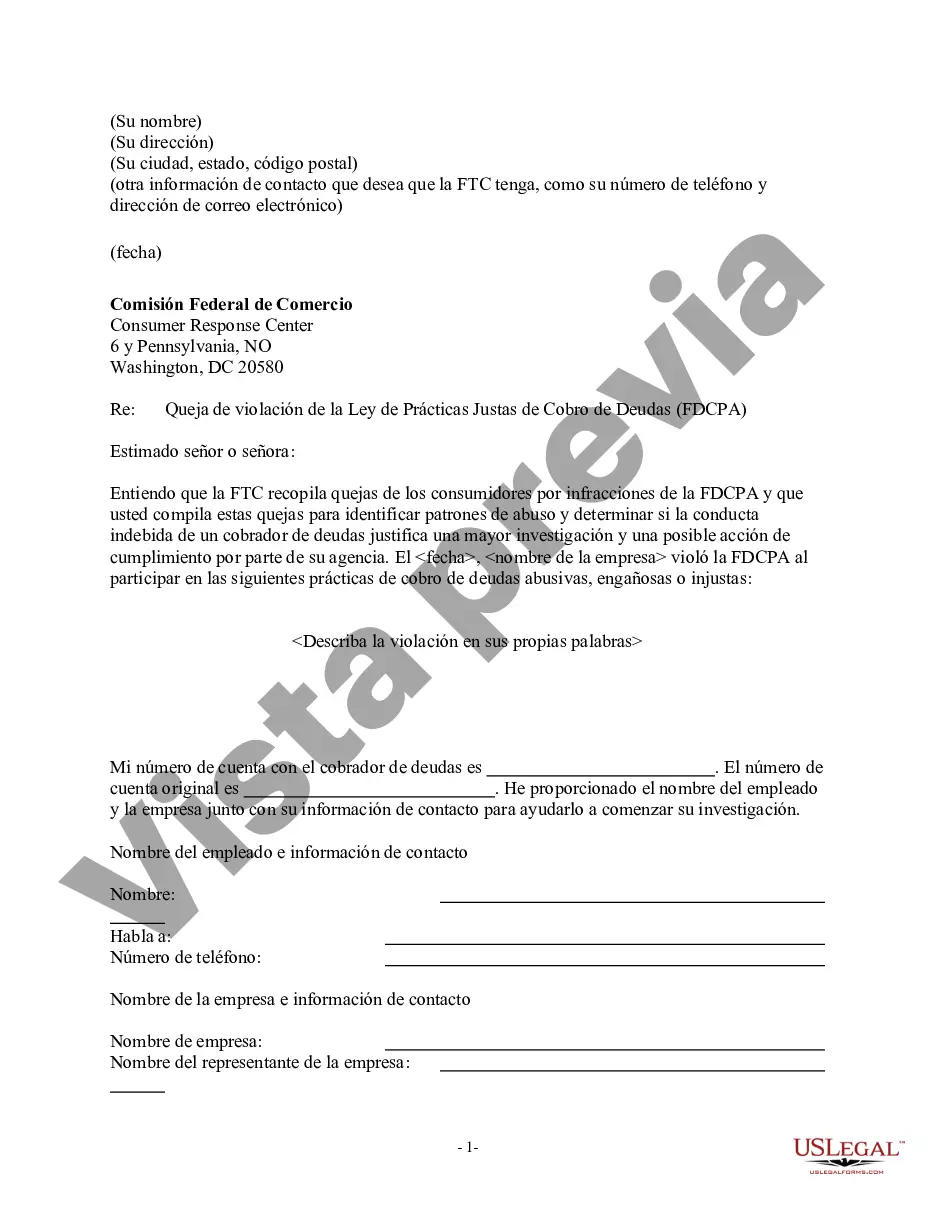

Suffolk County, located in the state of New York, is a suburban county that forms part of the eastern portion of Long Island. With a population of over 1.4 million residents, it is the fourth-most populous county in the state and is known for its diverse communities, beautiful beaches, and vibrant cultural scene. The "Suffolk New York Notice of Violation of Fair Debt Act — Letter To The Federal Trade Commission" is a legal document that addresses alleged violations of the Fair Debt Collection Practices Act (FD CPA) within Suffolk County. The FD CPA is a federal law that protects consumers from abusive and deceptive debt collection practices. The letter is typically sent by individuals who believe that a debt collector or collection agency has violated their rights under the FD CPA within Suffolk County. It outlines the details of the alleged violations, including the specific actions taken by the debt collector that are deemed non-compliant with the law. Possible variations of the "Suffolk New York Notice of Violation of Fair Debt Act — Letter To The Federal Trade Commission" may include: 1. Suffolk New York Notice of Harassment Violation of Fair Debt Act — Letter To The Federal Trade Commission: This variant specifically addresses cases where the debtor is subjected to persistent and intrusive harassment by the debt collector, which is prohibited under the FD CPA. 2. Suffolk New York Notice of Misleading Communication Violation of Fair Debt Act — Letter To The Federal Trade Commission: This variation focuses on situations where the debt collector has engaged in deceptive or misleading communication tactics, such as falsely representing the amount owed or the consequences of non-payment. 3. Suffolk New York Notice of Unfair Practices Violation of Fair Debt Act — Letter To The Federal Trade Commission: This type of notice highlights instances where the debt collector has engaged in unfair practices, such as threatening legal action that they do not intend to take or misrepresenting their authority. It is important to note that each variation of the letter may differ in the specific details of the alleged violations, providing evidence and supporting documentation to substantiate the claim, and requesting appropriate action from the Federal Trade Commission, the agency responsible for enforcing the FD CPA. By sending the "Suffolk New York Notice of Violation of Fair Debt Act — Letter To The Federal Trade Commission," individuals aim to hold debt collectors accountable for their actions and seek legal remedies or penalties for the alleged violations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Aviso de violación de la Ley de Deuda Justa - Carta a la Comisión Federal de Comercio - Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Suffolk New York Aviso De Violación De La Ley De Deuda Justa - Carta A La Comisión Federal De Comercio?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Suffolk Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Suffolk Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!