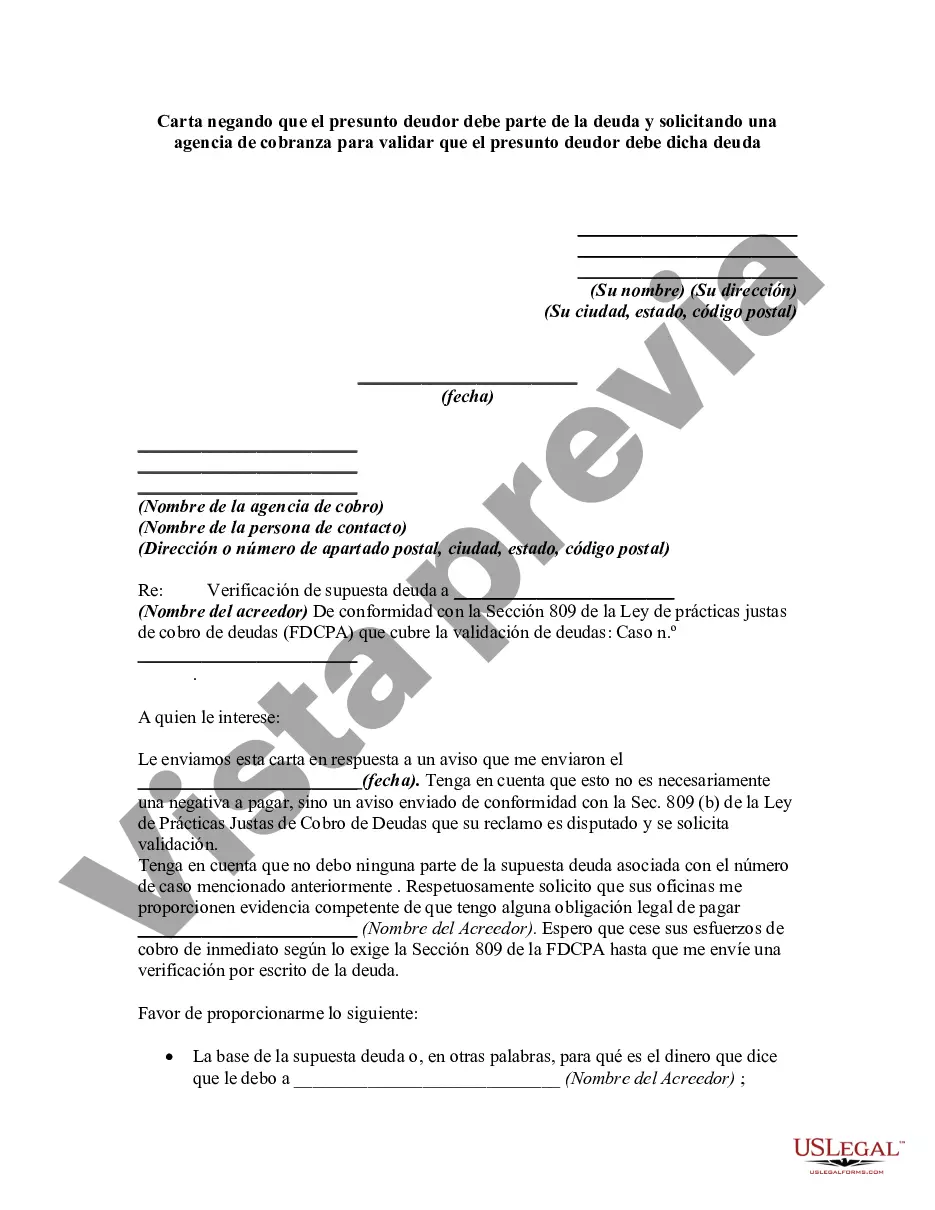

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Carta negando que el presunto deudor debe parte de la deuda y solicitando una agencia de cobranza para validar que el presunto deudor debe dicha deuda - Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Carta Negando Que El Presunto Deudor Debe Parte De La Deuda Y Solicitando Una Agencia De Cobranza Para Validar Que El Presunto Deudor Debe Dicha Deuda?

How long does it typically require for you to draft a legal document.

As every state has its own statutes and regulations for various life circumstances, finding a Franklin Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such a Debt that fulfills all local requirements can be exhausting, and obtaining it from a qualified attorney is frequently costly.

Numerous online platforms provide the most frequently utilized state-specific documents for download, but utilizing the US Legal Forms repository is particularly advantageous.

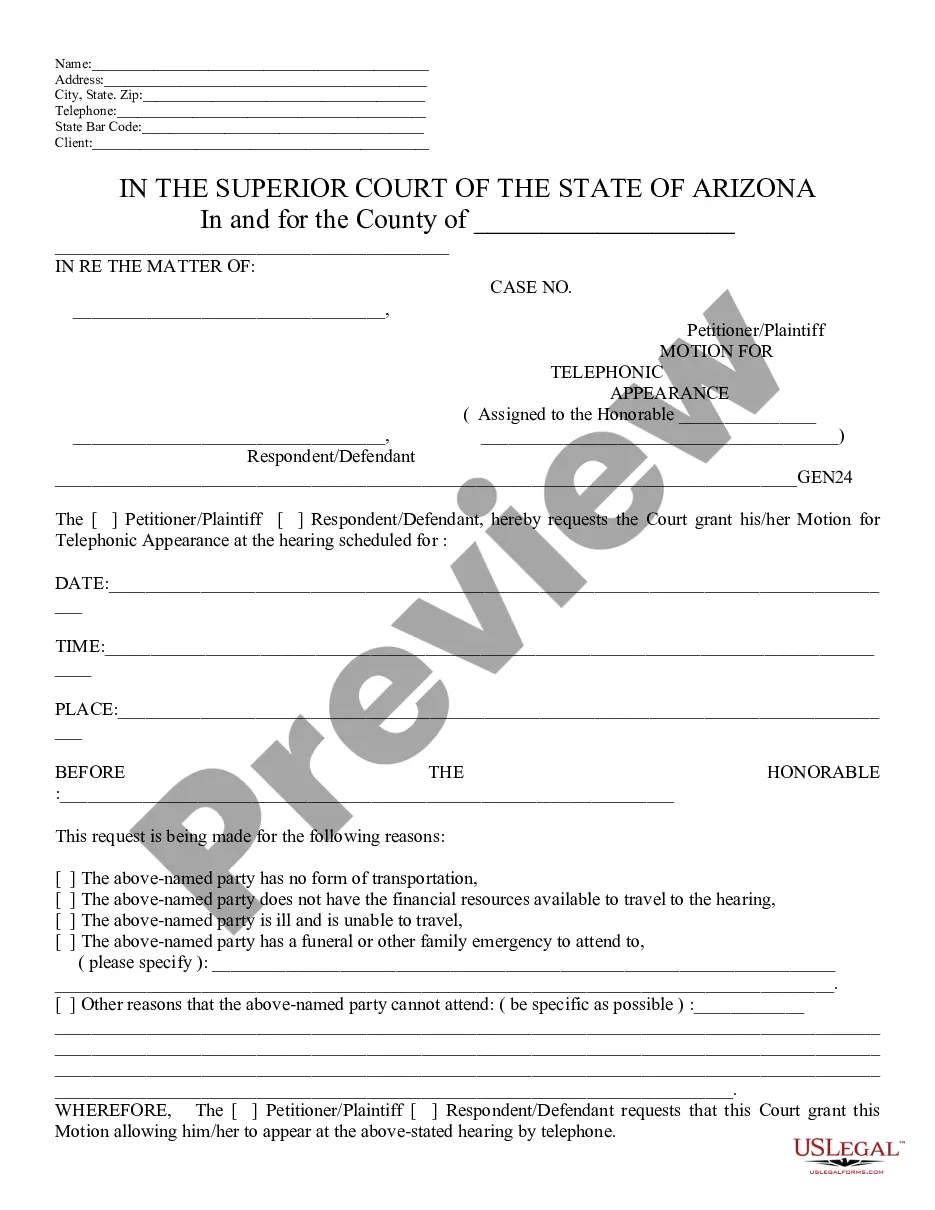

Choose the subscription plan that best fits your needs. Create an account on the platform or Log In to move forward to payment options. Complete the payment via PayPal or with your credit card. Alter the file format if needed. Click Download to save the Franklin Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such a Debt. Print the template or utilize any suitable online editor to finalize it electronically. Regardless of how many times you need to access the purchased document, you can find all the samples you’ve previously downloaded in your profile by navigating to the My documents tab. Give it a try!

- US Legal Forms is the largest online catalog of templates, organized by states and areas of application.

- In addition to the Franklin Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such a Debt, here you can acquire any particular form necessary for managing your business or personal activities, adhering to your county standards.

- Experts validate all samples for their accuracy, so you can be assured in preparing your documents correctly.

- Utilizing the service is remarkably straightforward.

- If you already possess an account on the platform and your subscription is current, you just need to Log In, select the necessary template, and download it.

- You can retrieve the document in your profile at any point in the future.

- If you are new to the platform, you will have a few additional steps to complete before accessing your Franklin Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such a Debt.

- Examine the content of the page you’re visiting.

- Review the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re confident in the selected document.

Form popularity

FAQ

Cuando un cobrador de deudas le contacte, averigue lo siguiente: La identidad del cobrador de deudas, incluyendo: nombre, direccion y telefono. El monto de la deuda, incluyendo cualquier tarifa como intereses, o costos de cobranza. Para que y cuando fue contraida la deuda. Nombre del acreedor original.

1. Validar y verificar. Dentro de los cinco dias de contactarlo, un cobrador debe enviar una notificacion de validacion de la deuda por escrito que indique quien y que debe. Si no lo ha recibido, digales que no se pongan en contacto con usted hasta que lo envien.

Pregunta cualquier duda, asi evitaras malos entendidos y la negociacion sera mas agil. Analiza tus opciones.... Fija un acuerdo. Considera que este debe ser realista con tu situacion.Informa sobre tu situacion real y actual.Manten una comunicacion abierta.Comprometete.

Buenos dias XXX, A pesar de mi mensaje anterior del dia XXX y salvo error por mi parte, sigo sin recibir el pago de la factura XXX con fecha XXX e importe XXX que adjunto en copia. Espero un pago inmediato. De no ser asi, tendre que tomar medidas formales para ejercer mi derecho al cobro.

La carta de cobro es el documento que acompana a la nota de cobro del cliente, es decir, la carta con la cual te diriges a ellos para presentar el cobro de tus honorarios y/o gastos.

COMPONENTES DE UN EMAIL DE COBRANZA Nombre de quien envia el email.Asunto del email.Motivo del contacto.Deuda.Llamada a la accion.Penalidades (opcional).Disclaimer.Firma.

Un ejemplo de mensajes de cobranza de este tipo seria el siguiente: Hola, Pedro Antonio. Nos gustaria informarte que aun no hemos recibido el pago de la factura (XXXX) con vencimiento(fecha). Por favor, comprueba si el pago ha sido efectuado.

Los elementos imprescindibles de un acuerdo de pago son: Datos del acreedor y del deudor: El nombre y los apellidos, asi como el documento nacional de identidad deben estar presentes en los documentos. Clausulas: Deben establecerse las clausulas o declaraciones que modifican o cumplimentan al acuerdo original.

Una carta de compromiso de pago es un documento, a traves del cual una persona fisica o juridica acepta hacerse cargo del pago de una cantidad de dinero que mantenia a modo de deuda con una persona o empresa.

Formato de la carta de compromiso de pago Datos del pagador: Despues incluye los datos del particular o empresa a quien va dirigida. Fecha de la carta: En lado superior derecho coloca la fecha en la que se redacta la carta. Cantidad de pago y condiciones: En el cuerpo de la carta haz constar el compromiso de pago.