Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Allegheny Pennsylvania is a county located in the state of Pennsylvania, known for its rich history, diverse population, and vibrant communities. As the second-most populous county in the state, Allegheny is home to the city of Pittsburgh and several other municipalities, making it a significant economic and cultural hub in the region. When it comes to financial matters, it is not uncommon for individuals to find themselves dealing with debt-related issues. In such cases, it is crucial to ensure that the alleged debt is legitimate and properly validated. A letter denying that an alleged debtor owes any part of the debt and requesting a collection agency to validate the debt can be an effective way to resolve disputes and protect one's rights. The purpose of this letter is to clearly state the denial of any indebtedness on the part of the alleged debtor and to request the collection agency to provide proper validation of the debt. By asserting that the debtor does not owe any part of the alleged debt, the letter aims to challenge the legitimacy of the claim made by the collection agency. It is crucial to include relevant keywords throughout the letter to ensure its efficiency, such as: 1. Allegheny Pennsylvania: As the jurisdiction in which the alleged debt is being disputed, mentioning the county's name helps establish the context and validity of the letter. 2. Letter denying indebtedness: Emphasizing the purpose of the letter to deny any responsibility for the alleged debt reinforces the message to the collection agency. This ensures they understand that the debtor disputes the claim and seeks resolution. 3. Collection agency validation request: By specifically requesting the collection agency to validate the debt, the debtor is asserting their rights under the Fair Debt Collection Practices Act (FD CPA). This request seeks to obtain proper documentation and verification of the alleged debt's validity. 4. Alleged debtor: Addressing oneself as the "alleged debtor" demonstrates a willingness to engage in communication while asserting that no debt is admitted. This helps maintain a non-confrontational approach and encourages factual validation rather than an assumption of liability. Different types of letters denying an alleged debtor's indebtedness can vary based on factors such as the nature of the debt, specific legal requirements, or the level of detail provided. Each case may require a personalized approach and the inclusion of additional relevant keywords, such as: — Allegheny Pennsylvania Student Loan Denial Letter: This specific type of denial letter is focused on disputing alleged indebtedness related to student loans, ensuring that the borrower's rights are protected and properly validated. — Allegheny Pennsylvania Medical Debt Denial Letter: This variation of the denial letter pertains to challenging alleged medical debt to ensure that the debtor's rights are respected, proper documentation is provided, and all relevant laws and regulations are adhered to. In conclusion, when disputing alleged debt in Allegheny Pennsylvania, a thorough and detailed letter denying indebtedness and requesting validation is a crucial step. Including relevant keywords related to the location, denial, validation request, and specific debt type can help improve the effectiveness of the letter and increase the chances of a favorable resolution.

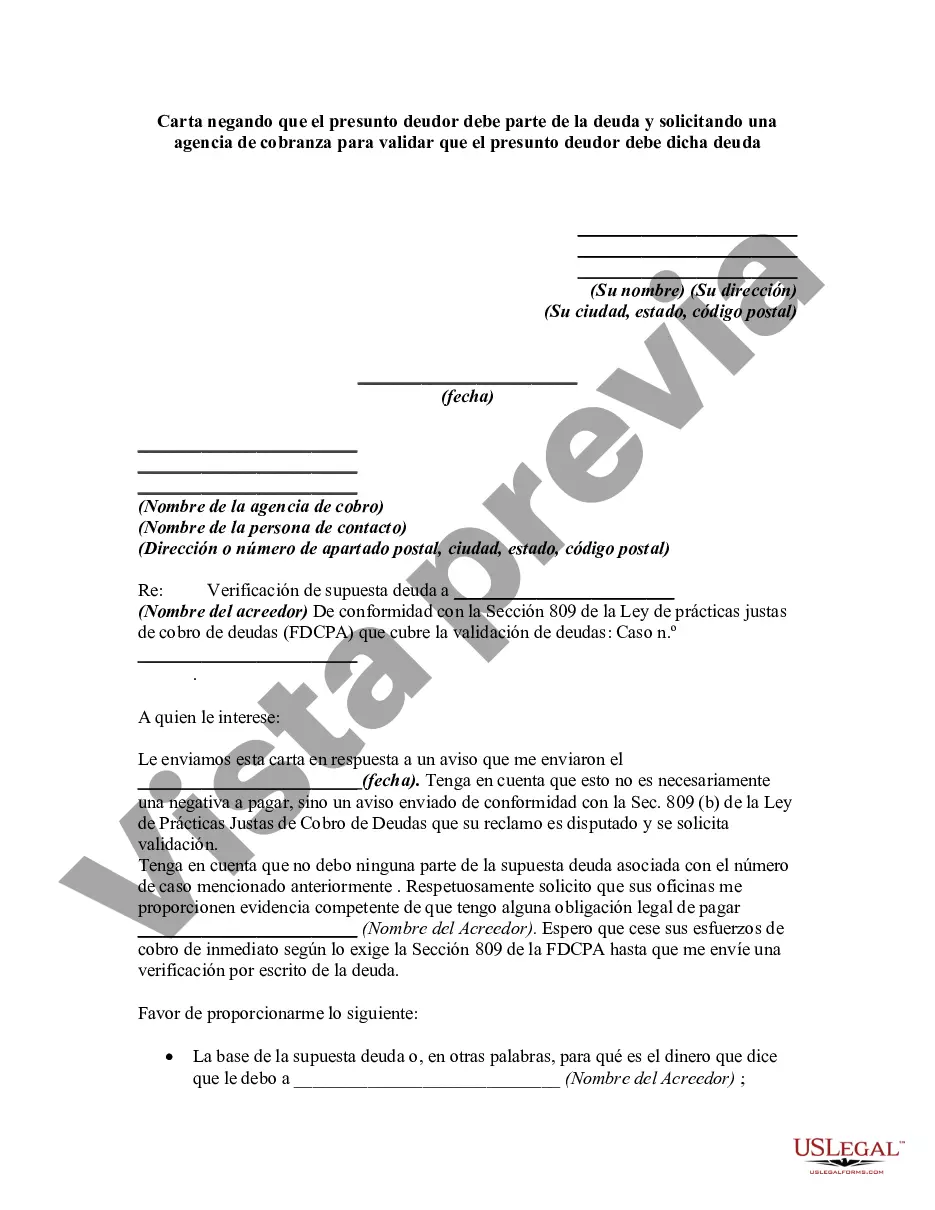

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.