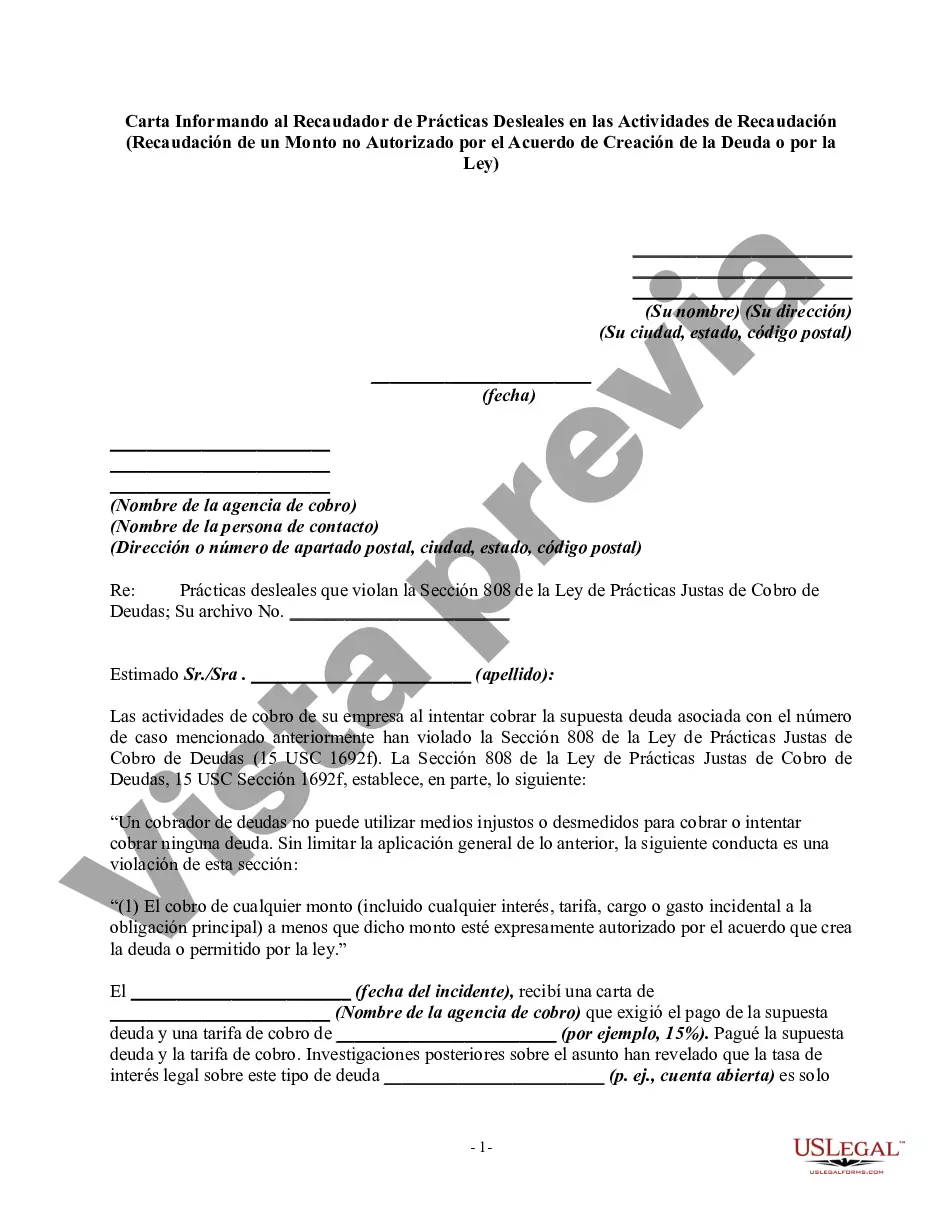

Section 808 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692f, provides, in part, as follows:

"A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(1) The collection of any amount (including any interest, fee, charge, or expense incidental to the principal obligation) unless such amount is expressly authorized by the agreement creating the debt or permitted by law."

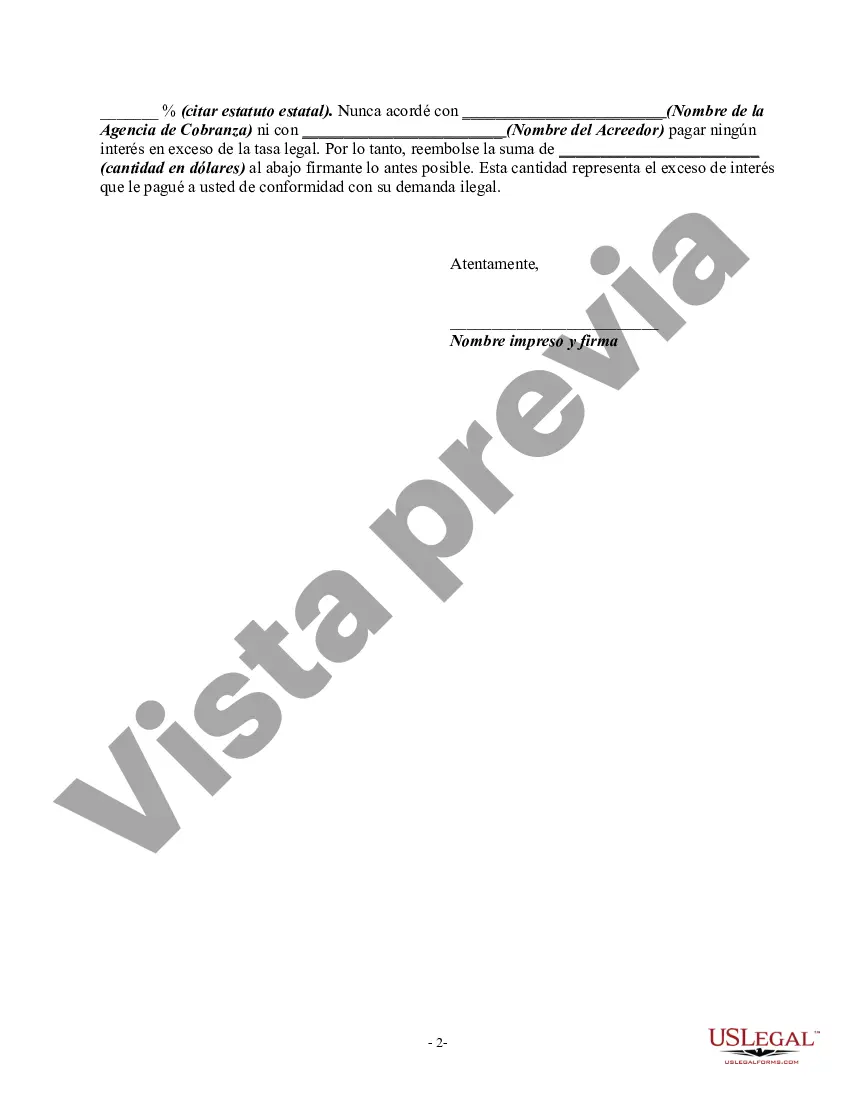

Title: Dallas, Texas: Letter Informing Debt Collector of Unfair Collection Practices — Unauthorized Amounts Collected Introduction: This detailed description will outline the process of writing a letter informing a debt collector in Dallas, Texas about their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law. This letter is crucial in holding debt collectors accountable and safeguarding consumers' rights. Content: I. Understanding Unfair Collection Practices: A. Definition of Unfair Practices B. Examples of Unauthorized Collection Activities II. Importance of Writing a Letter: A. Legal Protections for Consumers B. Purpose of the Letter C. Potential Consequences for Debt Collectors III. Steps to Write an Effective Letter: A. Format and Structure B. Essential Content and Sections to Include 1. Salutation and Personal Information 2. Reference to the Agreement Creating the Debt 3. Details of Unfair Collection Activities 4. Citations of Relevant Laws and Regulations 5. Request for Immediate Cease and Desist 6. Mentioning Potential Legal Action 7. Closing Remarks and Contact Information IV. Additional Types of Dallas, Texas Letters Informing Debt Collectors of Unfair Collection Practices: A. Letter Complaining about Harassment or Threats B. Letter Demanding Validation of Debt C. Letter Notifying of Incorrect Information Reporting D. Letter Requesting Accurate Debt Documentation E. Letter Disputing the Debt and Requesting a Cease and Desist V. Strengthening the Letter: A. Gathering Evidence and Documentation B. Consultation with Consumer Protection Agencies C. Seeking Legal Aid or Credit Counseling Services Conclusion: Writing a well-structured letter to inform a debt collector in Dallas, Texas about their unfair practices in collecting an unauthorized amount is a vital step in protecting consumer rights. By taking action against such practices, individuals can rectify their debt situations, prevent further harm, and encourage fair practices within the debt collection industry.Title: Dallas, Texas: Letter Informing Debt Collector of Unfair Collection Practices — Unauthorized Amounts Collected Introduction: This detailed description will outline the process of writing a letter informing a debt collector in Dallas, Texas about their unfair practices in collecting an amount not authorized by the agreement creating the debt or by law. This letter is crucial in holding debt collectors accountable and safeguarding consumers' rights. Content: I. Understanding Unfair Collection Practices: A. Definition of Unfair Practices B. Examples of Unauthorized Collection Activities II. Importance of Writing a Letter: A. Legal Protections for Consumers B. Purpose of the Letter C. Potential Consequences for Debt Collectors III. Steps to Write an Effective Letter: A. Format and Structure B. Essential Content and Sections to Include 1. Salutation and Personal Information 2. Reference to the Agreement Creating the Debt 3. Details of Unfair Collection Activities 4. Citations of Relevant Laws and Regulations 5. Request for Immediate Cease and Desist 6. Mentioning Potential Legal Action 7. Closing Remarks and Contact Information IV. Additional Types of Dallas, Texas Letters Informing Debt Collectors of Unfair Collection Practices: A. Letter Complaining about Harassment or Threats B. Letter Demanding Validation of Debt C. Letter Notifying of Incorrect Information Reporting D. Letter Requesting Accurate Debt Documentation E. Letter Disputing the Debt and Requesting a Cease and Desist V. Strengthening the Letter: A. Gathering Evidence and Documentation B. Consultation with Consumer Protection Agencies C. Seeking Legal Aid or Credit Counseling Services Conclusion: Writing a well-structured letter to inform a debt collector in Dallas, Texas about their unfair practices in collecting an unauthorized amount is a vital step in protecting consumer rights. By taking action against such practices, individuals can rectify their debt situations, prevent further harm, and encourage fair practices within the debt collection industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.