Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Contra Costa California: Letter Denying Debt and Requesting Validation by Collection Agency Keywords: Contra Costa California, debt, alleged debtor, denial letter, debt validation, collection agency, debt dispute Introduction: In Contra Costa California, individuals or entities facing debt claims have the right to dispute the validity of the alleged debt. This letter serves as a formal written denial of the debt and requests a collection agency to provide proper validation of the alleged debtor's responsibility for the debt in question. 1. Standard Letter Denying Debt and Requesting Validation: — Overview: This letter template is a general denial of the alleged debt, requesting a collection agency to validate its legitimacy. — Keywords: denial letter, debt validation, disputed debt, Contra Costa California 2. Limited Liability Denial Letter: — Overview: This letter variation is applicable when the alleged debtor is disputing accountability for a debt due to limited liability or incorrect association with the debt. — Keywords: limited liability, incorrect association, denial letter, debt validation 3. Statute of Limitations Denial Letter: — Overview: This type of letter disputes a debt by citing the expiration of the statute of limitations, which prohibits legal action for the debt. — Keywords: statute of limitations, expiration, denial letter, debt validation, Contra Costa California 4. Identity Theft Denial Letter: — Overview: This letter variant denies the alleged debtor's involvement in the debt, claiming it is a result of identity theft. — Keywords: identity theft, denial letter, debt validation, Contra Costa California 5. Incorrect Amount Denial Letter: — Overview: This letter asserts that the alleged debtor does not owe the specified amount claimed, challenging the accuracy of the debt. — Keywords: incorrect amount, denial letter, inaccurate claim, debt validation, Contra Costa California Conclusion: These Contra Costa California letter templates serve to support alleged debtors in disputing and requesting validation for debts asserted by collection agencies. Each type of denial letter addresses specific circumstances, empowering individuals or entities to exercise their rights and protect their interests when faced with disputed debts.Title: Contra Costa California: Letter Denying Debt and Requesting Validation by Collection Agency Keywords: Contra Costa California, debt, alleged debtor, denial letter, debt validation, collection agency, debt dispute Introduction: In Contra Costa California, individuals or entities facing debt claims have the right to dispute the validity of the alleged debt. This letter serves as a formal written denial of the debt and requests a collection agency to provide proper validation of the alleged debtor's responsibility for the debt in question. 1. Standard Letter Denying Debt and Requesting Validation: — Overview: This letter template is a general denial of the alleged debt, requesting a collection agency to validate its legitimacy. — Keywords: denial letter, debt validation, disputed debt, Contra Costa California 2. Limited Liability Denial Letter: — Overview: This letter variation is applicable when the alleged debtor is disputing accountability for a debt due to limited liability or incorrect association with the debt. — Keywords: limited liability, incorrect association, denial letter, debt validation 3. Statute of Limitations Denial Letter: — Overview: This type of letter disputes a debt by citing the expiration of the statute of limitations, which prohibits legal action for the debt. — Keywords: statute of limitations, expiration, denial letter, debt validation, Contra Costa California 4. Identity Theft Denial Letter: — Overview: This letter variant denies the alleged debtor's involvement in the debt, claiming it is a result of identity theft. — Keywords: identity theft, denial letter, debt validation, Contra Costa California 5. Incorrect Amount Denial Letter: — Overview: This letter asserts that the alleged debtor does not owe the specified amount claimed, challenging the accuracy of the debt. — Keywords: incorrect amount, denial letter, inaccurate claim, debt validation, Contra Costa California Conclusion: These Contra Costa California letter templates serve to support alleged debtors in disputing and requesting validation for debts asserted by collection agencies. Each type of denial letter addresses specific circumstances, empowering individuals or entities to exercise their rights and protect their interests when faced with disputed debts.

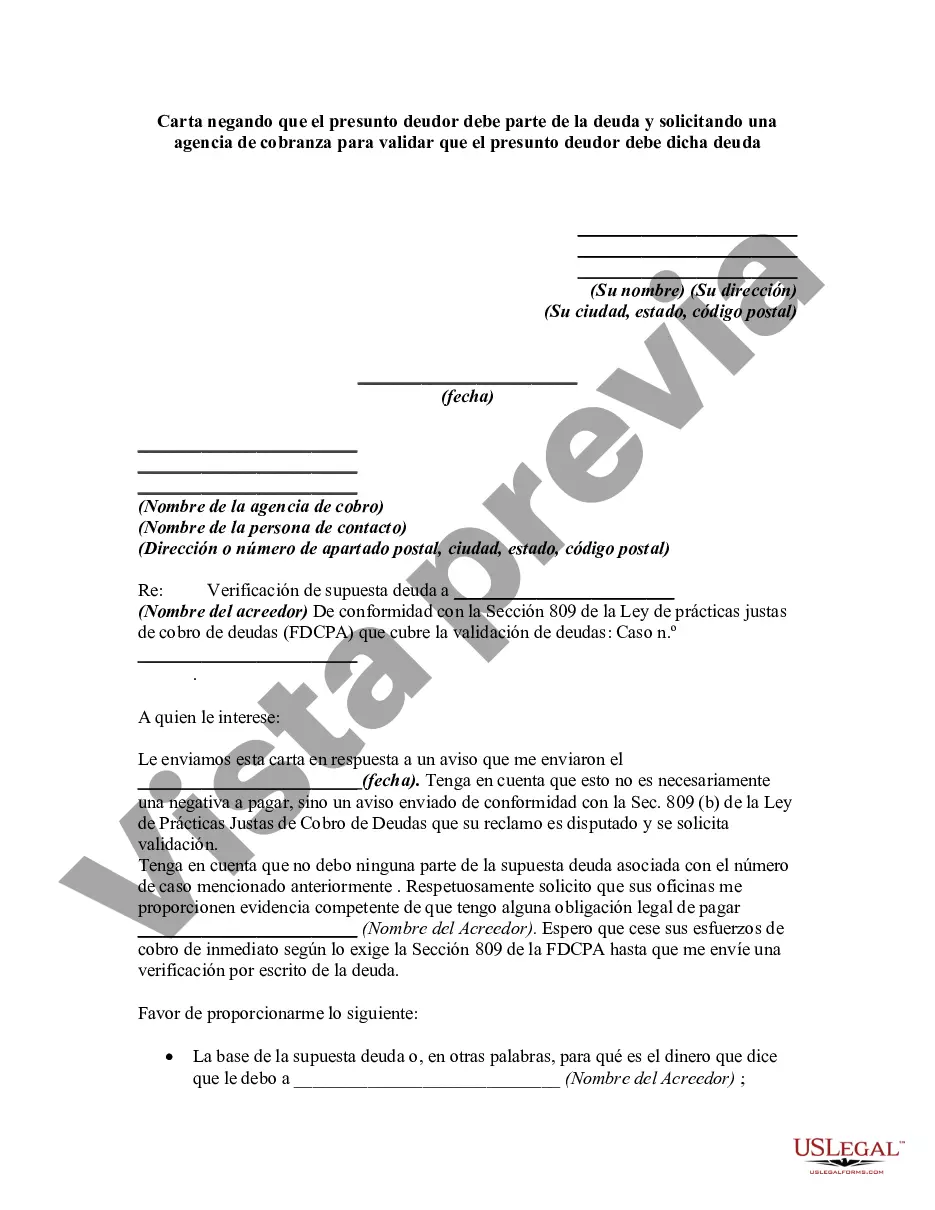

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.