Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

A Santa Clara California letter denying that an alleged debtor owes any part of the debt and requesting a collection agency to validate the alleged debtor's obligation can be a powerful tool when dealing with debt-related issues. It is crucial to draft a detailed and legally sound document to assert your rights as a debtor and request proof of the alleged debt. Here are some key elements and variations you may consider for a Santa Clara California letter: 1. Heading: Start the letter with a clear and concise heading, such as: — "Letter Denying Debtor's Obligation and Requesting Validation of Alleged Debt." — "Debtor's Written Denial of Outstanding Debt with Request for Debt Validation." 2. Introduction: Begin by addressing the collection agency or creditor by name, and provide your contact information. — Clearly state that you are writing on behalf of the alleged debtor. 3. Debt Denial: Firmly deny the debtor's obligation to pay any part of the alleged debt and explain the reasons for the denial. — Use keywords like "denial," "refutation," "non-recognition" to emphasize your position. — Clearly state that the debtor disputes the validity, accuracy, or existence of the debt. 4. Legal Rights: Mention the debtor's rights under the federal Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). — Keywords: "consumer rights," "debt collection laws," "debt validation rights." 5. Request Validation: Clearly request the collection agency to validate the alleged debt and supply specific information that substantiates the obligation. — Keywords: "debt validation request," "verification of debt," "proof of obligation." — Specify that the collection agency must provide details such as the original creditor, the amount owed, and the date the debt was incurred. 6. Supporting Documents: State that the debtor expects the collection agency to provide copies of any agreements, contracts, billing statements, or other supporting documentation related to the alleged debt. — Emphasize that failing to validate the debt may result in potential legal action against the collection agency for violations of debt collection laws. 7. Response Deadline: Specify a reasonable timeframe (typically within 30 days) for the collection agency to respond to your letter and provide the requested validation. — Mention that the debtor expects a prompt response within the designated timeframe. — Stress that failure to respond within the given timeframe will be considered a violation of the debtor's rights. 8. Closing: Express appreciation for the opportunity to resolve the matter amicably and restate your expectation of a timely response. — Provide contact information for further communication. — Encourage the collection agency to cooperate to avoid unnecessary legal actions and potential damages. Remember to adapt the language and framework of the letter to suit your specific situation while using relevant keywords targeting Santa Clara California and debt situations. It may also be advisable to consult with an attorney or legal professional when composing such a letter to ensure its compliance with applicable laws and regulations.A Santa Clara California letter denying that an alleged debtor owes any part of the debt and requesting a collection agency to validate the alleged debtor's obligation can be a powerful tool when dealing with debt-related issues. It is crucial to draft a detailed and legally sound document to assert your rights as a debtor and request proof of the alleged debt. Here are some key elements and variations you may consider for a Santa Clara California letter: 1. Heading: Start the letter with a clear and concise heading, such as: — "Letter Denying Debtor's Obligation and Requesting Validation of Alleged Debt." — "Debtor's Written Denial of Outstanding Debt with Request for Debt Validation." 2. Introduction: Begin by addressing the collection agency or creditor by name, and provide your contact information. — Clearly state that you are writing on behalf of the alleged debtor. 3. Debt Denial: Firmly deny the debtor's obligation to pay any part of the alleged debt and explain the reasons for the denial. — Use keywords like "denial," "refutation," "non-recognition" to emphasize your position. — Clearly state that the debtor disputes the validity, accuracy, or existence of the debt. 4. Legal Rights: Mention the debtor's rights under the federal Fair Debt Collection Practices Act (FD CPA) and the California Rosenthal Fair Debt Collection Practices Act (RFD CPA). — Keywords: "consumer rights," "debt collection laws," "debt validation rights." 5. Request Validation: Clearly request the collection agency to validate the alleged debt and supply specific information that substantiates the obligation. — Keywords: "debt validation request," "verification of debt," "proof of obligation." — Specify that the collection agency must provide details such as the original creditor, the amount owed, and the date the debt was incurred. 6. Supporting Documents: State that the debtor expects the collection agency to provide copies of any agreements, contracts, billing statements, or other supporting documentation related to the alleged debt. — Emphasize that failing to validate the debt may result in potential legal action against the collection agency for violations of debt collection laws. 7. Response Deadline: Specify a reasonable timeframe (typically within 30 days) for the collection agency to respond to your letter and provide the requested validation. — Mention that the debtor expects a prompt response within the designated timeframe. — Stress that failure to respond within the given timeframe will be considered a violation of the debtor's rights. 8. Closing: Express appreciation for the opportunity to resolve the matter amicably and restate your expectation of a timely response. — Provide contact information for further communication. — Encourage the collection agency to cooperate to avoid unnecessary legal actions and potential damages. Remember to adapt the language and framework of the letter to suit your specific situation while using relevant keywords targeting Santa Clara California and debt situations. It may also be advisable to consult with an attorney or legal professional when composing such a letter to ensure its compliance with applicable laws and regulations.

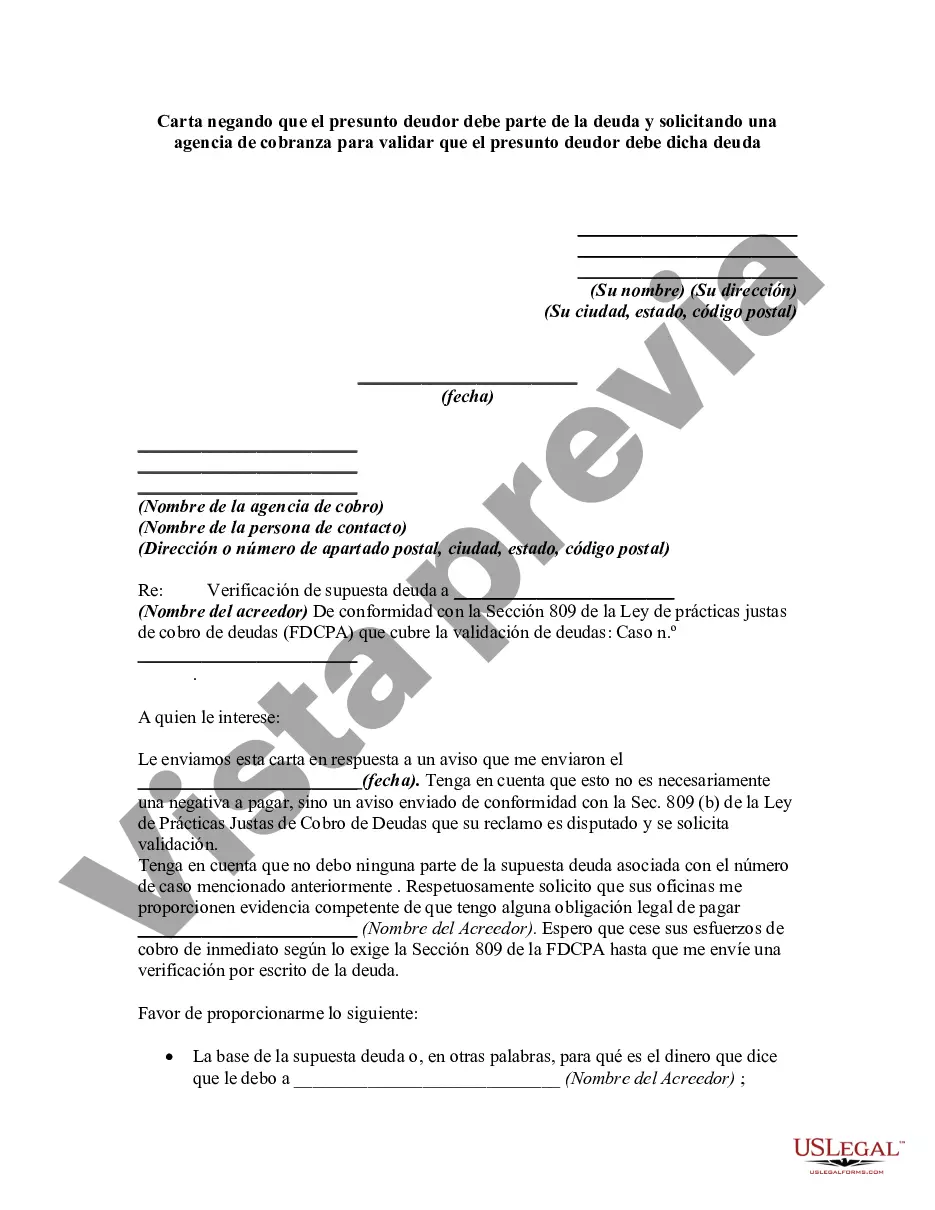

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.