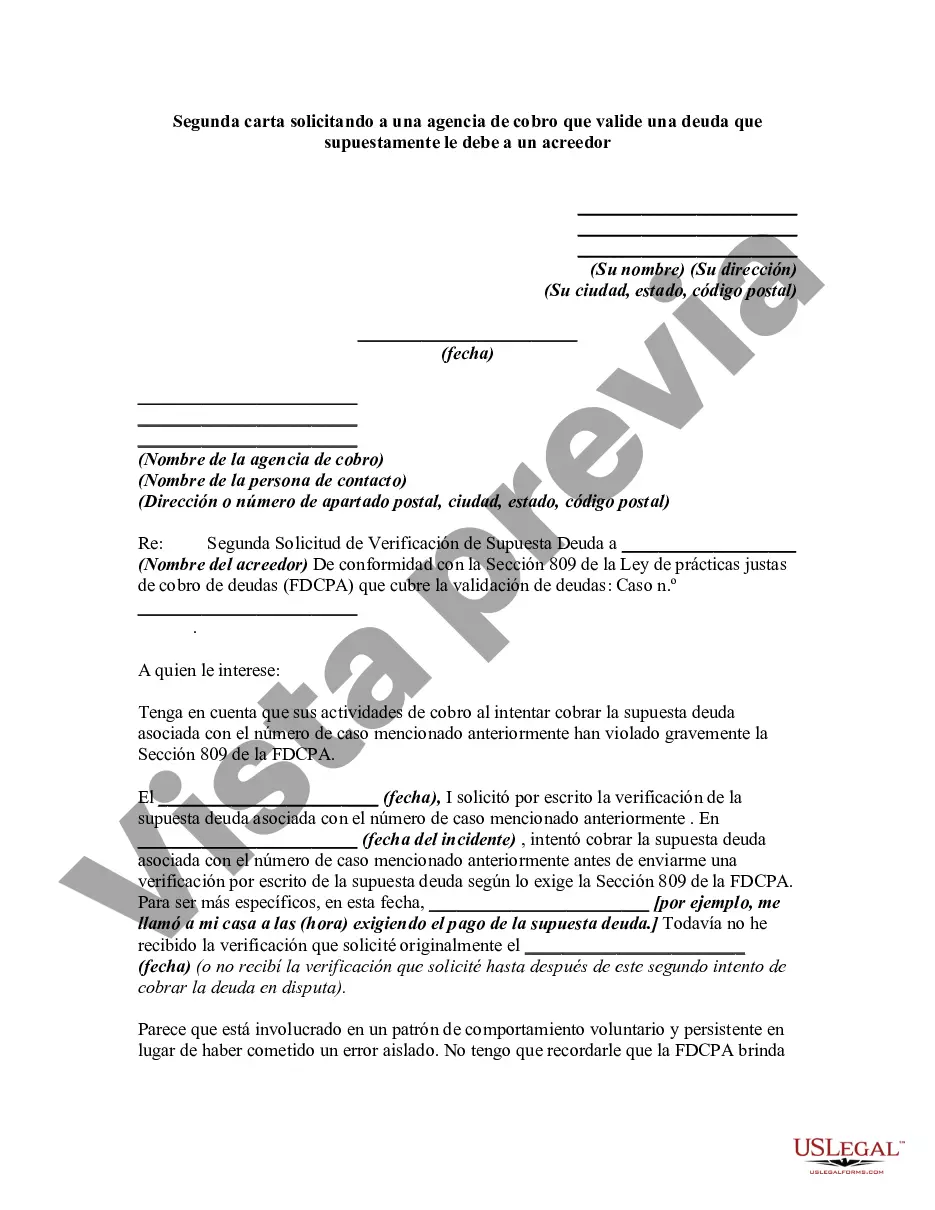

Harris Texas Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor: A Comprehensive Guide In Harris County, Texas, when dealing with a collection agency regarding a debt that you allegedly owe to a creditor, it is crucial to follow the proper steps to protect your rights as a consumer. One important step is to send a second letter requesting the collection agency to validate the debt. This letter acts as a formal request asking the agency to provide detailed information and evidence to prove that you are indeed responsible for the debt they claim you owe. Here is a breakdown of the key elements to include in your Harris Texas second letter requesting debt validation, along with relevant keywords: 1. Header: — Use an official letterhead or personal information in the top corner, including your name, address, and contact details (phone number and email). — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 2. Date: — Write the current date when the letter is being sent. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 3. Recipient's Information: — Include the collection agency's name, address, and contact details. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 4. Salutation: — Address the recipient formally using "Dear," followed by the recipient's name or title. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 5. Reference Information: — Clearly reference your previous correspondence with the collection agency, including the date of the initial letter sent. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 6. Request for Debt Validation: — Politely request the collection agency to provide specific documents and information that establish the validity and enforceability of the alleged debt. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 7. Detailed Explanation: — Clearly outline your concerns regarding the alleged debt, raising questions about its legitimacy and accuracy. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 8. Documents and Evidence: — Request the collection agency to provide copies of the original signed contract, account statements, payment history, and any other relevant documents to validate the debt. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 9. Legal Compliance: — Highlight that you are aware of your rights under relevant federal and state laws, such as the Fair Debt Collection Practices Act (FD CPA) and the Texas Debt Collection Act, and emphasize the necessity for the agency to comply with these regulations. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 10. Response Deadline: — Specify a reasonable timeframe (typically 30 days) within which you expect the collection agency to respond and provide the requested debt validation documentation. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 11. Closing: — Politely and professionally close the letter, expressing your expectation for a timely response from the agency. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 12. Enclosures: — Mention any additional documents or evidence you are including with the letter, such as copies of previous correspondence or a copy of the original debt validation letter. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. 13. Signature Block: — Sign the letter in ink above your typed name, providing additional contact information if necessary. — Keywords: Harris Texas, second letter, debt validation, collection agency, creditor. It's important to note that this is a general outline for a Harris Texas second letter requesting a collection agency to validate a debt, and you should consult with a legal professional or credit counseling agency for specific advice tailored to your situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Segunda carta solicitando a una agencia de cobro que valide una deuda que supuestamente le debe a un acreedor - Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Harris Texas Segunda Carta Solicitando A Una Agencia De Cobro Que Valide Una Deuda Que Supuestamente Le Debe A Un Acreedor?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the recent version of the Harris Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Harris Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!