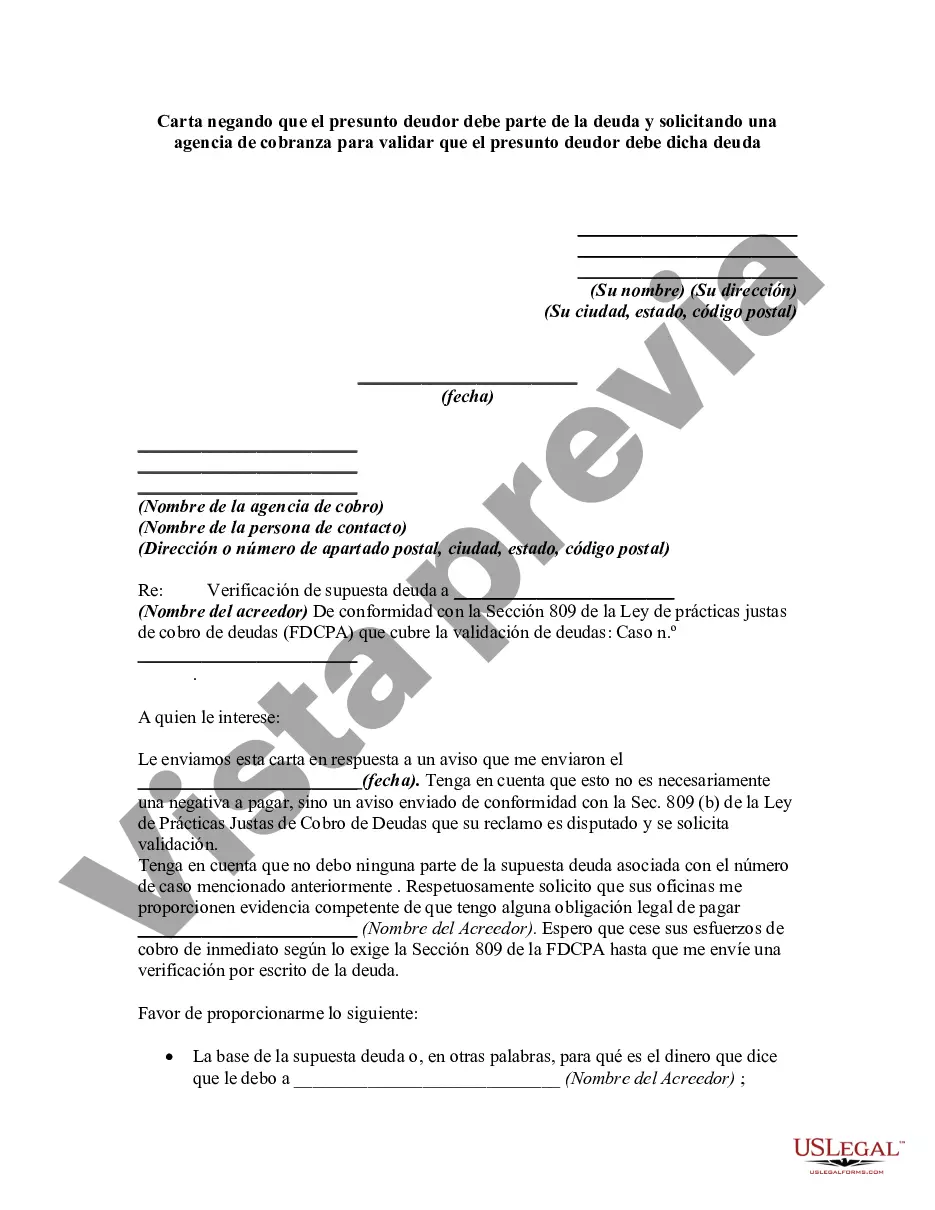

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

There are various types of Travis Texas letters that can be used to deny an alleged debtor's obligation to repay a debt and request a collection agency to provide validation of the alleged debt. These letters are typically sent to dispute the validity of the debt and ensure that proper verification is obtained. Here is a detailed description of Travis Texas letter variations and their relevant keywords: 1. Travis Texas Letter Denying Debt & Requesting Validation: This type of letter is used to state unequivocally that the alleged debtor does not owe any part of the debt and to demand that the collection agency validate the debt by providing evidence of its legitimacy. The letter may include keywords such as debt denial, invalid debt claim, debt verification request, validation demand, Travis Texas letter. 2. Travis Texas Letter Denying Specific Debt Details: Sometimes, an alleged debtor may not dispute the entire debt amount but may challenge specific details of the debt, such as incorrect dates, erroneous charges, or mistaken identity. In this variation, the letter would focus on disputing these specific elements and request the collection agency to validate the accurate debt amount related to the remainder. Keywords may include specific debt denial, dispute details, debt element validation, Travis Texas letter. 3. Travis Texas Letter Denying Statute of Limitations Debt: If the alleged debt is past the statute of limitations, a debtor can use this specialized letter to deny the obligation. The letter would assert that the debt is time-barred and demand the collection agency cease collection activities. Keywords for this type of letter may include statute of limitations denial, time-barred debt, collection cease demand, Travis Texas letter. 4. Travis Texas Letter Denying Unauthorized Debt: In cases where a debtor contests the validity of the debt due to identity theft, fraud, or unauthorized charges, this specific variation would focus on expressing the denial of the debt on these grounds. The letter would request the collection agency to provide relevant documentation proving that the debt is indeed the debtor's own responsibility. Keywords may include unauthorized debt denial, identity theft, fraud dispute, debt responsibility proof, Travis Texas letter. 5. Travis Texas Letter Denying Inaccurate Credit Reporting: If the alleged debtor believes that the collection agency has inaccurately reported the debt on their credit report, they can use this type of letter to deny the debt and request the agency to correct any erroneous reporting. The letter would assert the inaccurate credit reporting and demand proper rectification. Keywords may include credit report denial, inaccurate reporting dispute, credit reporting correction, Travis Texas letter. These variations of the Travis Texas letter denying the alleged debtor's obligation and requesting validation cater to specific scenarios and help ensure the accuracy and legitimacy of the debt in question.There are various types of Travis Texas letters that can be used to deny an alleged debtor's obligation to repay a debt and request a collection agency to provide validation of the alleged debt. These letters are typically sent to dispute the validity of the debt and ensure that proper verification is obtained. Here is a detailed description of Travis Texas letter variations and their relevant keywords: 1. Travis Texas Letter Denying Debt & Requesting Validation: This type of letter is used to state unequivocally that the alleged debtor does not owe any part of the debt and to demand that the collection agency validate the debt by providing evidence of its legitimacy. The letter may include keywords such as debt denial, invalid debt claim, debt verification request, validation demand, Travis Texas letter. 2. Travis Texas Letter Denying Specific Debt Details: Sometimes, an alleged debtor may not dispute the entire debt amount but may challenge specific details of the debt, such as incorrect dates, erroneous charges, or mistaken identity. In this variation, the letter would focus on disputing these specific elements and request the collection agency to validate the accurate debt amount related to the remainder. Keywords may include specific debt denial, dispute details, debt element validation, Travis Texas letter. 3. Travis Texas Letter Denying Statute of Limitations Debt: If the alleged debt is past the statute of limitations, a debtor can use this specialized letter to deny the obligation. The letter would assert that the debt is time-barred and demand the collection agency cease collection activities. Keywords for this type of letter may include statute of limitations denial, time-barred debt, collection cease demand, Travis Texas letter. 4. Travis Texas Letter Denying Unauthorized Debt: In cases where a debtor contests the validity of the debt due to identity theft, fraud, or unauthorized charges, this specific variation would focus on expressing the denial of the debt on these grounds. The letter would request the collection agency to provide relevant documentation proving that the debt is indeed the debtor's own responsibility. Keywords may include unauthorized debt denial, identity theft, fraud dispute, debt responsibility proof, Travis Texas letter. 5. Travis Texas Letter Denying Inaccurate Credit Reporting: If the alleged debtor believes that the collection agency has inaccurately reported the debt on their credit report, they can use this type of letter to deny the debt and request the agency to correct any erroneous reporting. The letter would assert the inaccurate credit reporting and demand proper rectification. Keywords may include credit report denial, inaccurate reporting dispute, credit reporting correction, Travis Texas letter. These variations of the Travis Texas letter denying the alleged debtor's obligation and requesting validation cater to specific scenarios and help ensure the accuracy and legitimacy of the debt in question.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.