Title: Demanding Debt Validation: Fairfax, Virginia's Second Letter to Collection Agency Keywords: Fairfax, Virginia, second letter, requesting, collection agency, validate debt, creditor Introduction: In the realm of debt collection, it is crucial for individuals to exercise their rights and ensure the accuracy and legitimacy of their debts. This article discusses the process of drafting a second letter to a collection agency in Fairfax, Virginia, requesting validation of a debt allegedly owed to a creditor. Emphasizing the importance of clear communication and adhering to the laws governing debt collection, this guide aims to assist recipients in navigating the debt validation process effectively. 1. Understanding Debt Validation: — Definition: Explaining what debt validation entails and its purpose. — Legal rights: Discussing the Fair Debt Collection Practices Act (FD CPA) and its applicability in Fairfax, Virginia. — Timeframe: Highlighting the 30-day window for a consumer to request debt validation after the initial contact with a collection agency. 2. First Letter Recap: — Brief overview: Reiterating the purpose and content of the first letter sent to the collection agency. — Importance of maintaining documented communication: Stressing the significance of retaining copies of all previous correspondence for future reference. 3. Drafting a Second Letter: — Introduction and salutation: Properly addressing the collection agency and adhering to professional writing etiquette. — Clearly referencing previous communication: Providing the date and subject of the initial letter requesting debt validation. — Detailed description of the debt: Including relevant information such as the creditor's name, the alleged amount owed, and any supporting documentation (if available). — Request for validation: Explicitly demanding the collection agency provide evidence substantiating the existence and validity of the debt. — Reminder of the 30-day timeframe: Urging the collection agency to respond within the legally mandated period. — Enclosing a cease-and-desist request: Optionally including a request to cease all communication until the validation process is complete. — Signature and contact information: Signing the letter and providing accurate contact details for future correspondence. Types of Fairfax, Virginia Second Letter Requests for Debt Validation: 1. Standard Second Letter: A comprehensive template suitable for individuals seeking debt validation after the initial contact with a collection agency. 2. Cease-and-Desist Second Letter: A variation of the standard letter that requests validation while concurrently instructing the collection agency to halt further communication until the validation process concludes. 3. Escalated Second Letter: A more assertive approach, suitable for situations where the collection agency fails to respond or provide adequate validation to the first letter. This letter escalates the urgency and emphasizes the potential consequences of non-compliance with the FD CPA. Conclusion: When dealing with debt collection in Fairfax, Virginia, individuals must be aware of their rights and obligations. Crafting a second letter, requesting collection agencies to validate alleged debts, empowers consumers to safeguard their financial well-being. By adhering to the guidelines presented in this article, individuals can navigate the debt validation process effectively and maintain control over their financial affairs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Segunda carta solicitando a una agencia de cobro que valide una deuda que supuestamente le debe a un acreedor - Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Fairfax Virginia Segunda Carta Solicitando A Una Agencia De Cobro Que Valide Una Deuda Que Supuestamente Le Debe A Un Acreedor?

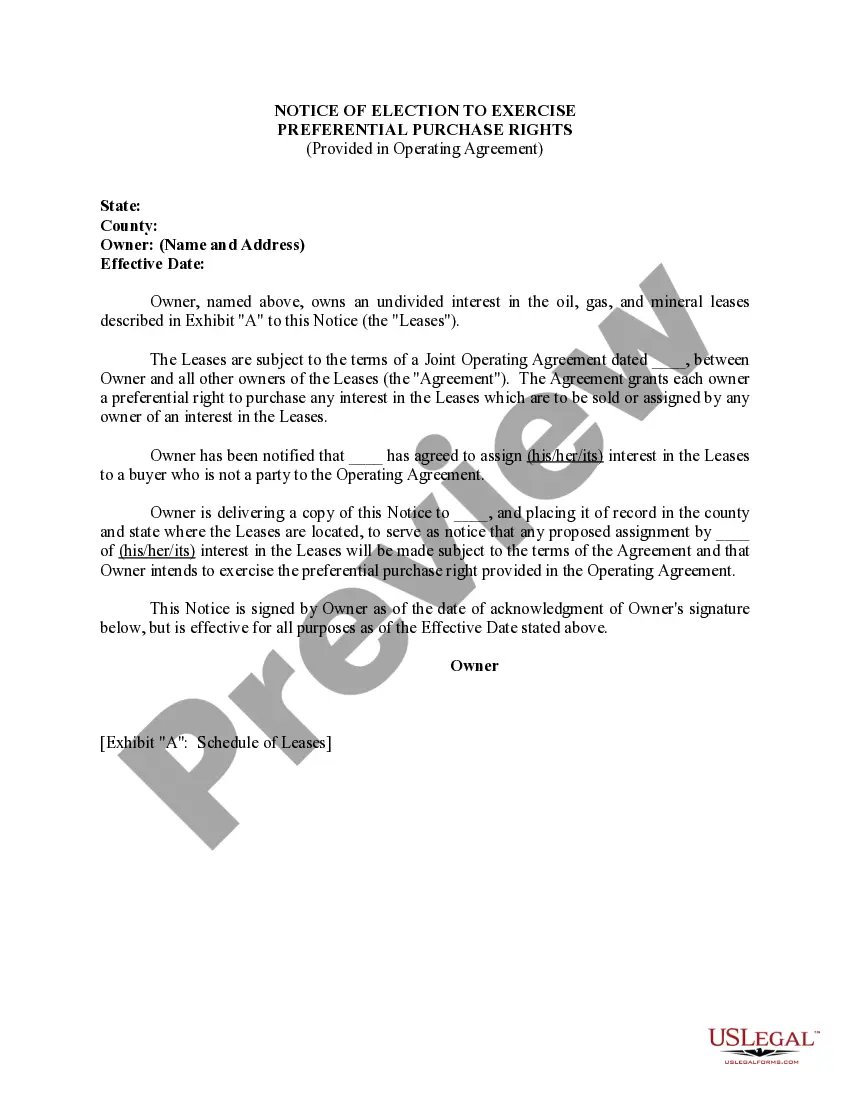

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Fairfax Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Fairfax Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Fairfax Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!