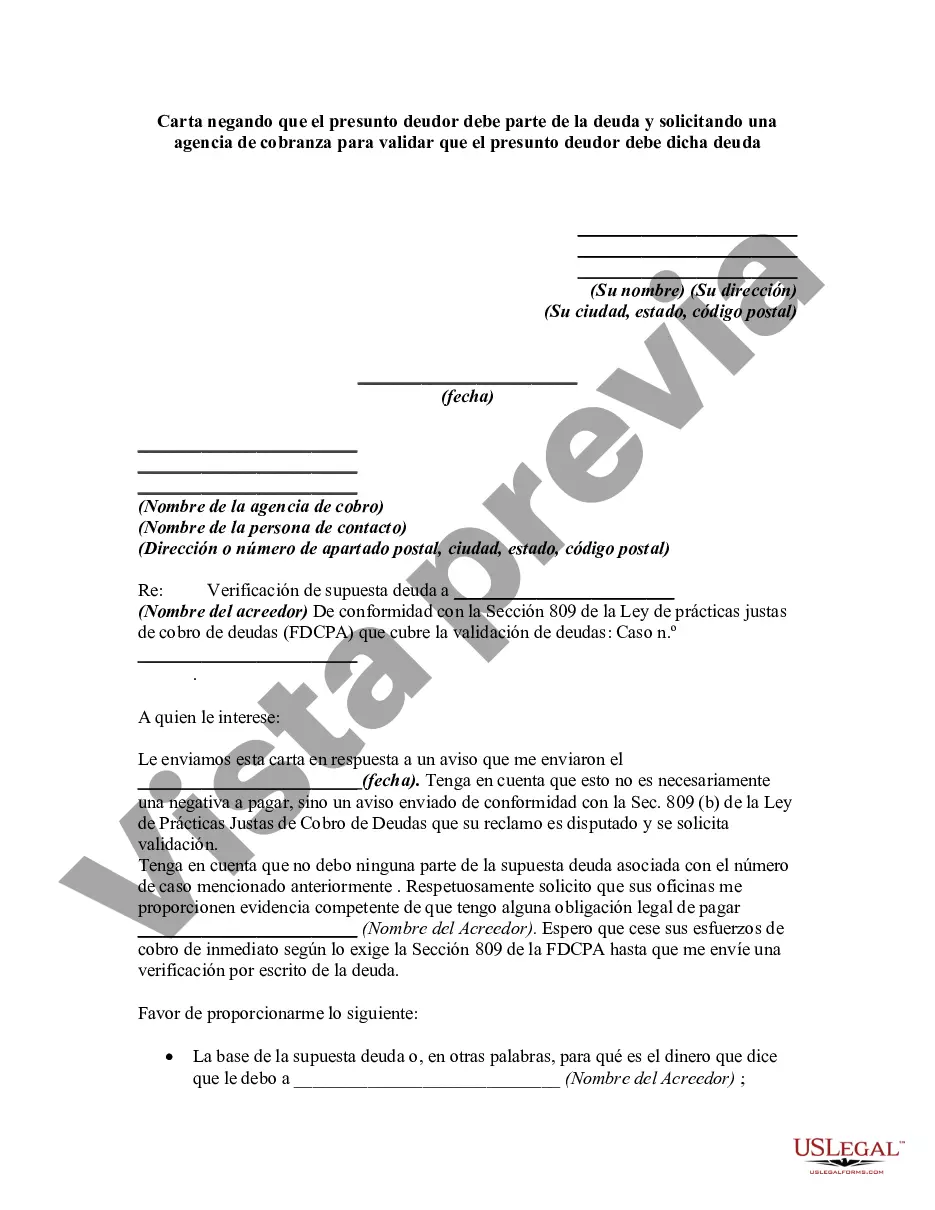

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Title: Lima, Arizona — Denying Alleged Debt and Requesting Debt Validation from Collection Agency Introduction: In Lima, Arizona, individuals sometimes find themselves in frustrating situations where they receive debt collection notices for debts they believe they do not owe. In such cases, it is crucial to respond promptly and assertively to the collection agency by sending a Letter Denying that Alleged Debtor Owes Any Part of the Debt and Request for Debt Validation. This detailed description aims to provide an overview of how to construct such a letter, highlighting its importance and offering suggestions for effective communication. I. The Importance of Denying the Alleged Debt: 1. Protecting your rights: Denying the alleged debt ensures that your rights as a consumer and debtor are upheld, preventing unjust collection attempts. 2. Avoiding unnecessary payments: By promptly denying the alleged debt, you can prevent yourself from making payments for debts you do not owe. 3. Opportunity for debt investigation: A letter denying the debt prompts the collection agency to validate the debt, giving you an opportunity to check its legitimacy and accuracy. II. Components of a Comprehensive Denial Letter: 1. Clear identification: Start the letter by explicitly addressing the collection agency, providing your name, address, and any reference numbers associated with the alleged debt. 2. Statement of denial: Firmly state that you deny any responsibility for the alleged debt, precisely mentioning the amount and the time of the alleged debt occurrence. 3. Request for validation: Explicitly ask the collection agency to provide detailed documentation validating the existence of the debt, including a copy of the original signed agreement, proof of indebtedness, payment history, and any other supporting documents. 4. Proof of delivery: Ensure that you send the letter via certified mail with a return receipt requested or any other method that provides proof of delivery, to maintain evidence of your attempt to resolve the issue. 5. Deadline for response: Specify a reasonable timeframe, generally within 30 days, within which the collection agency should validate the debt and provide you with the requested information. III. Additional Types of Debt Denial Letters: 1. Multiple debts with the same collection agency: If you receive multiple debt collection notices from the same agency but dispute each one, consider sending separate letters addressing each alleged debt individually. 2. Different collection agencies for separate creditors: In situations where you are dealing with various collection agencies representing different creditors, you may need to develop tailored letters for each alleged debt. Conclusion: Facing a debt collection notice can be daunting, but with a well-crafted Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting Debt Validation, individuals in Lima, Arizona can protect their rights and ensure the accuracy of the alleged debts. By assertively requesting debt validation, it is possible to resolve the matter and avoid paying for debts one does not owe. Remember to stay organized, keep copies of all correspondence, and consult legal professionals if necessary for guidance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.