Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

San Bernardino, California, is a city located in the Inland Empire region of Southern California. Situated east of Los Angeles, San Bernardino is known for its rich history, diverse culture, and natural beauty. With a population of over 215,000 residents, this vibrant city offers a wide range of attractions and opportunities. In a Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, the alleged debtor or their representative expresses their disagreement regarding the existence of the debt in question. The letter raises doubts about the validity of the alleged debt and requests the collection agency to provide evidence to validate the claim. The purpose of this letter is to dispute the debt and protect the alleged debtor's rights. By sending such a letter, the alleged debtor aims to urge the collection agency to either provide substantial proof of the debt's legitimacy or cease any further collection attempts. This letter serves as a tool for the alleged debtor to exercise their rights under the Fair Debt Collection Practices Act (FD CPA) while also seeking validation and clarification about the alleged debt. Different types of San Bernardino, California, letters denying alleged debts and requesting collection agencies to validate the debt may include variations in wording or specific details, but their purpose remains the same: to challenge the legitimacy of the claimed debt and request evidence from the collection agency. Some possible variations of this letter could include: 1. San Bernardino, California, Debt Dispute Letter: Denying any obligation towards the alleged debt and asking the collection agency to verify its validity. 2. San Bernardino, California, Debt Validation Request Letter: Requesting the collection agency to validate the alleged debt by providing documentation supporting their claim. 3. San Bernardino, California, Letter of Disagreement: Expressing disagreement with the alleged debt and demanding proof from the collection agency to substantiate their claim. 4. San Bernardino, California, Cease and Desist Letter: Demanding the collection agency to halt any further communication or collection attempts until the debt's validity and accuracy have been confirmed. 5. San Bernardino, California, Debt Verification Request: Requesting the collection agency to provide detailed information about the alleged debt, including the original creditor, account number, and transaction history. These are some possible variations of the San Bernardino, California, letter denying alleged debts and requesting collection agencies to validate the debt. The specific wording and details within each letter may vary based on the individual circumstances and legal advice.San Bernardino, California, is a city located in the Inland Empire region of Southern California. Situated east of Los Angeles, San Bernardino is known for its rich history, diverse culture, and natural beauty. With a population of over 215,000 residents, this vibrant city offers a wide range of attractions and opportunities. In a Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, the alleged debtor or their representative expresses their disagreement regarding the existence of the debt in question. The letter raises doubts about the validity of the alleged debt and requests the collection agency to provide evidence to validate the claim. The purpose of this letter is to dispute the debt and protect the alleged debtor's rights. By sending such a letter, the alleged debtor aims to urge the collection agency to either provide substantial proof of the debt's legitimacy or cease any further collection attempts. This letter serves as a tool for the alleged debtor to exercise their rights under the Fair Debt Collection Practices Act (FD CPA) while also seeking validation and clarification about the alleged debt. Different types of San Bernardino, California, letters denying alleged debts and requesting collection agencies to validate the debt may include variations in wording or specific details, but their purpose remains the same: to challenge the legitimacy of the claimed debt and request evidence from the collection agency. Some possible variations of this letter could include: 1. San Bernardino, California, Debt Dispute Letter: Denying any obligation towards the alleged debt and asking the collection agency to verify its validity. 2. San Bernardino, California, Debt Validation Request Letter: Requesting the collection agency to validate the alleged debt by providing documentation supporting their claim. 3. San Bernardino, California, Letter of Disagreement: Expressing disagreement with the alleged debt and demanding proof from the collection agency to substantiate their claim. 4. San Bernardino, California, Cease and Desist Letter: Demanding the collection agency to halt any further communication or collection attempts until the debt's validity and accuracy have been confirmed. 5. San Bernardino, California, Debt Verification Request: Requesting the collection agency to provide detailed information about the alleged debt, including the original creditor, account number, and transaction history. These are some possible variations of the San Bernardino, California, letter denying alleged debts and requesting collection agencies to validate the debt. The specific wording and details within each letter may vary based on the individual circumstances and legal advice.

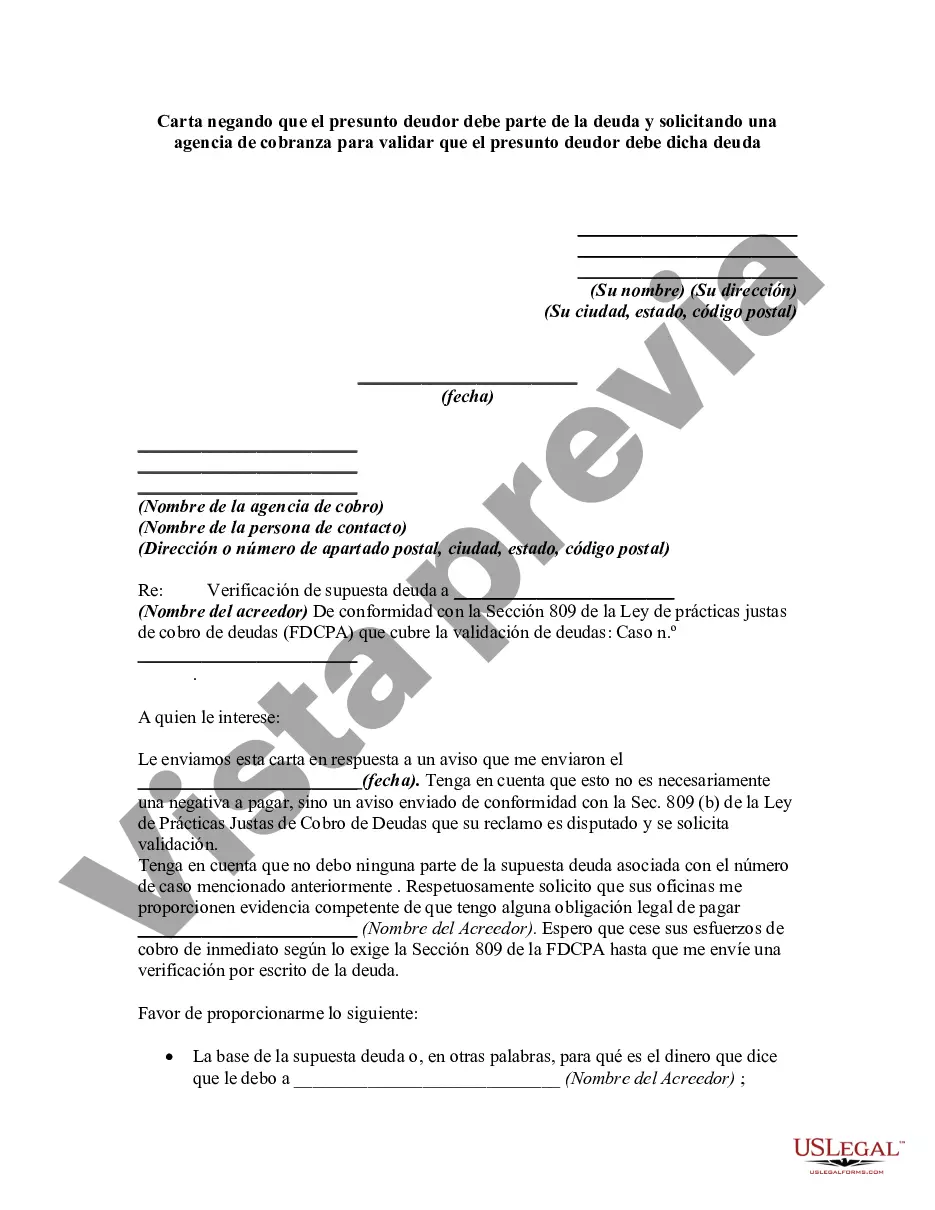

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.