A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(5) Causing charges to be made to any person for communications by concealment of the true propose of the communication. Such charges include, but are not limited to, collect telephone calls and telegram fees." Title: Oakland Michigan Debt Collection Practices: Unveiling the True Purpose of Communications Introduction: Oakland County, located in Michigan, is a vibrant and thriving community known for its diverse population, beautiful landscapes, and robust economy. However, amidst its lively atmosphere, instances of unfair debt collection practices can occur. This article aims to shed light on the nature of these practices, specifically focusing on the concealment of true communication purposes that lead individuals to incur unnecessary charges. We will further explore various types of letters that individuals can draft to inform debt collectors about these unfair practices. Unfair Collection Practices and Hidden Communication Purposes: Debt collection activities often involve various industry-specific terms and acronyms that may confuse and mislead individuals who owe debts. The unethical use of these terms can result in debtors being charged for unnecessary communications. Debt collectors may hide the true purpose of their communications, misrepresenting them as crucial or necessary, leading to unfair financial burden on debtors. Types of Oakland Michigan Letters to Inform Debt Collectors: 1. General Letter Informing Debt Collector of Unfair Practices: This type of letter serves as a formal complaint to debt collectors, addressing their unfair actions in concealing the true purpose of communications that result in unwarranted charges for debtors. 2. Dispute Letter for Inaccurate Charges: This specific letter focuses on disputing and providing evidence against any false charges incurred due to the deceptive practices of the debt collector. It asserts the debtor's right to accurate and transparent communication. 3. Cease and Desist Communication Letter: In cases of repeated concealment of true communication purposes resulting in unwarranted charges, this letter emphasizes a debtor's request to cease any further communication and warns of potential legal action if the practices persist. 4. Fair Debt Collection Practices Act Violation Letter: The Fair Debt Collection Practices Act (FD CPA) safeguards debtors from unfair practices. This letter notifies debt collectors of their violation of FD CPA clauses by concealing communication purposes. It asserts the debtor's rights and warns of legal consequences. Keywords: — OaklanMichiganga— - Debt collectors - Collection activities — Incur charge— - Concealing true purpose — Unfair practice— - Communication - Debt collection letters — Debt dispute— - Cease and desist - Fair Debt Collection Practices Act (FD CPA) — Formal complain— - Violation letter — Legal action Conclusion: Addressing unfair debt collection practices in Oakland County, Michigan, is crucial to protecting the rights and financial well-being of individuals facing debt-related challenges. By raising awareness, drafting official letters to inform debt collectors about the unfair practices that lead to unnecessary charges, and asserting their rights, debtors can work towards resolving these issues. Empowered with knowledge and utilizing proper legal channels, individuals can combat deceptive collection practices and seek fair treatment in their financial dealings.

Title: Oakland Michigan Debt Collection Practices: Unveiling the True Purpose of Communications Introduction: Oakland County, located in Michigan, is a vibrant and thriving community known for its diverse population, beautiful landscapes, and robust economy. However, amidst its lively atmosphere, instances of unfair debt collection practices can occur. This article aims to shed light on the nature of these practices, specifically focusing on the concealment of true communication purposes that lead individuals to incur unnecessary charges. We will further explore various types of letters that individuals can draft to inform debt collectors about these unfair practices. Unfair Collection Practices and Hidden Communication Purposes: Debt collection activities often involve various industry-specific terms and acronyms that may confuse and mislead individuals who owe debts. The unethical use of these terms can result in debtors being charged for unnecessary communications. Debt collectors may hide the true purpose of their communications, misrepresenting them as crucial or necessary, leading to unfair financial burden on debtors. Types of Oakland Michigan Letters to Inform Debt Collectors: 1. General Letter Informing Debt Collector of Unfair Practices: This type of letter serves as a formal complaint to debt collectors, addressing their unfair actions in concealing the true purpose of communications that result in unwarranted charges for debtors. 2. Dispute Letter for Inaccurate Charges: This specific letter focuses on disputing and providing evidence against any false charges incurred due to the deceptive practices of the debt collector. It asserts the debtor's right to accurate and transparent communication. 3. Cease and Desist Communication Letter: In cases of repeated concealment of true communication purposes resulting in unwarranted charges, this letter emphasizes a debtor's request to cease any further communication and warns of potential legal action if the practices persist. 4. Fair Debt Collection Practices Act Violation Letter: The Fair Debt Collection Practices Act (FD CPA) safeguards debtors from unfair practices. This letter notifies debt collectors of their violation of FD CPA clauses by concealing communication purposes. It asserts the debtor's rights and warns of legal consequences. Keywords: — OaklanMichiganga— - Debt collectors - Collection activities — Incur charge— - Concealing true purpose — Unfair practice— - Communication - Debt collection letters — Debt dispute— - Cease and desist - Fair Debt Collection Practices Act (FD CPA) — Formal complain— - Violation letter — Legal action Conclusion: Addressing unfair debt collection practices in Oakland County, Michigan, is crucial to protecting the rights and financial well-being of individuals facing debt-related challenges. By raising awareness, drafting official letters to inform debt collectors about the unfair practices that lead to unnecessary charges, and asserting their rights, debtors can work towards resolving these issues. Empowered with knowledge and utilizing proper legal channels, individuals can combat deceptive collection practices and seek fair treatment in their financial dealings.

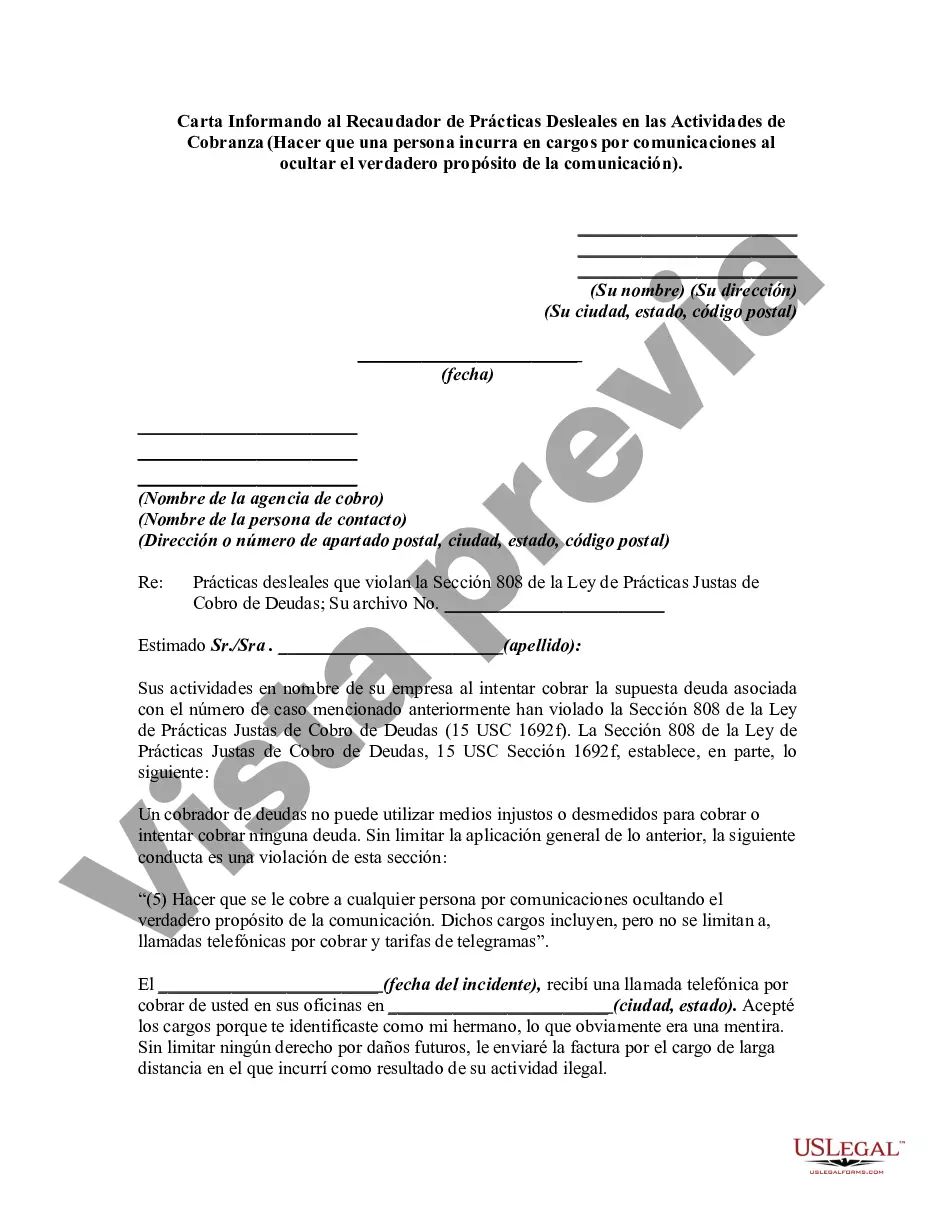

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.