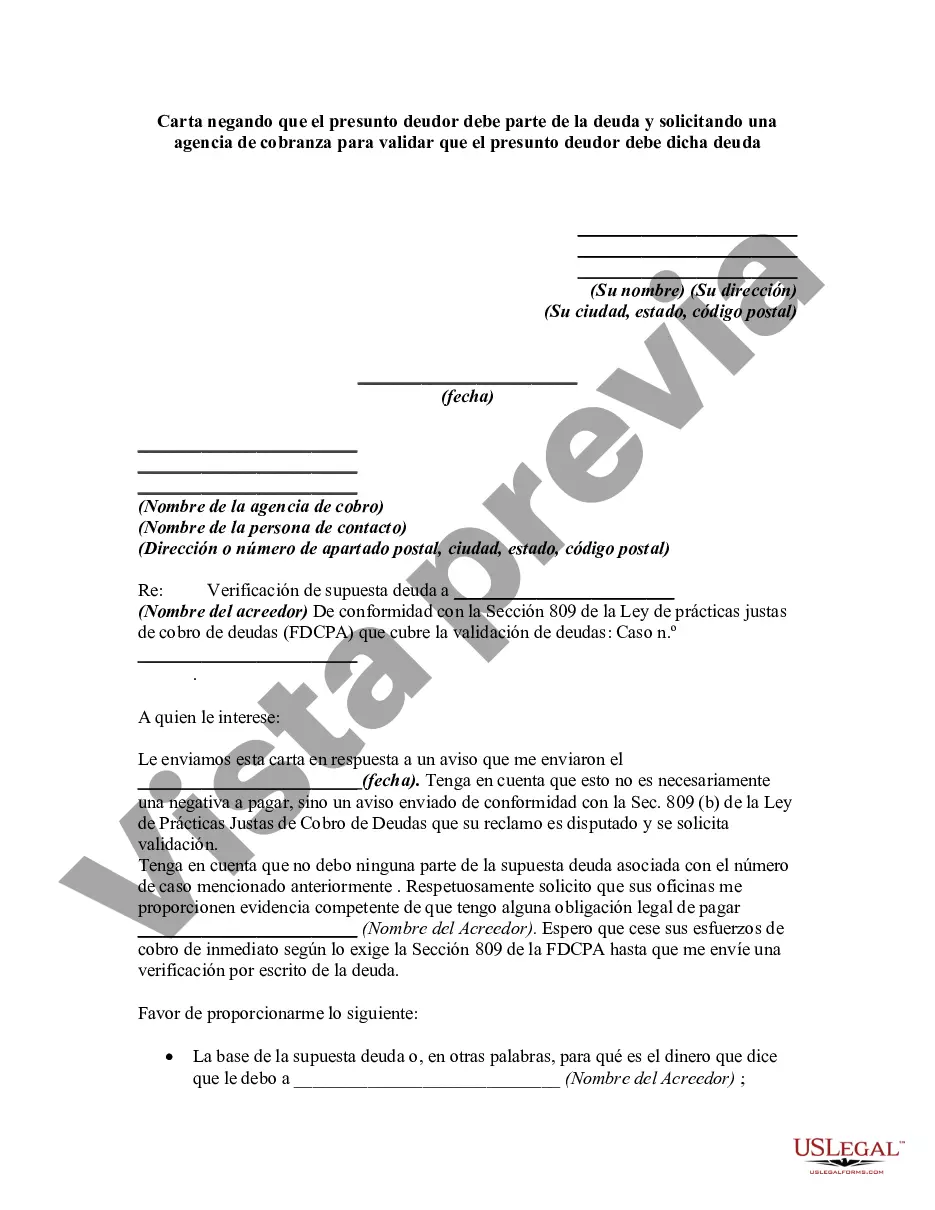

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Maricopa, Arizona: Request for Debt Validation and Denial of Alleged Debt Introduction: In Maricopa, Arizona, individuals facing debt-related challenges may need to inquire about the validity of a debt and seek proper verification. This article will provide a detailed description of a letter denying that an alleged debtor owes any part of a debt, while requesting a collection agency to validate the alleged debt. We will also discuss different types of this letter, depending on specific circumstances. Keywords: Maricopa Arizona, debt, alleged debtor, denial, collection agency, validation, request, letter 1. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Debt Validation: This type of letter is used when an individual believes they do not owe the debt in question and wants the collection agency to prove its validity. This letter should include specific details about the debt, the reasons for the denial, and a request for proper documentation supporting the claim. 2. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Verification of Debt Ownership: This variation of the letter is suitable when the alleged debtor questions the ownership of the debt. It requests the collection agency to validate their legal right to collect the debt and provide evidence of proper authority and transfer of ownership. 3. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Creditor Information: In circumstances where the alleged debtor doubts the credibility of the creditor, this type of letter seeks to obtain relevant information about the original creditor. It asks the collection agency to disclose the necessary details such as contact information, history, and proof of the creditor's validity. 4. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Debt Verification Accuracy: If a debtor disputes the accuracy of the debt's amount or any associated charges or fees, this letter is appropriate. It demands the collection agency to provide a detailed breakdown of the debt, including principal amount, interest, penalties, and other additional charges. 5. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Cease and Desist: In certain instances, debtors may no longer want communication from the collection agency. This type of letter specifically denies the debt's existence, declares the intention to dispute it, and requests the agency to cease all contact attempts, as allowed by applicable laws. Conclusion: When dealing with a debt-related dispute in Maricopa, Arizona, it is essential to understand the various types of letters available to assert one's rights as an alleged debtor. By customizing the letter to address individual circumstances, debtors can effectively deny owing any part of a debt while requesting collection agencies to validate their claims. Remember to seek legal advice when needed to ensure the proper procedures are followed.Title: Maricopa, Arizona: Request for Debt Validation and Denial of Alleged Debt Introduction: In Maricopa, Arizona, individuals facing debt-related challenges may need to inquire about the validity of a debt and seek proper verification. This article will provide a detailed description of a letter denying that an alleged debtor owes any part of a debt, while requesting a collection agency to validate the alleged debt. We will also discuss different types of this letter, depending on specific circumstances. Keywords: Maricopa Arizona, debt, alleged debtor, denial, collection agency, validation, request, letter 1. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Debt Validation: This type of letter is used when an individual believes they do not owe the debt in question and wants the collection agency to prove its validity. This letter should include specific details about the debt, the reasons for the denial, and a request for proper documentation supporting the claim. 2. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Verification of Debt Ownership: This variation of the letter is suitable when the alleged debtor questions the ownership of the debt. It requests the collection agency to validate their legal right to collect the debt and provide evidence of proper authority and transfer of ownership. 3. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Creditor Information: In circumstances where the alleged debtor doubts the credibility of the creditor, this type of letter seeks to obtain relevant information about the original creditor. It asks the collection agency to disclose the necessary details such as contact information, history, and proof of the creditor's validity. 4. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Debt Verification Accuracy: If a debtor disputes the accuracy of the debt's amount or any associated charges or fees, this letter is appropriate. It demands the collection agency to provide a detailed breakdown of the debt, including principal amount, interest, penalties, and other additional charges. 5. Maricopa Arizona Letter Denying Alleged Debtor's Debt and Requesting Cease and Desist: In certain instances, debtors may no longer want communication from the collection agency. This type of letter specifically denies the debt's existence, declares the intention to dispute it, and requests the agency to cease all contact attempts, as allowed by applicable laws. Conclusion: When dealing with a debt-related dispute in Maricopa, Arizona, it is essential to understand the various types of letters available to assert one's rights as an alleged debtor. By customizing the letter to address individual circumstances, debtors can effectively deny owing any part of a debt while requesting collection agencies to validate their claims. Remember to seek legal advice when needed to ensure the proper procedures are followed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.