Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Los Angeles is a vibrant and bustling city located in the state of California. Known for its sunny weather, diverse population, and iconic landmarks, Los Angeles is a popular tourist destination and a major center for entertainment, arts, and business. In a Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, the debtor disputes the claim made by the collection agency and requests proof of the alleged debt. This type of letter is commonly known as a Debt Validation Letter or a Debt Verification Letter. Keywords: Los Angeles, California, debt, alleged debtor, collection agency, validation, debt dispute, debt validation letter, debt verification letter. Different types of Los Angeles California Letters Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt may include: 1. Formal Debt Validation Letter: This letter is a formal, written response from the alleged debtor to the collection agency, denying the existence or validity of the debt and requesting proper validation. 2. Informal Debt Dispute Letter: This type of letter may take a slightly more informal tone, but still clearly states the debtor's denial of the debt and request for validation. 3. Debt Verification Letter: This letter specifically asks the collection agency to provide verification and proof of the alleged debt, including any associated documents or paperwork. 4. Cease and Desist Letter: In certain situations, the alleged debtor may include a cease and desist demand in the letter, instructing the collection agency to stop all communication regarding the debt until proper validation is provided. 5. Dispute Response Letter: This type of letter is sent in response to a collection agency's initial communication regarding the alleged debt. It states the debtor's denial of the debt and requests validation. Remember, it is important for the alleged debtor to carefully review their specific situation and consult with legal counsel if needed, as laws and regulations related to debt validation may vary.Los Angeles is a vibrant and bustling city located in the state of California. Known for its sunny weather, diverse population, and iconic landmarks, Los Angeles is a popular tourist destination and a major center for entertainment, arts, and business. In a Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, the debtor disputes the claim made by the collection agency and requests proof of the alleged debt. This type of letter is commonly known as a Debt Validation Letter or a Debt Verification Letter. Keywords: Los Angeles, California, debt, alleged debtor, collection agency, validation, debt dispute, debt validation letter, debt verification letter. Different types of Los Angeles California Letters Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt may include: 1. Formal Debt Validation Letter: This letter is a formal, written response from the alleged debtor to the collection agency, denying the existence or validity of the debt and requesting proper validation. 2. Informal Debt Dispute Letter: This type of letter may take a slightly more informal tone, but still clearly states the debtor's denial of the debt and request for validation. 3. Debt Verification Letter: This letter specifically asks the collection agency to provide verification and proof of the alleged debt, including any associated documents or paperwork. 4. Cease and Desist Letter: In certain situations, the alleged debtor may include a cease and desist demand in the letter, instructing the collection agency to stop all communication regarding the debt until proper validation is provided. 5. Dispute Response Letter: This type of letter is sent in response to a collection agency's initial communication regarding the alleged debt. It states the debtor's denial of the debt and requests validation. Remember, it is important for the alleged debtor to carefully review their specific situation and consult with legal counsel if needed, as laws and regulations related to debt validation may vary.

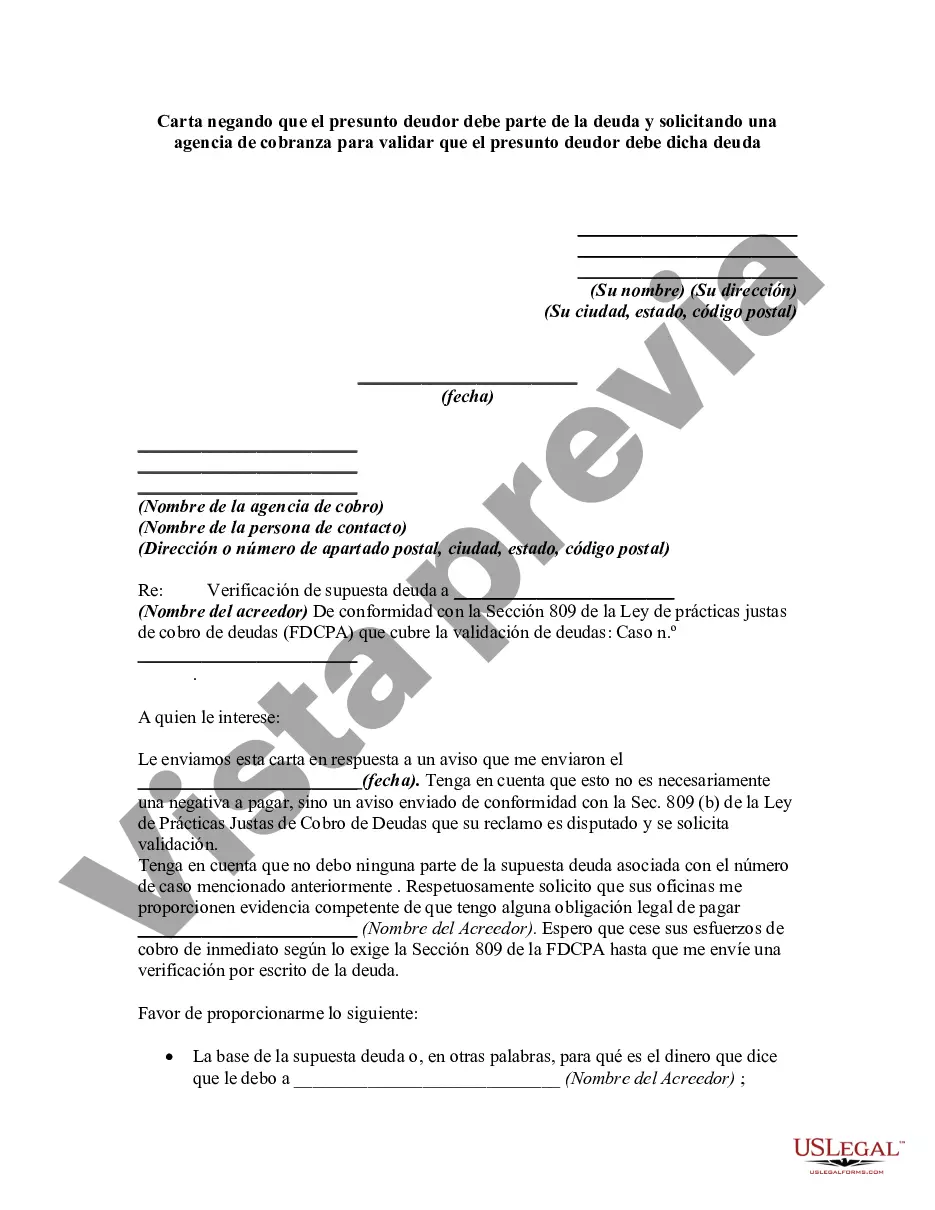

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.