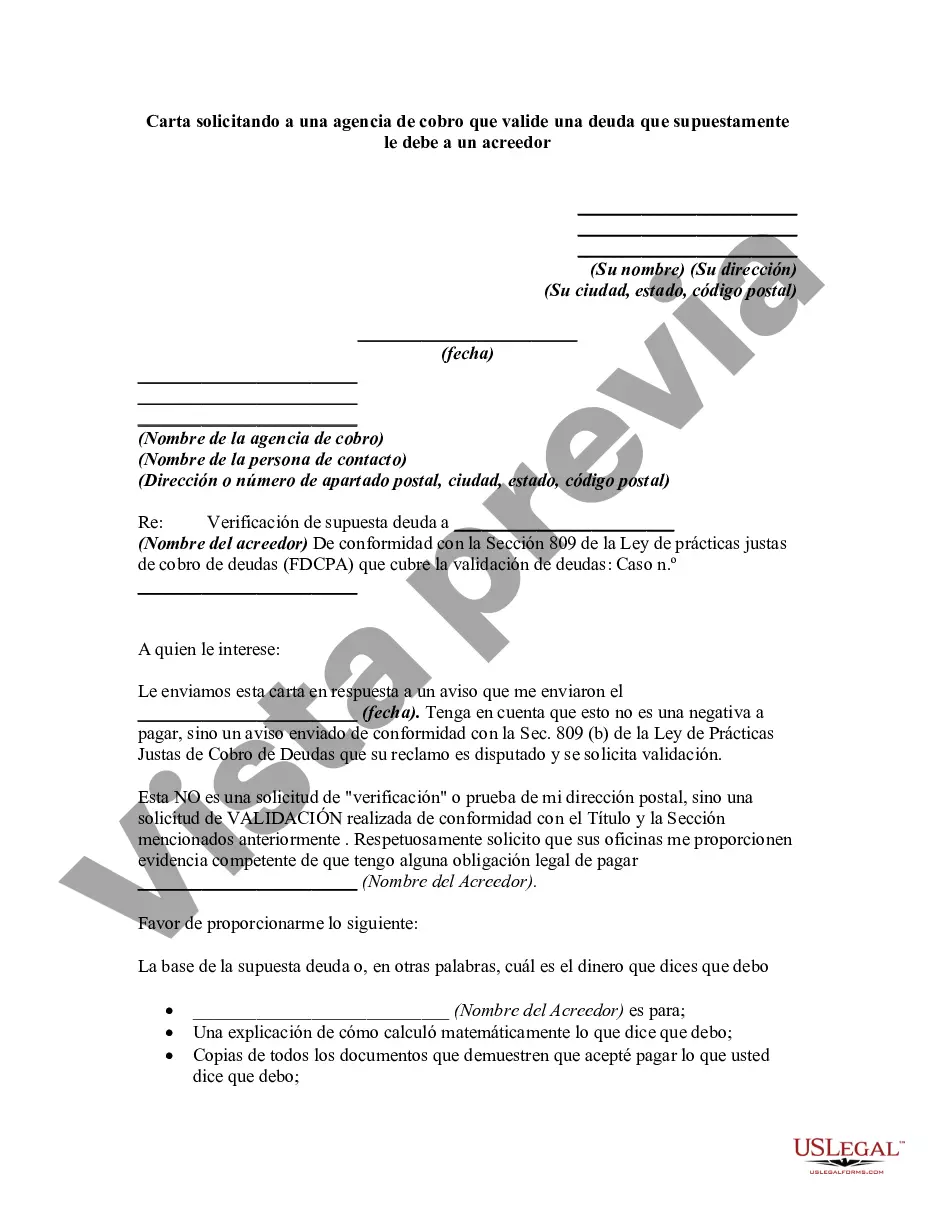

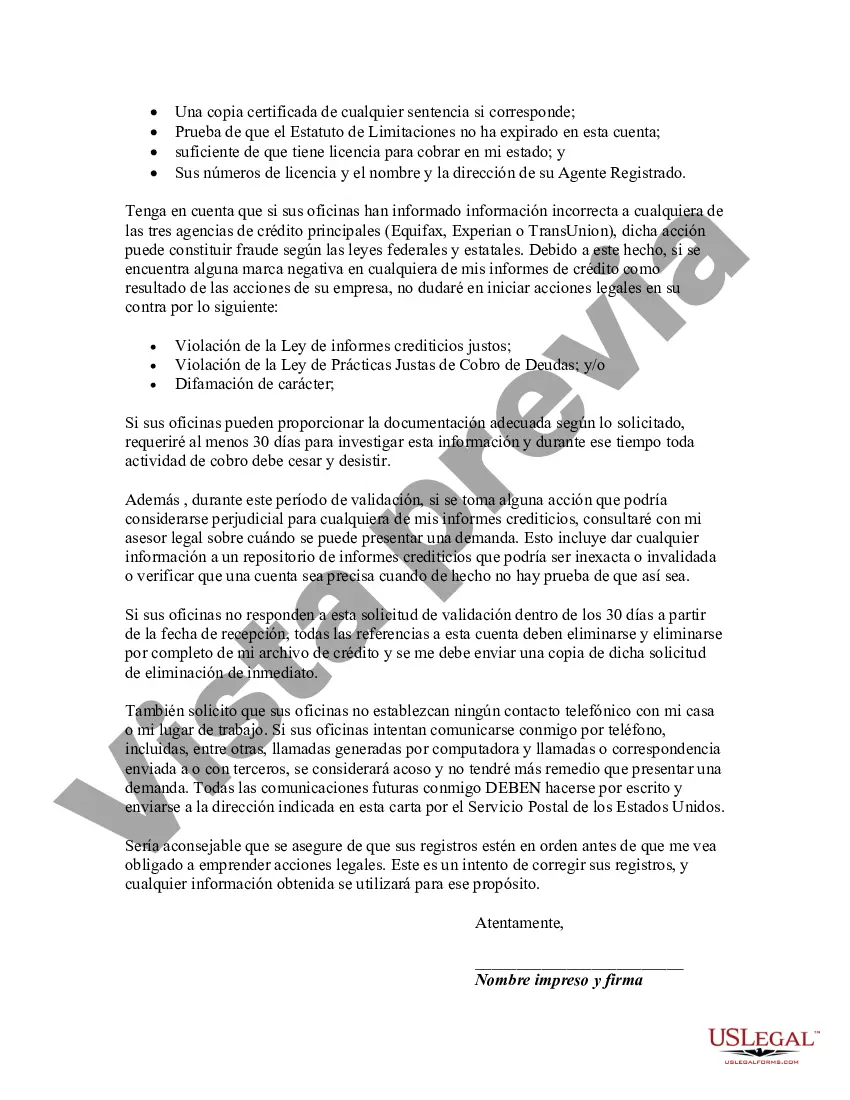

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

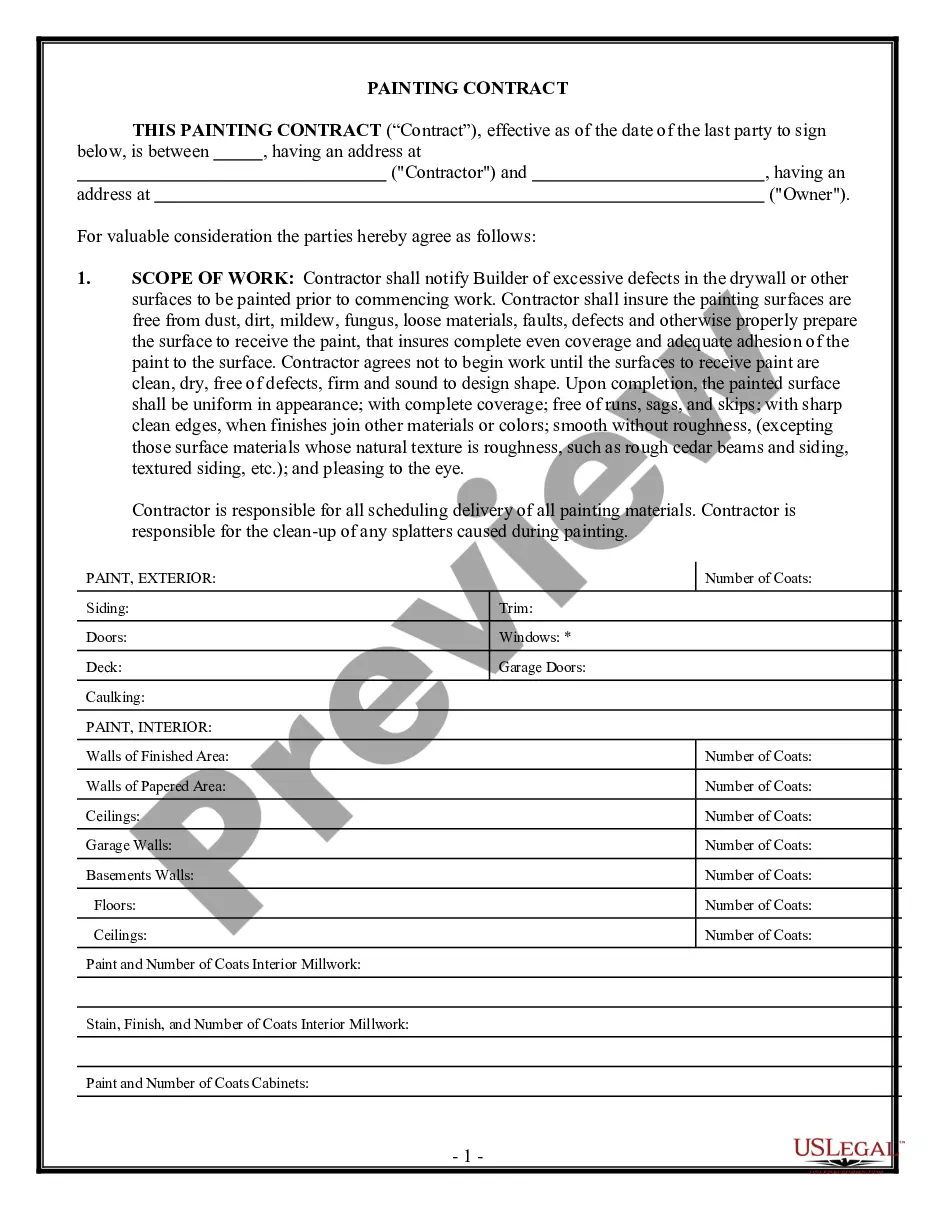

Title: Chicago Illinois — Detailed Description and Types of Letter Requesting Debt Validation from a Collection Agency Introduction: Chicago, Illinois, often referred to as the "Windy City," is a bustling metropolis renowned for its rich history, diverse culture, iconic architecture, and thriving business environment. However, like any other city, individuals may find themselves in a situation where they need to request a collection agency to validate a debt they allegedly owe to a creditor. In this article, we will provide a detailed description of what this entails and discuss different types of Chicago Illinois letters requesting debt validation. 1. What is a Letter Requesting Debt Validation? A letter requesting debt validation is a formal communication written by an individual to a collection agency, seeking proof that they indeed owe the alleged debt to a specific creditor. This letter serves as a crucial step in protecting consumer rights under the Fair Debt Collection Practices Act (FD CPA). 2. Detailed Description of the Letter Requesting Debt Validation: • Purpose: The primary purpose of this letter is to challenge the existence of a debt and request proof from the collection agency regarding its validity. • Essential Elements: The letter should include personal information such as full name, contact details, and account information related to the alleged debt. It should clearly state the creditor's name and the amount claimed, along with a specific request to validate the debt, highlighting the reference to the FD CPA. • Supporting Documents: It is advisable to attach relevant supporting documents such as account statements, receipts, or any other records that may help in establishing the validity of the debt. • Proper Format: The letter should be formal and concise, using clear and professional language throughout. It should be sent via certified mail with a return receipt to ensure proof of delivery and open communication. 3. Different Types of Chicago Illinois Letters Requesting Debt Validation: While the basic structure of the letter remains the same, its contents can vary depending on the debtor's circumstances. Some variations of Chicago Illinois letters requesting debt validation may include: • Statute of Limitations Verification: If the alleged debt is beyond the statute of limitations, the debtor may mention this fact and request validation accordingly. • Disputed Debt Verification: In cases where the debtor disputes the debt's accuracy, the letter may outline specific reasons or discrepancies, seeking validation based on those concerns. • Identity Theft Claim Verification: If the debtor suspects that the alleged debt may be a result of identity theft, the letter may highlight the need for further investigation and provide relevant supporting evidence. • Cease and Desist Request: If the debtor believes the collection agency is engaging in unfair practices or violating their rights, the letter may include a request to cease and desist all communication until proper validation is provided. Conclusion: In Chicago, Illinois, as in any other city, individuals have the right to request collection agencies to validate a debt they allegedly owe to a creditor. By understanding the detailed description of a debt validation letter and its different types, debtors can take appropriate action to safeguard their rights while resolving debt-related matters. It is essential to consult legal professionals or credit counseling agencies for personalized advice in such situations.Title: Chicago Illinois — Detailed Description and Types of Letter Requesting Debt Validation from a Collection Agency Introduction: Chicago, Illinois, often referred to as the "Windy City," is a bustling metropolis renowned for its rich history, diverse culture, iconic architecture, and thriving business environment. However, like any other city, individuals may find themselves in a situation where they need to request a collection agency to validate a debt they allegedly owe to a creditor. In this article, we will provide a detailed description of what this entails and discuss different types of Chicago Illinois letters requesting debt validation. 1. What is a Letter Requesting Debt Validation? A letter requesting debt validation is a formal communication written by an individual to a collection agency, seeking proof that they indeed owe the alleged debt to a specific creditor. This letter serves as a crucial step in protecting consumer rights under the Fair Debt Collection Practices Act (FD CPA). 2. Detailed Description of the Letter Requesting Debt Validation: • Purpose: The primary purpose of this letter is to challenge the existence of a debt and request proof from the collection agency regarding its validity. • Essential Elements: The letter should include personal information such as full name, contact details, and account information related to the alleged debt. It should clearly state the creditor's name and the amount claimed, along with a specific request to validate the debt, highlighting the reference to the FD CPA. • Supporting Documents: It is advisable to attach relevant supporting documents such as account statements, receipts, or any other records that may help in establishing the validity of the debt. • Proper Format: The letter should be formal and concise, using clear and professional language throughout. It should be sent via certified mail with a return receipt to ensure proof of delivery and open communication. 3. Different Types of Chicago Illinois Letters Requesting Debt Validation: While the basic structure of the letter remains the same, its contents can vary depending on the debtor's circumstances. Some variations of Chicago Illinois letters requesting debt validation may include: • Statute of Limitations Verification: If the alleged debt is beyond the statute of limitations, the debtor may mention this fact and request validation accordingly. • Disputed Debt Verification: In cases where the debtor disputes the debt's accuracy, the letter may outline specific reasons or discrepancies, seeking validation based on those concerns. • Identity Theft Claim Verification: If the debtor suspects that the alleged debt may be a result of identity theft, the letter may highlight the need for further investigation and provide relevant supporting evidence. • Cease and Desist Request: If the debtor believes the collection agency is engaging in unfair practices or violating their rights, the letter may include a request to cease and desist all communication until proper validation is provided. Conclusion: In Chicago, Illinois, as in any other city, individuals have the right to request collection agencies to validate a debt they allegedly owe to a creditor. By understanding the detailed description of a debt validation letter and its different types, debtors can take appropriate action to safeguard their rights while resolving debt-related matters. It is essential to consult legal professionals or credit counseling agencies for personalized advice in such situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.