Title: Nassau New York Notice of Violation of Fair Debt Act — Letter to the Federal Trade Commission: Understanding the Issue and Seeking Resolution Introduction: In this detailed description, we explore the concept of a Nassau New York Notice of Violation of Fair Debt Act, specifically addressed in a letter to the Federal Trade Commission. We will provide an overview of what this notice entails, the purpose it serves, and the potential consequences for violating the Fair Debt Act. Additionally, we will discuss different types of violations that can occur in Nassau New York and how they may be identified. Keywords: Nassau New York, Notice of Violation, Fair Debt Act, Federal Trade Commission, letter, consequences, violations, identify. 1. Understanding Nassau New York Notice of Violation of Fair Debt Act: The Nassau New York Notice of Violation of Fair Debt Act serves as a formal notification to the Federal Trade Commission about potential instances where individuals or entities violate the provisions established by the Fair Debt Act in Nassau County, New York. This notice aims to bring attention to unfair debt collection practices and protect the rights of debtors protected under this Act. 2. Purpose of the Letter to the Federal Trade Commission: The purpose of writing a letter to the Federal Trade Commission is to provide a detailed account of the alleged violation(s) of the Fair Debt Act in Nassau New York. The letter should include evidence, documentation, and any other relevant information to support the claim and assist the Commission in taking appropriate actions against the violators. 3. Consequences for Violating the Fair Debt Act: Violating the Fair Debt Act can result in severe consequences for the party found guilty, such as monetary penalties, license revocation, restriction on debt collection activities, or even legal action by affected debtors. The Federal Trade Commission plays a vital role in investigating these violations, levying fines, and ensuring compliance with the Fair Debt Act. 4. Types of Nassau New York Notice of Violation of Fair Debt Act: a) Harassment or Intimidation: This type of violation includes instances where debt collectors engage in threatening behavior, use offensive language, or repeatedly contact debtors to coerce or intimidate them into settling debts. b) False or Misleading Representations: This violation occurs when debt collectors provide incorrect or misleading information to debtors, misrepresenting the amount owed, the identity of the creditor, or the legal consequences of non-payment. c) Unfair Practices: This type of violation involves unfair collection methods, such as contacting debtors at inappropriate times, disclosing private information to unauthorized entities, or continuing to harass individuals even after being instructed to cease communication. Conclusion: The Nassau New York Notice of Violation of Fair Debt Act is a crucial mechanism to address unfair debt collection practices in the county. By submitting a detailed letter to the Federal Trade Commission, debtors and concerned individuals can ensure that allegations of violations are heard, investigated, and appropriate actions are taken against violators. By understanding the process and identifying different types of violations, individuals can protect their rights and contribute to a fair debt collection environment in Nassau New York. Keywords: Nassau New York, Notice of Violation, Fair Debt Act, Federal Trade Commission, letter, consequences, violations, identify.

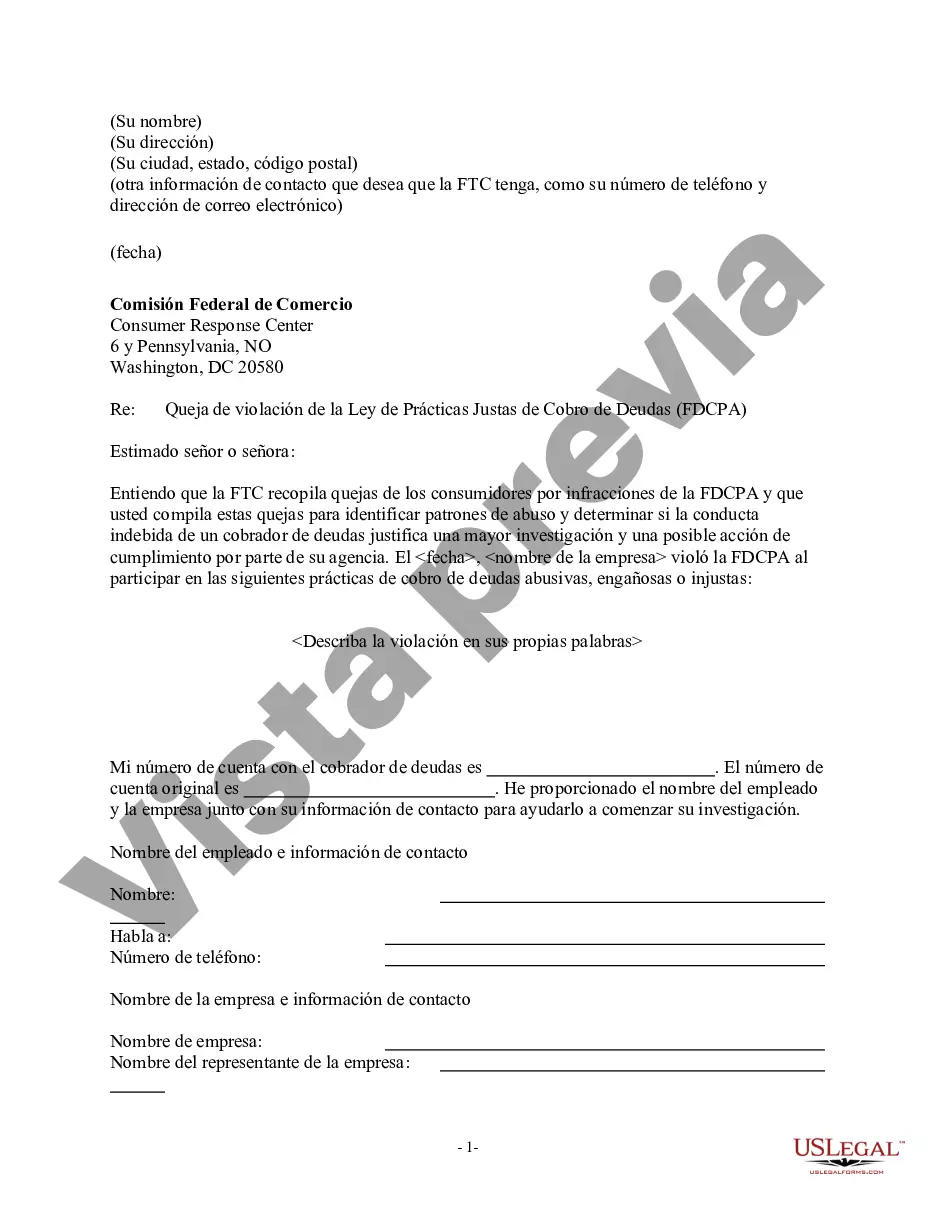

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Aviso de violación de la Ley de Deuda Justa - Carta a la Comisión Federal de Comercio - Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Nassau New York Aviso De Violación De La Ley De Deuda Justa - Carta A La Comisión Federal De Comercio?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Nassau Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Nassau Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Nassau Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission:

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

5 tips para que puedas pagar tus deudas si no tienes dinero Ajusta tus gastos. Elabora tu presupuesto para que sepas cuanto estas gastando cada mes y cuanto te queda al final.Haz un plan con fechas y cantidades.Busca otros ingresos.Intenta negociar con la institucion financiera.Considera un prestamo.

8 maneras de tratar con los cobradores de deudas 8 maneras de tratar con los cobradores de deudas.Validar y verificar.Disputar.Enviar una carta de cese y desistimiento.Compruebe el estatuto de limitaciones.Presentar quejas.Revise su seguro medico.Llegar al proveedor original.

Por telefono, llamando al Centro de Atencion Telefonica al 01800 999 80 80 o al 53400 999 en la Ciudad de Mexico; es necesario llamar desde el numero telefonico que va a restringir ya sea (casa u oficina), proporcionar datos personales asi como la direccion de correo electronico que desea bloquear.

Cobranza extrajudicial, lo que no pueden hacer los despachos: Amenazar, ofender o intimidar al deudor.Realizar gestiones de cobro a terceros.Enviar documentos que aparenten ser escritos judiciales.Establecer registros especiales.Deben identificarse.Respeto para el deudor.

Deudas mayores a 500 UDIS y hasta 1000 UDIS, se eliminan despues de cuatro anos. Deudas mayores a 1000 UDIS, se eliminan despues de seis anos siempre y cuando: sean menores a 400 mil UDIS, el credito no se encuentre en proceso judicial y/o no hayas cometido algun fraude en tus creditos.

Deudas mayores a 500 UDIS y hasta 1000 UDIS, se eliminan despues de cuatro anos. Deudas mayores a 1000 UDIS, se eliminan despues de seis anos siempre y cuando: sean menores a 400 mil UDIS, el credito no se encuentre en proceso judicial y/o no hayas cometido algun fraude en tus creditos.

Si te rehusas a contestar las llamadas o no atiendes los avisos que te dejan, los despachos lo tomaran como una negativa de pago.

Cuando un cobrador de deudas le contacte, averigue lo siguiente: La identidad del cobrador de deudas, incluyendo: nombre, direccion y telefono. El monto de la deuda, incluyendo cualquier tarifa como intereses, o costos de cobranza. Para que y cuando fue contraida la deuda.

La referencia comercial es un documento que puede otorgar alguna empresa o comercio para referirse a una persona y comprobar su confiabilidad. Puede indicar el tiempo que duro la relacion entre esa empresa y la persona, ademas de anexar el historial crediticio.