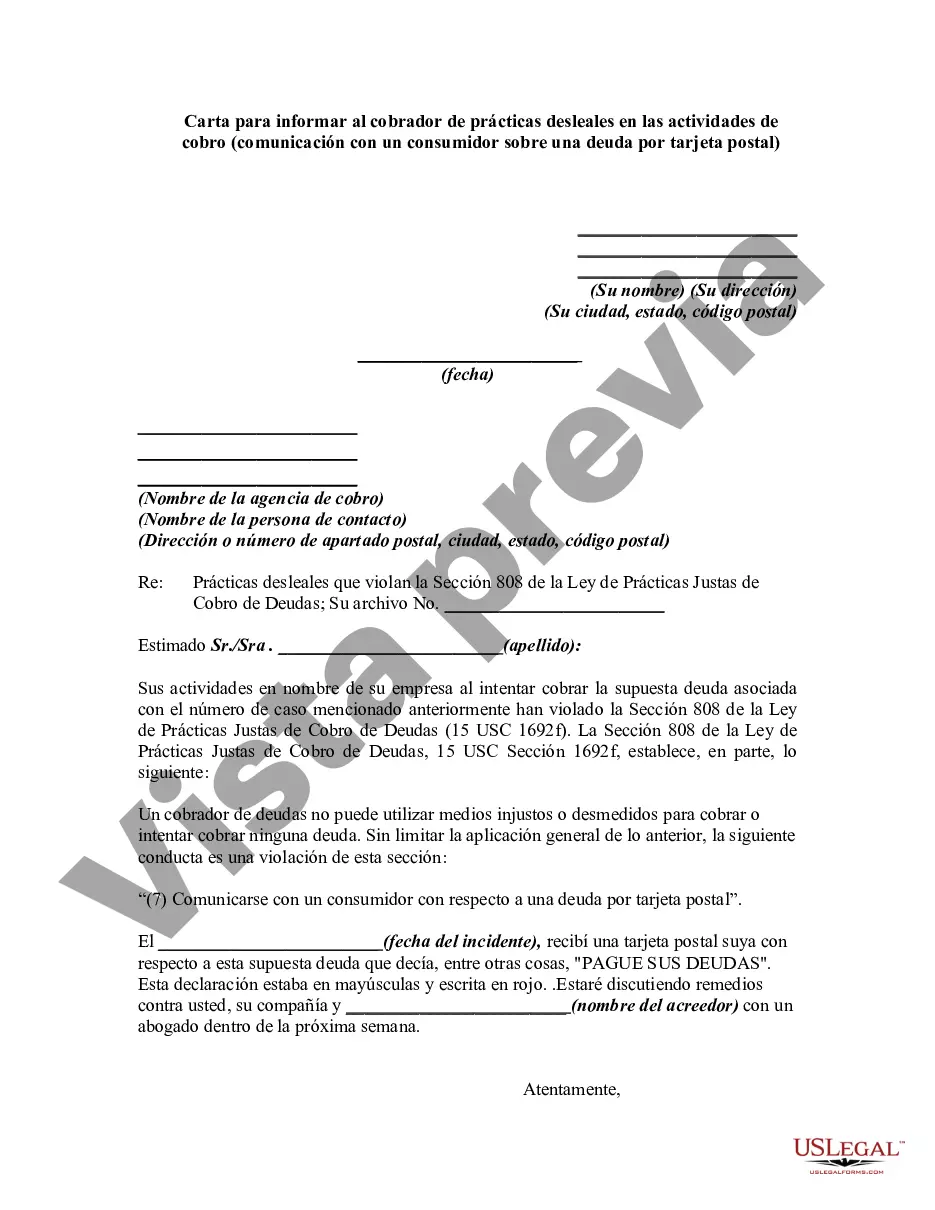

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(7) Communicating with a consumer regarding a debt by post card."

Title: Harris Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Keywords: Harris Texas, letter, informing, debt collector, unfair practices, collection activities, communicating, consumer, post card Introduction: In Harris Texas, consumers have the right to be treated fairly and with respect by debt collectors when it comes to collecting debts. This detailed description focuses on how to write a letter informing a debt collector of unfair practices in collection activities, specifically in relation to communicating with a consumer regarding a debt through a post card. Types of Letters Informing Debt Collectors of Unfair Practices in Collection Activities: 1. Harris Texas Letter Regarding Unfair Practices in Collection Activities — Post Card Communication 2. Sample Harris Texas Letter Informing Debt Collector of Unfair Practices — Post Card Communication 3. Template for Harris Texas Letter Regarding Unfair Practices in Collection Activities — Post Card Communication Key Elements to Include in the Letter: 1. Your Contact Information: Begin the letter by providing your full name, mailing address, phone number, and email address. Providing your contact information helps the debt collector identify your account and respond to your concerns promptly. 2. Date: Include the date on which the letter is written. 3. Debt Collector's Contact Information: Provide the receiver's full name, position, mailing address, and company name. This information helps ensure that the letter reaches the appropriate department or individual at the debt collector's agency. 4. Subject Line: Clearly state the purpose of the letter in the subject line, such as "Concerns Regarding Unfair Practices — Post Card Communication." 5. Introduction: Address the debt collector professionally and briefly describe the nature of your relationship with them. Mention the specific debt or account number for better identification. 6. Unfair Practices: Detail the specific unfair practices you have encountered in the debt collector's post card communication. This may include violations of privacy, security concerns, or any other issues that you believe constitute unfair practices. 7. Relevant Laws and Regulations: Reference the applicable laws and regulations regarding debt collection practices in Texas, such as the Fair Debt Collection Practices Act (FD CPA) and the Texas Debt Collection Act. Highlight provisions that support your claim of unfair practices. 8. Request for Corrective Action: Clearly state your expectation for the debt collector to rectify the unfair practices. This could involve ceasing post card communication, using alternative communication methods, or implementing strict data protection measures. 9. Documentation: Enclose copies of any relevant documents, such as copies of post cards received, records of conversations with the debt collector, or evidence supporting your claims. 10. Request for Written Confirmation: Ask the debt collector to confirm in writing that they have received your letter, are investigating your concerns, and will take corrective actions as necessary within a designated time frame. 11. Final Thoughts: Express your willingness to cooperate in resolving the matter amicably. State the consequences of further noncompliance with the law, including potential legal action or filing complaints with relevant regulatory bodies. 12. Closing: End the letter with a polite closing, such as "Sincerely" or "Yours faithfully." Sign your name legibly above your typed name. By incorporating these key elements into your Harris Texas letter informing a debt collector of unfair practices in collection activities related to post card communication, you can effectively convey your concerns and assert your rights as a consumer.Title: Harris Texas Letter Informing Debt Collector of Unfair Practices in Collection Activities — Communicating with a Consumer Regarding a Debt by Post Card Keywords: Harris Texas, letter, informing, debt collector, unfair practices, collection activities, communicating, consumer, post card Introduction: In Harris Texas, consumers have the right to be treated fairly and with respect by debt collectors when it comes to collecting debts. This detailed description focuses on how to write a letter informing a debt collector of unfair practices in collection activities, specifically in relation to communicating with a consumer regarding a debt through a post card. Types of Letters Informing Debt Collectors of Unfair Practices in Collection Activities: 1. Harris Texas Letter Regarding Unfair Practices in Collection Activities — Post Card Communication 2. Sample Harris Texas Letter Informing Debt Collector of Unfair Practices — Post Card Communication 3. Template for Harris Texas Letter Regarding Unfair Practices in Collection Activities — Post Card Communication Key Elements to Include in the Letter: 1. Your Contact Information: Begin the letter by providing your full name, mailing address, phone number, and email address. Providing your contact information helps the debt collector identify your account and respond to your concerns promptly. 2. Date: Include the date on which the letter is written. 3. Debt Collector's Contact Information: Provide the receiver's full name, position, mailing address, and company name. This information helps ensure that the letter reaches the appropriate department or individual at the debt collector's agency. 4. Subject Line: Clearly state the purpose of the letter in the subject line, such as "Concerns Regarding Unfair Practices — Post Card Communication." 5. Introduction: Address the debt collector professionally and briefly describe the nature of your relationship with them. Mention the specific debt or account number for better identification. 6. Unfair Practices: Detail the specific unfair practices you have encountered in the debt collector's post card communication. This may include violations of privacy, security concerns, or any other issues that you believe constitute unfair practices. 7. Relevant Laws and Regulations: Reference the applicable laws and regulations regarding debt collection practices in Texas, such as the Fair Debt Collection Practices Act (FD CPA) and the Texas Debt Collection Act. Highlight provisions that support your claim of unfair practices. 8. Request for Corrective Action: Clearly state your expectation for the debt collector to rectify the unfair practices. This could involve ceasing post card communication, using alternative communication methods, or implementing strict data protection measures. 9. Documentation: Enclose copies of any relevant documents, such as copies of post cards received, records of conversations with the debt collector, or evidence supporting your claims. 10. Request for Written Confirmation: Ask the debt collector to confirm in writing that they have received your letter, are investigating your concerns, and will take corrective actions as necessary within a designated time frame. 11. Final Thoughts: Express your willingness to cooperate in resolving the matter amicably. State the consequences of further noncompliance with the law, including potential legal action or filing complaints with relevant regulatory bodies. 12. Closing: End the letter with a polite closing, such as "Sincerely" or "Yours faithfully." Sign your name legibly above your typed name. By incorporating these key elements into your Harris Texas letter informing a debt collector of unfair practices in collection activities related to post card communication, you can effectively convey your concerns and assert your rights as a consumer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.