A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda In Fulton County, Georgia, individuals have certain rights when it comes to debt collection practices. The mini-Miranda warning is a crucial component that debt collectors must adhere to in order to protect consumers' rights. Failure to provide the mini-Miranda warning can have serious consequences for debt collectors, including potential legal action against them. The mini-Miranda warning is a statement that debt collectors must make to individuals when initiating communication regarding a debt. It serves to inform the debtor of their rights and ensure transparency in the collection process. The intent is to prevent deceptive or abusive practices and give debtors the necessary information to make informed decisions. There are various types of Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda, including: 1. Written Notice: Debt collectors are required to provide written notice that includes the mini-Miranda warning within five days of the initial communication. This notice should clearly state the purpose of the communication, the amount of the debt, and the debtor's rights. 2. Verbal Warning: In addition to the written notice, debt collectors must provide the mini-Miranda warning during any verbal communication with the debtor regarding the debt. This ensures that debtors are aware of their rights at all times during the collection process. 3. Recorded Conversations: If a debt collector records conversations with debtors, they should ensure that the mini-Miranda warning is part of the recording. This serves as evidence that the warning was provided, protecting both parties in case of any disputes. Failure to provide the mini-Miranda warning can lead to legal consequences for debt collectors. Debtors who have not been properly informed of their rights may have grounds to take legal action against the debt collector for violating the Fair Debt Collection Practices Act (FD CPA). This can result in penalties, fines, and potential damages awarded to the debtor. It is essential for debt collectors in Fulton County, Georgia, to understand and comply with the mini-Miranda requirements to avoid any legal complications. By providing the warning in both written and verbal communications, debt collectors can ensure transparency and protect both their interests and those of the debtors. In conclusion, the Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda is a crucial legal requirement aimed at protecting consumers' rights during debt collection. Debt collectors must provide both written and verbal warnings to debtors, ensuring transparency and preventing deceptive practices. Failure to comply with the mini-Miranda requirements can lead to legal consequences for debt collectors, emphasizing the importance of adhering to these guidelines.

Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda In Fulton County, Georgia, individuals have certain rights when it comes to debt collection practices. The mini-Miranda warning is a crucial component that debt collectors must adhere to in order to protect consumers' rights. Failure to provide the mini-Miranda warning can have serious consequences for debt collectors, including potential legal action against them. The mini-Miranda warning is a statement that debt collectors must make to individuals when initiating communication regarding a debt. It serves to inform the debtor of their rights and ensure transparency in the collection process. The intent is to prevent deceptive or abusive practices and give debtors the necessary information to make informed decisions. There are various types of Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda, including: 1. Written Notice: Debt collectors are required to provide written notice that includes the mini-Miranda warning within five days of the initial communication. This notice should clearly state the purpose of the communication, the amount of the debt, and the debtor's rights. 2. Verbal Warning: In addition to the written notice, debt collectors must provide the mini-Miranda warning during any verbal communication with the debtor regarding the debt. This ensures that debtors are aware of their rights at all times during the collection process. 3. Recorded Conversations: If a debt collector records conversations with debtors, they should ensure that the mini-Miranda warning is part of the recording. This serves as evidence that the warning was provided, protecting both parties in case of any disputes. Failure to provide the mini-Miranda warning can lead to legal consequences for debt collectors. Debtors who have not been properly informed of their rights may have grounds to take legal action against the debt collector for violating the Fair Debt Collection Practices Act (FD CPA). This can result in penalties, fines, and potential damages awarded to the debtor. It is essential for debt collectors in Fulton County, Georgia, to understand and comply with the mini-Miranda requirements to avoid any legal complications. By providing the warning in both written and verbal communications, debt collectors can ensure transparency and protect both their interests and those of the debtors. In conclusion, the Fulton Georgia Notice to Debt Collector — Failure to Provide Mini-Miranda is a crucial legal requirement aimed at protecting consumers' rights during debt collection. Debt collectors must provide both written and verbal warnings to debtors, ensuring transparency and preventing deceptive practices. Failure to comply with the mini-Miranda requirements can lead to legal consequences for debt collectors, emphasizing the importance of adhering to these guidelines.

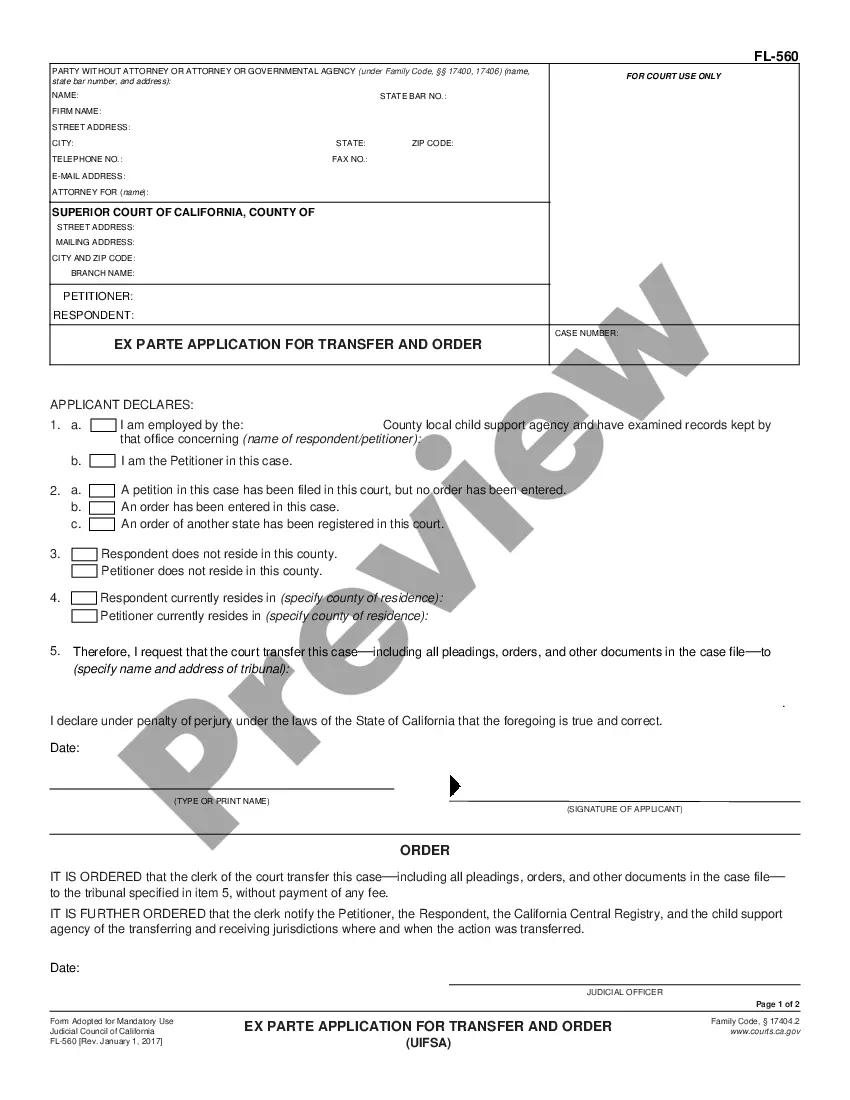

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.