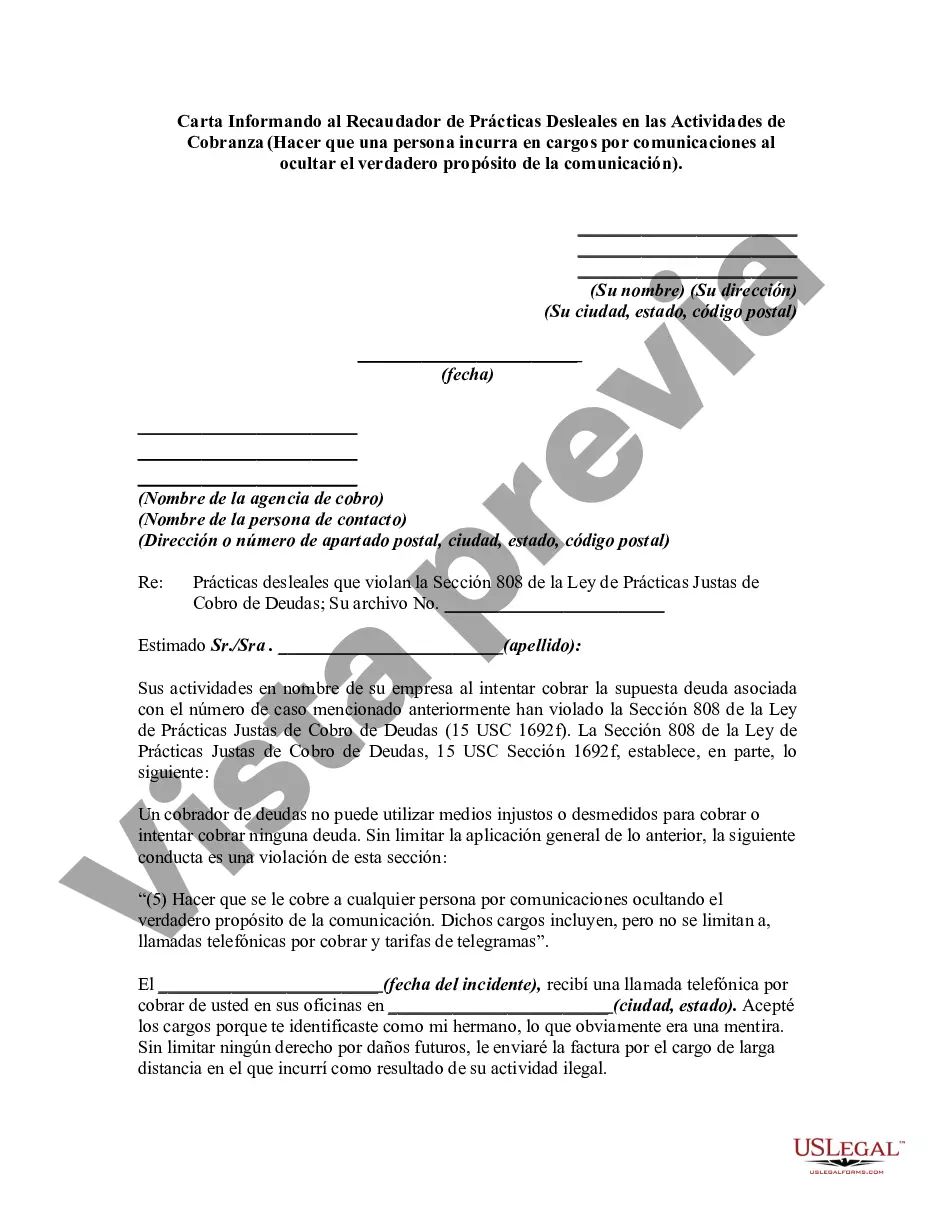

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(5) Causing charges to be made to any person for communications by concealment of the true propose of the communication. Such charges include, but are not limited to, collect telephone calls and telegram fees." Hennepin County, located in the state of Minnesota, has specific laws and regulations in place to protect consumers from unfair debt collection practices. If you believe that a debt collector in Hennepin County has engaged in unfair practices, such as concealing the true purpose of their communication and causing you to incur charges for unnecessary communications, it is important to take action. One effective way to address this issue is by writing a formal letter to the debt collector, informing them of their unfair practices and requesting that they cease such activities. Here is a detailed description of what should be included in a Hennepin County Letter Informing Debt Collector of Unfair Practices in Collection Activities: 1. Header: Start the letter with your name, address, phone number, and email address. Below this, provide the debt collector's name, address, and any relevant account or reference numbers. 2. Introduction: Begin the letter with a concise and assertive statement indicating that you are writing to address unfair collection practices. Mention that you are aware of your rights under both federal and Hennepin County debt collection laws. 3. Detailed Account: Provide a clear and specific account of the unfair practices you have experienced. Explain how the collector concealed the true purpose of their communication, resulting in additional charges for unnecessary communications. Include dates, times, and any supporting evidence, such as call logs, letters, or invoices. 4. Reference Legal Rights: Refer to relevant laws that protect consumers in debt collection matters, such as the Fair Debt Collection Practices Act (FD CPA) and the Hennepin County Debt Collection Ordinances. Quote specific provisions of these laws that the debt collector's actions violate. 5. Request for Change: Clearly state that you expect the debt collector to cease their unfair practices immediately. Request that they respond to your letter within a specific time frame (e.g., 15 days) to acknowledge receipt and confirm their intention to comply with the law. 6. Consequences: Inform the debt collector that failure to comply with your request may result in further action, such as filing a complaint with relevant regulatory agencies, reporting them to consumer protection organizations, or pursuing legal remedies available under the law. 7. Closing: Express your expectation that the matter will be resolved promptly and amicably. Sign the letter using your full name. It is important to note that there may be additional types of Hennepin County Letters Informing Debt Collectors of Unfair Practices. These could include letters specifically addressing other unfair practices, such as harassment, threatening behavior, or misleading statements. Each letter would need to be tailored to address the specific unfair practice experienced by the individual consumer.

Hennepin County, located in the state of Minnesota, has specific laws and regulations in place to protect consumers from unfair debt collection practices. If you believe that a debt collector in Hennepin County has engaged in unfair practices, such as concealing the true purpose of their communication and causing you to incur charges for unnecessary communications, it is important to take action. One effective way to address this issue is by writing a formal letter to the debt collector, informing them of their unfair practices and requesting that they cease such activities. Here is a detailed description of what should be included in a Hennepin County Letter Informing Debt Collector of Unfair Practices in Collection Activities: 1. Header: Start the letter with your name, address, phone number, and email address. Below this, provide the debt collector's name, address, and any relevant account or reference numbers. 2. Introduction: Begin the letter with a concise and assertive statement indicating that you are writing to address unfair collection practices. Mention that you are aware of your rights under both federal and Hennepin County debt collection laws. 3. Detailed Account: Provide a clear and specific account of the unfair practices you have experienced. Explain how the collector concealed the true purpose of their communication, resulting in additional charges for unnecessary communications. Include dates, times, and any supporting evidence, such as call logs, letters, or invoices. 4. Reference Legal Rights: Refer to relevant laws that protect consumers in debt collection matters, such as the Fair Debt Collection Practices Act (FD CPA) and the Hennepin County Debt Collection Ordinances. Quote specific provisions of these laws that the debt collector's actions violate. 5. Request for Change: Clearly state that you expect the debt collector to cease their unfair practices immediately. Request that they respond to your letter within a specific time frame (e.g., 15 days) to acknowledge receipt and confirm their intention to comply with the law. 6. Consequences: Inform the debt collector that failure to comply with your request may result in further action, such as filing a complaint with relevant regulatory agencies, reporting them to consumer protection organizations, or pursuing legal remedies available under the law. 7. Closing: Express your expectation that the matter will be resolved promptly and amicably. Sign the letter using your full name. It is important to note that there may be additional types of Hennepin County Letters Informing Debt Collectors of Unfair Practices. These could include letters specifically addressing other unfair practices, such as harassment, threatening behavior, or misleading statements. Each letter would need to be tailored to address the specific unfair practice experienced by the individual consumer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.