act — Letter To The Federal Trade Commission Keywords: Fulton Georgia, Notice of Violation, Fair Debt Act, Letter to the Federal Trade Commission, debt collection practices, consumer rights, debt harassment, consumer complaints, debt collection regulations Introduction: The Fulton Georgia Notice of Violation of Fair Debt Act is an essential legal document that aims to protect individuals from unfair debt collection practices. This letter is submitted to the Federal Trade Commission (FTC) to report violations of the Fair Debt Collection Practices Act (FD CPA). Let's delve into the intricacies of this notice and the types of violations commonly reported. 1. Understanding the Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law that safeguards consumers against abusive, deceptive, and unfair debt collection practices. It regulates the operations of debt collectors, sets standards for communications, and ensures the rights of consumers are protected during debt collection activities. 2. Purpose and Importance of the Notice: The Notice of Violation of Fair Debt Act is a crucial step towards addressing unlawful debt collection practices. It helps consumers exercise their rights by informing the FTC about violations of the FD CPA, enabling the commission to investigate the matter and take appropriate actions. 3. Types of Fulton Georgia Notice of Violation of Fair Debt Act: a) Harassment or Threats: This violation refers to instances where debt collectors engage in intimidating or threatening behavior, such as incessant calls, use of abusive language, or making false threats of legal actions or damage to the consumer's reputation. b) Misrepresentation or False Statements: This violation occurs when debt collectors misrepresent the amount owed, claim to be attorneys or government officials, provide false credit reporting information, or attempt to deceive consumers about their rights. c) Failure to Validate Debt: Debt collectors must provide written validation of a debt within five days of initial contact. Failure to do so upon consumer request is a violation. d) Improper Communication: This violation includes contacting consumers at inconvenient times or places, communicating with consumers who are represented by an attorney, or contacting third parties to obtain consumer information. e) Unauthorized Fees or Charges: Debt collectors must not impose unauthorized fees or charges on consumers, such as attorney's fees or additional interest not mentioned in the initial agreement. 4. Reporting the Violations: When submitting the Notice of Violation of Fair Debt Act to the Federal Trade Commission, consumers are required to include detailed information about the violation, such as the debt collector's name, contact details, instances of misconduct, copies of communication, and any relevant supporting documents. Conclusion: The Fulton Georgia Notice of Violation of Fair Debt Act is a powerful tool for consumers in dealing with unfair debt collection practices. By submitting this letter to the Federal Trade Commission, consumers can seek justice and hold debt collectors accountable for their unlawful actions. Understanding the different types of violations reported can help individuals recognize such misconduct and take the necessary steps to protect their rights and financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Aviso de violación de la Ley de Deuda Justa - Carta a la Comisión Federal de Comercio - Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Fulton Georgia Aviso De Violación De La Ley De Deuda Justa - Carta A La Comisión Federal De Comercio?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Fulton Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Fulton Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission. Follow the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fulton Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!