Title: Understanding Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties Introduction: When it comes to debt collection practices, debtors have rights that protect them from harassment and invasion of privacy. One such protection mechanism is the Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties. In this article, we will delve into the details of this notice, its purpose, and shed light on different types that debtors and collectors should be aware of. 1. Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties Explained: The Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties is a legal notice that serves to prevent debt collectors from communicating with third parties regarding a debtor's outstanding debt. This notice acts as a shield, safeguarding the debtor's privacy and providing a clear understanding of what debt collectors can and cannot do. 2. Types of Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties: a. Basic Harris Texas Notice: This is the standard notice, which explicitly informs debt collectors that they are prohibited from contacting third parties, such as family members, friends, neighbors, or employers, to disclose a debtor's debt situation. b. Timeframe Notice: Sometimes, debtors may impose a specific timeframe within which debt collectors are required to cease all communication with third parties. This variation of the notice clarifies the timeframe after which the debtor expects the debt collector to respect their privacy. c. Specific Exceptions Notice: In certain situations, debtors may grant consent to contact specific third parties to discuss their debt. This notice outlines the exceptions explicitly, specifying the individuals or entities that debt collectors are allowed to contact in order to verify the debtor's location or employment. 3. Objectives of the Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties: a. Protection from Harassment: The notice aims to shield debtors from persistent and intrusive communication practices employed by debt collectors in an attempt to recover outstanding debts. b. Safeguarding Privacy: By enforcing limitations on contacting third parties, the notice ensures that debtors' personal and financial information remains confidential and is not unnecessarily exposed to individuals who may not have any business knowing about it. c. Preventing Reputation Damage: Debt collectors sometimes employ aggressive tactics that involve disclosing a debtor's financial situation to others. The notice prevents these actions, thereby safeguarding the debtor's reputation and preventing potential harm to relationships or employment opportunities. Conclusion: The Harris Texas Notice to Debt Collector — Unlawful Messages to 3rd Parties is a valuable legal tool designed to protect debtors from undue harassment, invasion of privacy, and reputational harm. It offers clear guidelines for debt collectors to follow, ensuring compliant and ethical debt collection practices. By understanding the various types of this notice, debtors can effectively exercise their rights and maintain control over their personal and financial information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso al cobrador de deudas - Mensajes ilegales a terceros - Notice to Debt Collector - Unlawful Messages to 3rd Parties

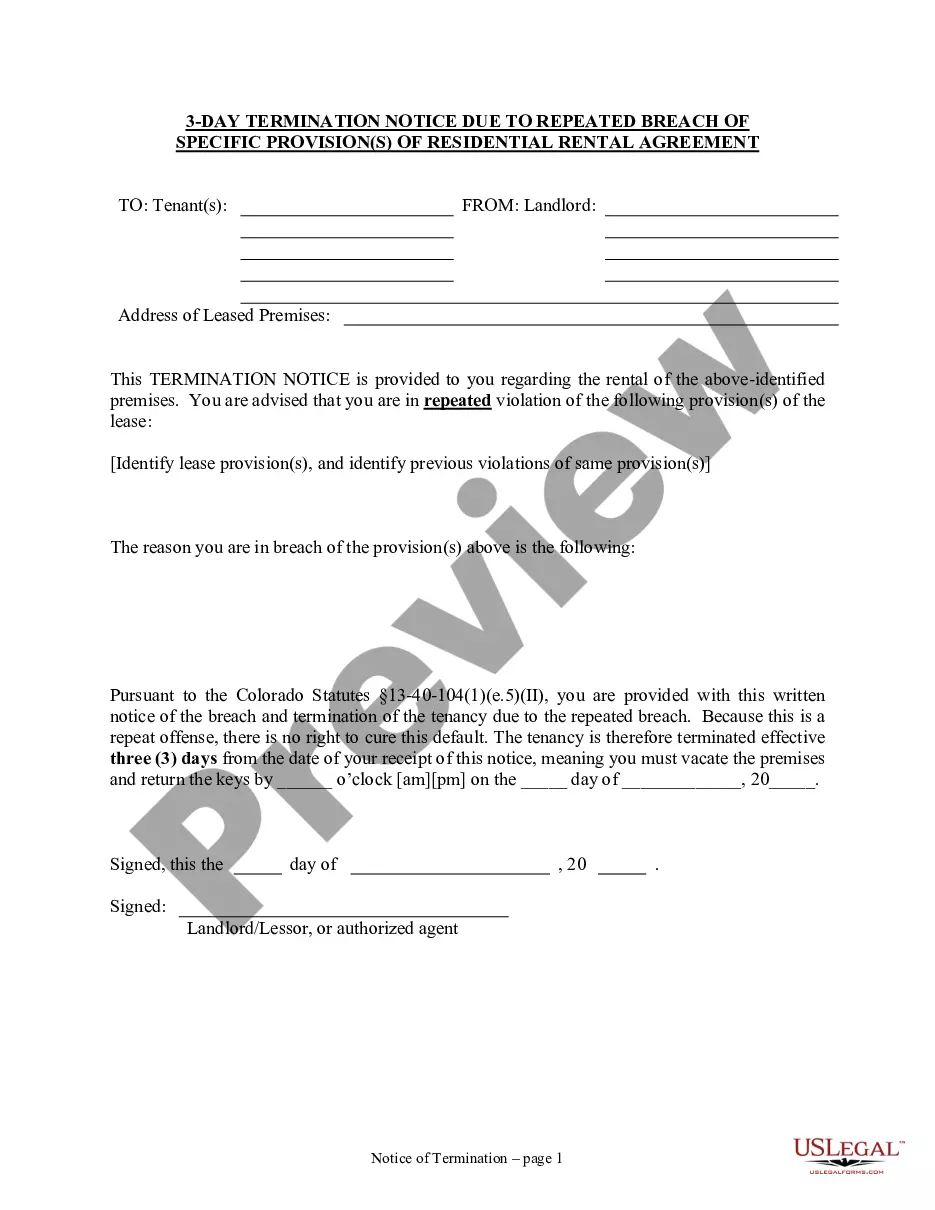

Description

How to fill out Harris Texas Aviso Al Cobrador De Deudas - Mensajes Ilegales A Terceros?

If you need to get a reliable legal document supplier to find the Harris Notice to Debt Collector - Unlawful Messages to 3rd Parties, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Harris Notice to Debt Collector - Unlawful Messages to 3rd Parties, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Harris Notice to Debt Collector - Unlawful Messages to 3rd Parties template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Harris Notice to Debt Collector - Unlawful Messages to 3rd Parties - all from the convenience of your home.

Sign up for US Legal Forms now!