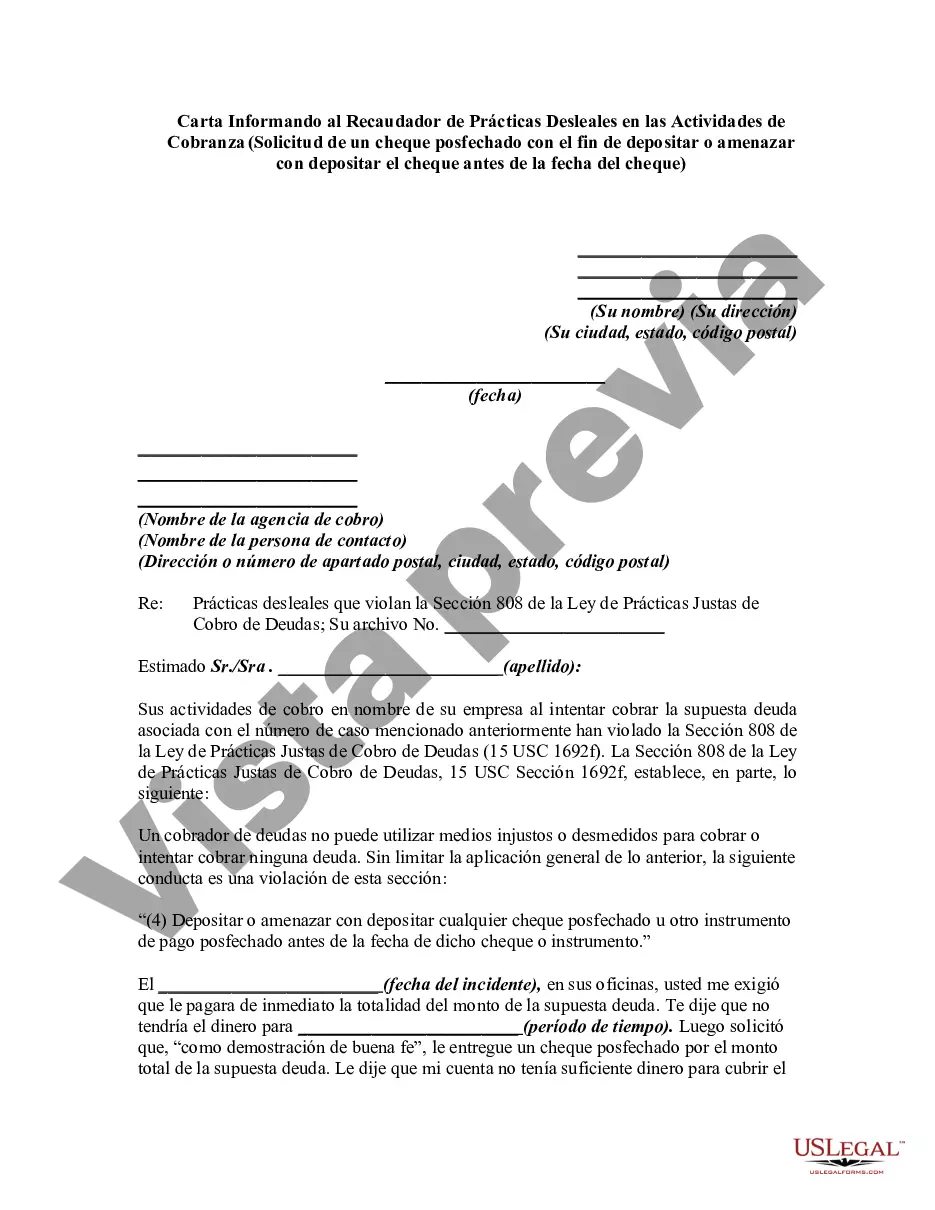

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) Depositing or threatening to deposit any postdated check or other postdated payment instrument prior to the date on such check or instrument."

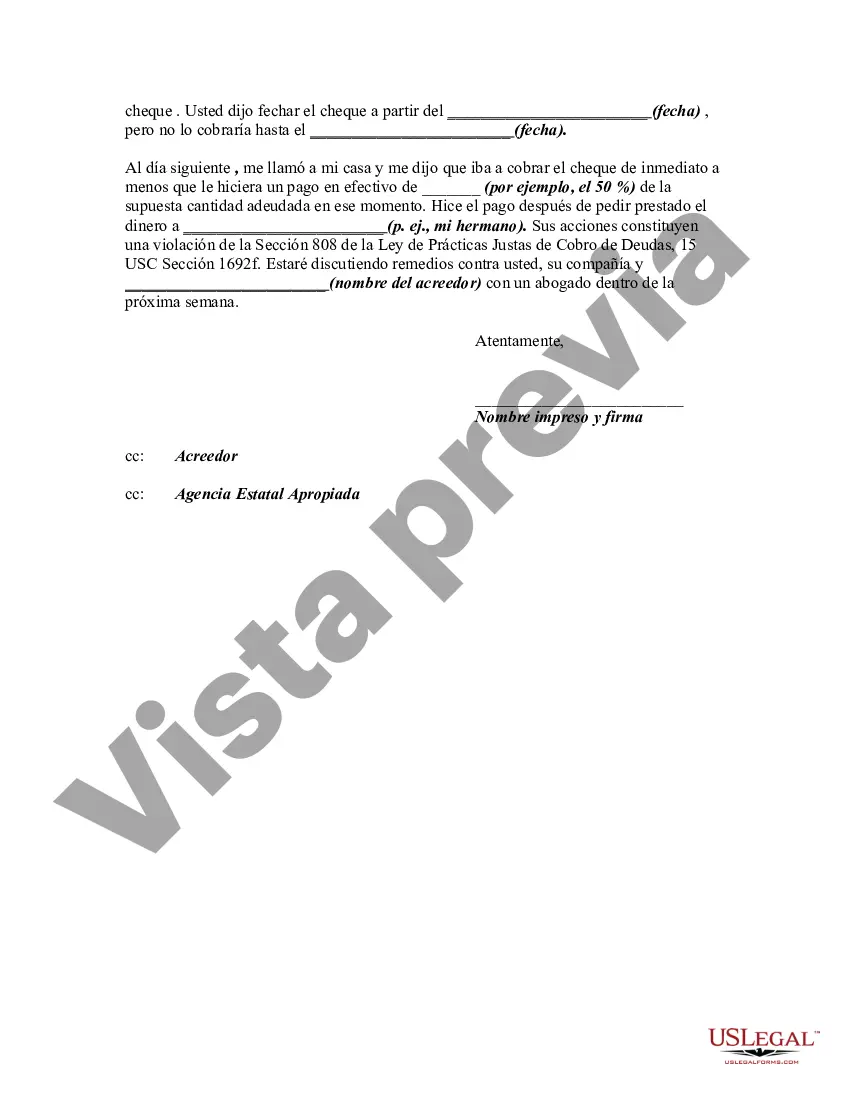

Title: Orange California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check Keywords: Orange California, debt collector, unfair practices, collection activities, postdated check, depositing check, threatening, letter informing, debt collection laws, consumer rights, cease and desist, legal action, Federal Trade Commission (FTC) Introduction: In Orange, California, debt collection activities must adhere to strict guidelines set forth by federal and state laws to protect consumer rights. One such unfair practice involves the solicitation of a postdated check for depositing purposes or the threat to deposit the check prior to the stated date. This article discusses the significance of writing a letter to inform debt collectors about such unfair practices, the potential consequences for violating debt collection laws, and the steps that individuals in Orange, California can take to protect their rights. 1. Understanding Unfair Practices in Debt Collection: Debt collectors are prohibited from engaging in activities that are considered unfair, deceptive, or abusive. Soliciting a postdated check for the purpose of depositing or threatening to deposit the check before its intended date falls within the purview of unfair practices. Individuals in Orange, California need to be aware of their rights and options when dealing with such situations. 2. Importance of Letter Informing Debt Collector: Writing a formal letter is an effective way to address the debt collector and inform them about their unfair practices. The letter should clearly state the violation, reference relevant laws, and demand immediate ceasing of the inappropriate activity. By documenting the unfair practices and notifying the debt collector, individuals can take an important step towards resolving the issue and protecting their rights. 3. Consequences for Violating Debt Collection Laws: Debt collectors who engage in unfair practices, such as depositing a postdated check prematurely or threatening to do so, can face serious consequences. Debt collection laws, both at the federal level (e.g., Fair Debt Collection Practices Act FD CPAPA) and California state level, provide individuals with legal remedies for such violations. Debtors may be entitled to damages, attorney fees, and other forms of relief if their rights are violated. 4. Steps to Protect Your Rights: a. Research and gather information: Understand federal and state debt collection laws to empower yourself in dealing with unfair practices. b. Document all communication: Keep a detailed record of interactions, including dates, times, and content of conversations. c. Draft a formal letter: Clearly articulate the unfair practices, cite specific laws violated, and demand the cessation of those activities. d. Send the letter via certified mail: Ensure the letter is officially received by the debt collector and retain the receipt as proof. e. Consult with an attorney: If the unfair practices persist, seeking legal advice may be necessary to understand available options for pursuing further action. Conclusion: Dealing with unfair practices by debt collectors, such as soliciting a postdated check for early deposit or threatening to do so, requires individuals in Orange, California, to take proactive steps to protect their rights. Writing a detailed letter to inform debt collectors of these unfair practices is an essential component of asserting consumer rights. By understanding the relevant laws and seeking proper legal advice, individuals can take action to rectify the situation and hold debt collectors accountable for their actions.Title: Orange California Letter Informing Debt Collector of Unfair Practices in Collection Activities — Soliciting a Postdated Check for the Purpose of Depositing or Threatening to Deposit the Check Prior to the Date on the Check Keywords: Orange California, debt collector, unfair practices, collection activities, postdated check, depositing check, threatening, letter informing, debt collection laws, consumer rights, cease and desist, legal action, Federal Trade Commission (FTC) Introduction: In Orange, California, debt collection activities must adhere to strict guidelines set forth by federal and state laws to protect consumer rights. One such unfair practice involves the solicitation of a postdated check for depositing purposes or the threat to deposit the check prior to the stated date. This article discusses the significance of writing a letter to inform debt collectors about such unfair practices, the potential consequences for violating debt collection laws, and the steps that individuals in Orange, California can take to protect their rights. 1. Understanding Unfair Practices in Debt Collection: Debt collectors are prohibited from engaging in activities that are considered unfair, deceptive, or abusive. Soliciting a postdated check for the purpose of depositing or threatening to deposit the check before its intended date falls within the purview of unfair practices. Individuals in Orange, California need to be aware of their rights and options when dealing with such situations. 2. Importance of Letter Informing Debt Collector: Writing a formal letter is an effective way to address the debt collector and inform them about their unfair practices. The letter should clearly state the violation, reference relevant laws, and demand immediate ceasing of the inappropriate activity. By documenting the unfair practices and notifying the debt collector, individuals can take an important step towards resolving the issue and protecting their rights. 3. Consequences for Violating Debt Collection Laws: Debt collectors who engage in unfair practices, such as depositing a postdated check prematurely or threatening to do so, can face serious consequences. Debt collection laws, both at the federal level (e.g., Fair Debt Collection Practices Act FD CPAPA) and California state level, provide individuals with legal remedies for such violations. Debtors may be entitled to damages, attorney fees, and other forms of relief if their rights are violated. 4. Steps to Protect Your Rights: a. Research and gather information: Understand federal and state debt collection laws to empower yourself in dealing with unfair practices. b. Document all communication: Keep a detailed record of interactions, including dates, times, and content of conversations. c. Draft a formal letter: Clearly articulate the unfair practices, cite specific laws violated, and demand the cessation of those activities. d. Send the letter via certified mail: Ensure the letter is officially received by the debt collector and retain the receipt as proof. e. Consult with an attorney: If the unfair practices persist, seeking legal advice may be necessary to understand available options for pursuing further action. Conclusion: Dealing with unfair practices by debt collectors, such as soliciting a postdated check for early deposit or threatening to do so, requires individuals in Orange, California, to take proactive steps to protect their rights. Writing a detailed letter to inform debt collectors of these unfair practices is an essential component of asserting consumer rights. By understanding the relevant laws and seeking proper legal advice, individuals can take action to rectify the situation and hold debt collectors accountable for their actions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.