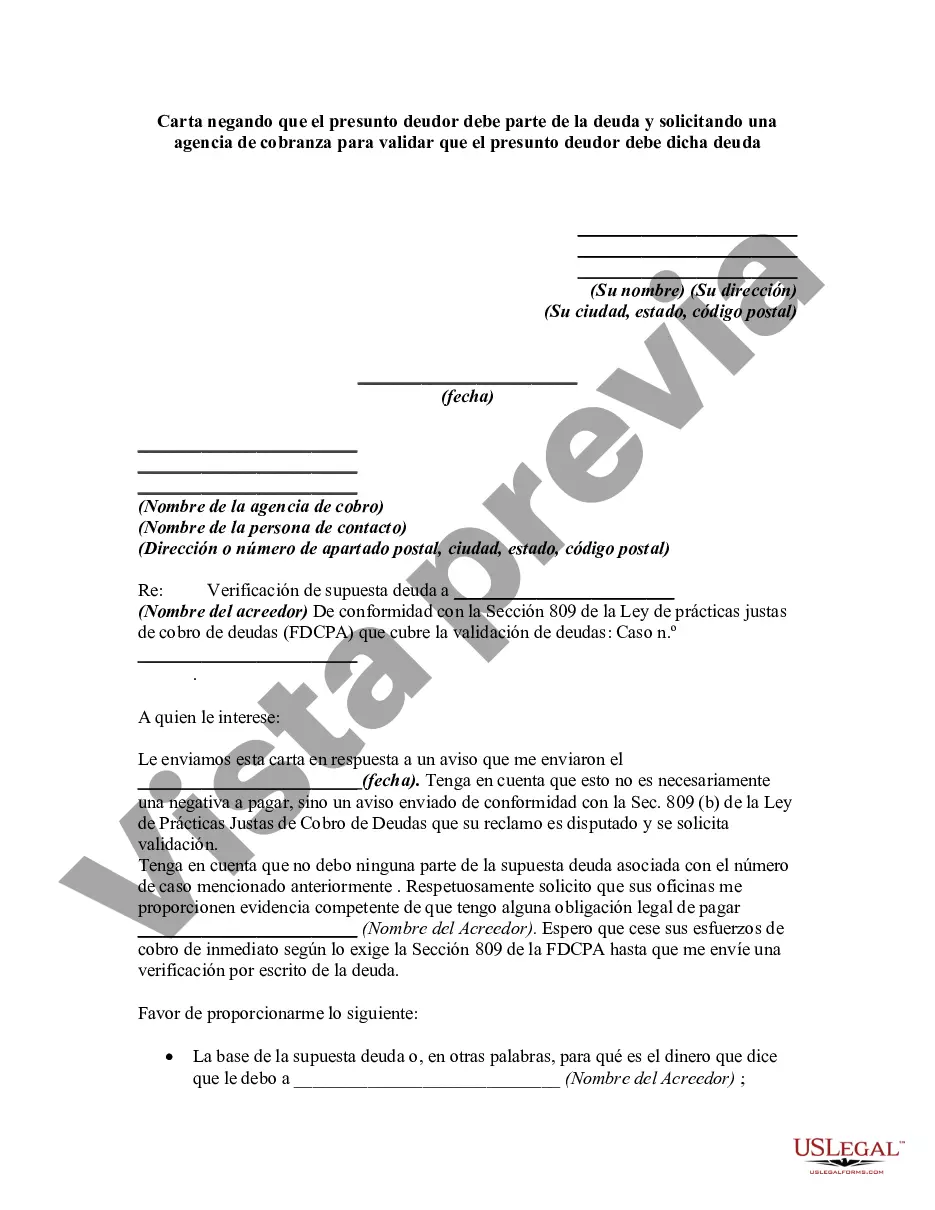

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Montgomery, Maryland: All You Need to Know Description: Montgomery, Maryland is a vibrant county located in the heart of the state. Known for its rich history, diverse culture, and thriving economy, it offers a wide range of opportunities to residents and visitors alike. This article provides a detailed description of what makes Montgomery, Maryland a unique place to live, work, and explore. Keywords: Montgomery Maryland, detailed description, unique place, live, work, explore, vibrant county, rich history, diverse culture, thriving economy --- Title: Letter Denying Debtor's Liability and Requesting Debt Validation in Montgomery, Maryland Description: In Montgomery, Maryland, individuals who find themselves facing allegations of debt without valid cause can benefit from understanding their rights and the available legal recourse. This letter template is designed to help residents draft a formal response to a collection agency, denying any liability for the alleged debt and requesting validation to ensure its accuracy and legitimacy. Keywords: Montgomery Maryland, letter denying debtor's liability, debt validation, collection agency, alleged debt, legal recourse, rights, accuracy, legitimacy --- Title: Different Types of Montgomery, Maryland Debt Denial and Validation Letters Description: Within Montgomery, Maryland, several types of debt denial and validation letters are commonly utilized to protect alleged debtors and ensure accurate accounting practices. These include denial letters for unpaid loans, disputed credit card debts, or even medical expenses. By requesting collection agencies to validate the alleged debts, residents can safeguard their financial reputation effectively. Keywords: Montgomery Maryland, debt denial, validation letters, alleged debtors, accounting practices, unpaid loans, disputed credit card debts, medical expenses, collection agencies, financial reputation

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.