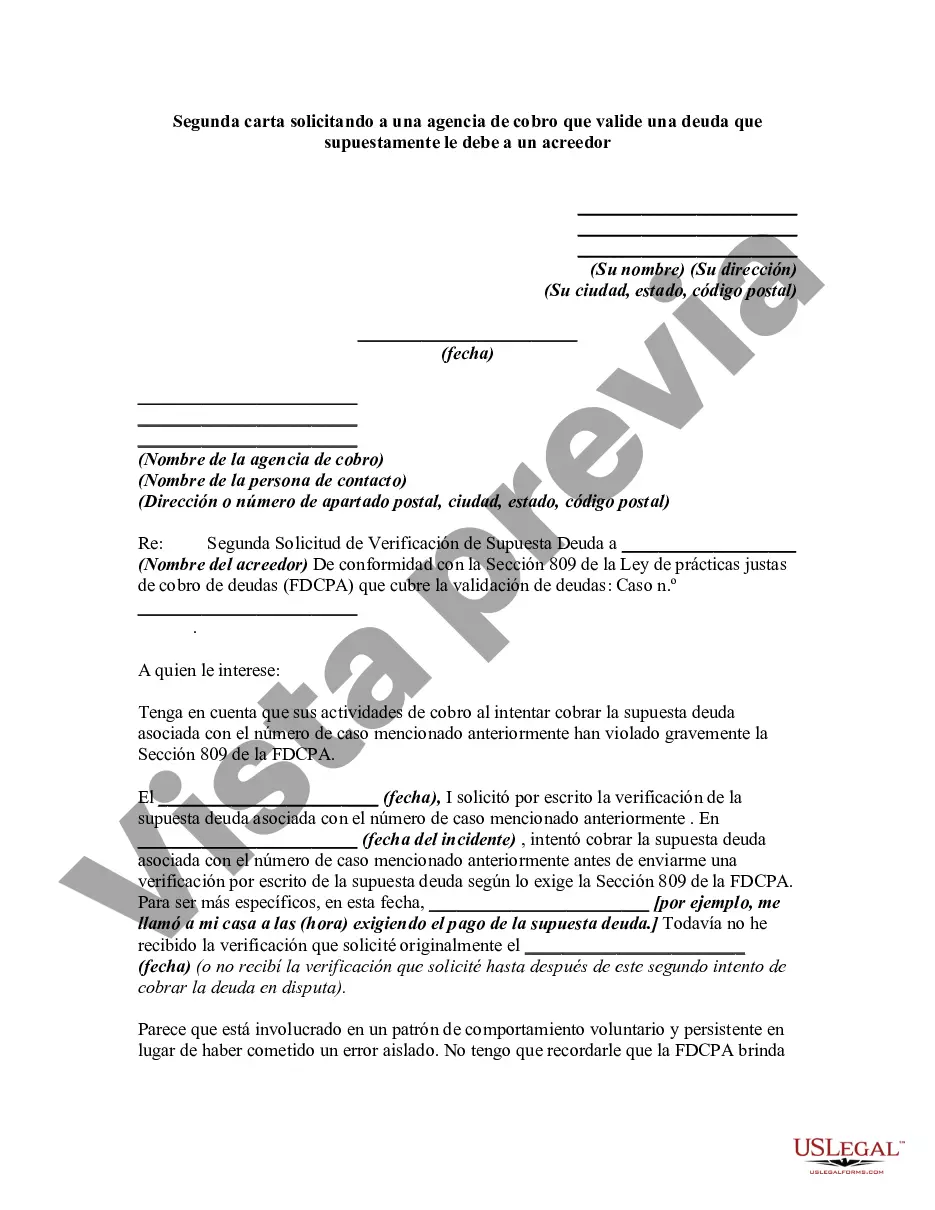

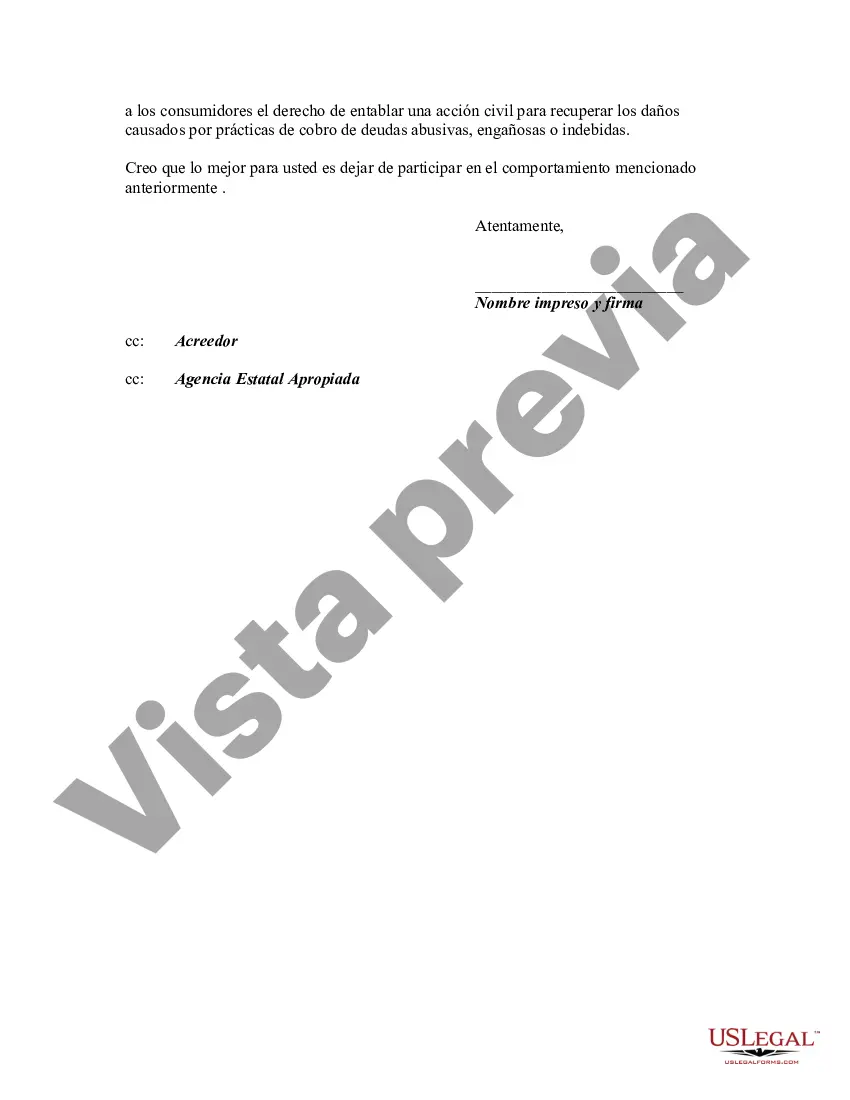

San Bernardino, California is a vibrant city located in the Inland Empire region of Southern California. Known for its beautiful landscapes, cultural diversity, and historical significance, San Bernardino offers a wide range of attractions and amenities for residents and visitors alike. The second letter requesting a collection agency to validate a debt that you allegedly owe a creditor is a crucial step in protecting your rights as a consumer. It is essential to assert your rights under the Fair Debt Collection Practices Act (FD CPA) and ensure that the debt being claimed is legitimate and accurate. When drafting the second letter, consider including important keywords to strengthen your request. Some relevant keywords for this letter could be: 1. Debt Validation: Clearly specify in your letter that you are requesting the collection agency to validate the debt, including providing evidence of the creditor's claim. 2. Creditor Information: Request the collection agency to provide complete details about the original creditor, such as their name, address, and contact information. 3. Proof of Authorization: Ask the collection agency to validate their authority to collect the debt on behalf of the creditor, including providing a copy of the signed agreement or contract. 4. Account Statements: Request copies of the account statements indicating the amount owed, including any fees, interest, or penalties. 5. Verification of Ownership: Inquire about the collection agency's ownership of the debt and request documentation proving their legal right to collect. 6. Deadline for Response: Set a reasonable deadline for the collection agency to provide the requested information and clearly state the consequences of non-compliance, such as potential legal action. 7. Certified Mail: Send the letter via certified mail with a return receipt requested to ensure proof of delivery. By incorporating these relevant keywords, you can effectively communicate your expectations and exercise your rights while requesting that the collection agency validate the alleged debt. Please note that there may not be different types of San Bernardino California Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor. The content provided in this response focuses on drafting a comprehensive letter with relevant keywords to address the debt validation process effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Carta De Validacion De Deuda - Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out San Bernardino California Segunda Carta Solicitando A Una Agencia De Cobro Que Valide Una Deuda Que Supuestamente Le Debe A Un Acreedor?

Draftwing documents, like San Bernardino Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, to take care of your legal affairs is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for a variety of scenarios and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the San Bernardino Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting San Bernardino Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor:

- Make sure that your form is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the San Bernardino Second Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!