Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Examining the Various Types of Phoenix, Arizona Letters Denying Debtor's Obligation and Urging Collection Agencies to Authenticate Debts Introduction: In Phoenix, Arizona, individuals facing alleged debts have the right to dispute and request validation from collection agencies before accepting any financial responsibility. This article sheds light on different types of letters that debtors can utilize to deny owing any part of the debt and demand verification from collection agencies. By incorporating relevant keywords, we aim to provide a comprehensive overview to assist debtors seeking guidance in Phoenix, Arizona. 1. Phoenix Arizona Letter Denying Debt: Sample Template and Guidelines — Understand the importance of a formal written denial of debt letter — Key components: debtor's contact information, creditor's details, explicit denial of debt obligation, request for debt validation — Emphasize the need for maintaining a constructive and professional tone — Highlight the significance of sending the letter via certified mail 2. Requesting Debt Validation in Phoenix, Arizona: Legal Rights and Procedures — Explore the legal rights possessed by alleged debtors in Phoenix, Arizona — Explain the Fair Debt Collection Practices Act (FD CPA) provisions and regulations — Detail the debt validation process, including the timeframe for response from collection agencies — Discuss the documentation required for proving the alleged debt 3. Individual Debt Denial Letter: Customized Approach for Alleged Debtor — Guiding alleged debtors on personalizing their letter to fit their unique circumstances — Provide tips for crafting a persuasive yet concise denial letter — Address common concerns such as handling old debts, mistaken identity, and lack of documentation — Encourage debtors to maintain a meticulous record of communication with the collection agency 4. Commercial Debt Denial Letter: Protecting Business Interests — Elucidate the key differences and additional considerations for commercial debts — Discuss legal obligations for businesses in responding to debt collection attempts — Emphasize the significance of documenting all communications and establishing a paper trail — Provide a sample commercial debt denial letter template 5. Debt Dispute Resolution in Phoenix, Arizona: Legal Assistance and Resources — Highlight the availability of legal assistance and counseling services in Phoenix, Arizona — Discuss organizations offering advice and support to debtors navigating the debt validation process — Provide information on relevant local and state resources for debt dispute resolution — Encourage debtors to familiarize themselves with their rights and obligations under Arizona debt collection laws Conclusion: Understanding the types of Phoenix, Arizona letters available for debt denial and requesting debt validation is crucial for alleged debtors seeking to safeguard their rights and ensure fair treatment within the debt collection process. By utilizing the appropriate letter templates and legal resources mentioned here, debtors can take important steps toward resolving their dispute and protect their financial well-being in Phoenix, Arizona.Title: Examining the Various Types of Phoenix, Arizona Letters Denying Debtor's Obligation and Urging Collection Agencies to Authenticate Debts Introduction: In Phoenix, Arizona, individuals facing alleged debts have the right to dispute and request validation from collection agencies before accepting any financial responsibility. This article sheds light on different types of letters that debtors can utilize to deny owing any part of the debt and demand verification from collection agencies. By incorporating relevant keywords, we aim to provide a comprehensive overview to assist debtors seeking guidance in Phoenix, Arizona. 1. Phoenix Arizona Letter Denying Debt: Sample Template and Guidelines — Understand the importance of a formal written denial of debt letter — Key components: debtor's contact information, creditor's details, explicit denial of debt obligation, request for debt validation — Emphasize the need for maintaining a constructive and professional tone — Highlight the significance of sending the letter via certified mail 2. Requesting Debt Validation in Phoenix, Arizona: Legal Rights and Procedures — Explore the legal rights possessed by alleged debtors in Phoenix, Arizona — Explain the Fair Debt Collection Practices Act (FD CPA) provisions and regulations — Detail the debt validation process, including the timeframe for response from collection agencies — Discuss the documentation required for proving the alleged debt 3. Individual Debt Denial Letter: Customized Approach for Alleged Debtor — Guiding alleged debtors on personalizing their letter to fit their unique circumstances — Provide tips for crafting a persuasive yet concise denial letter — Address common concerns such as handling old debts, mistaken identity, and lack of documentation — Encourage debtors to maintain a meticulous record of communication with the collection agency 4. Commercial Debt Denial Letter: Protecting Business Interests — Elucidate the key differences and additional considerations for commercial debts — Discuss legal obligations for businesses in responding to debt collection attempts — Emphasize the significance of documenting all communications and establishing a paper trail — Provide a sample commercial debt denial letter template 5. Debt Dispute Resolution in Phoenix, Arizona: Legal Assistance and Resources — Highlight the availability of legal assistance and counseling services in Phoenix, Arizona — Discuss organizations offering advice and support to debtors navigating the debt validation process — Provide information on relevant local and state resources for debt dispute resolution — Encourage debtors to familiarize themselves with their rights and obligations under Arizona debt collection laws Conclusion: Understanding the types of Phoenix, Arizona letters available for debt denial and requesting debt validation is crucial for alleged debtors seeking to safeguard their rights and ensure fair treatment within the debt collection process. By utilizing the appropriate letter templates and legal resources mentioned here, debtors can take important steps toward resolving their dispute and protect their financial well-being in Phoenix, Arizona.

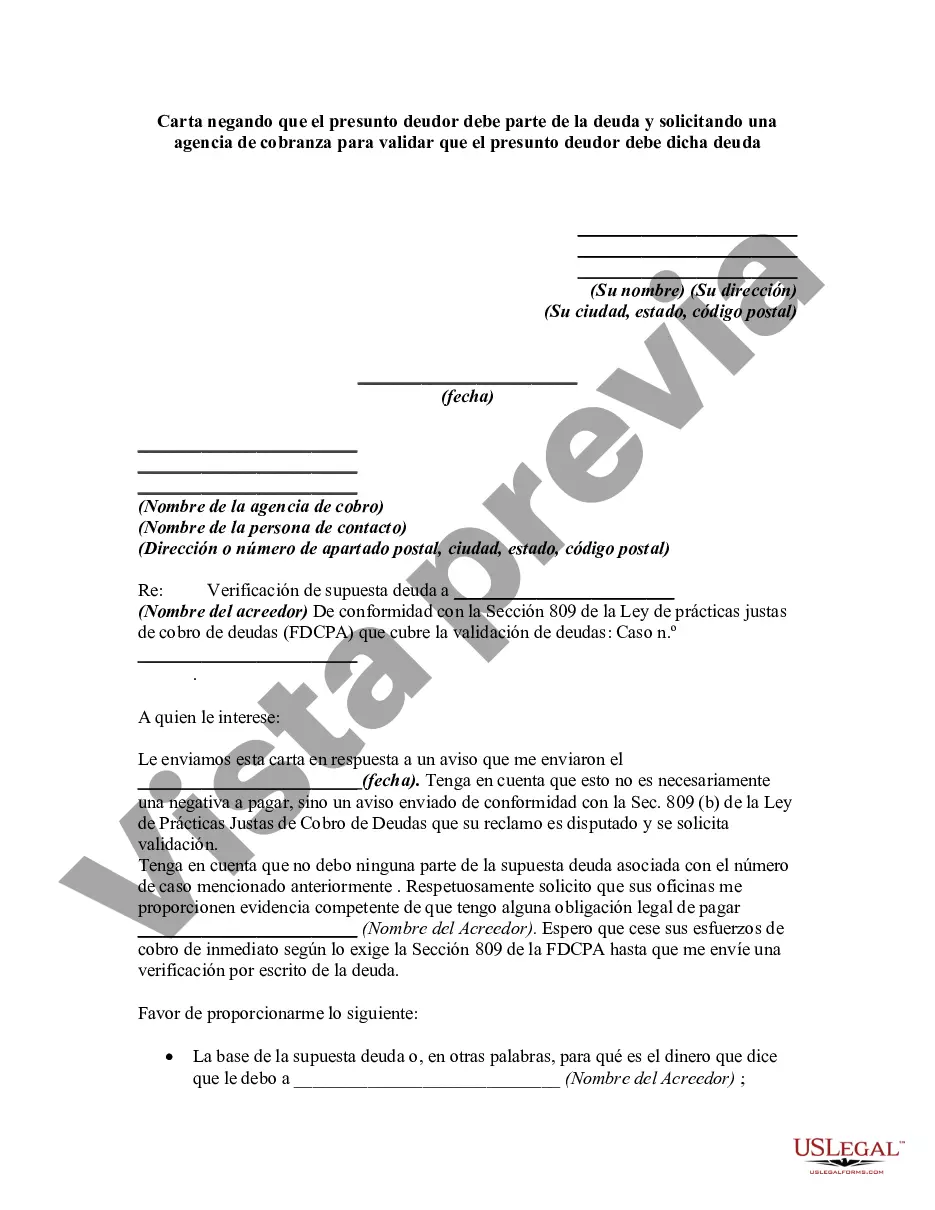

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.