A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication. Hennepin County, located in the state of Minnesota, serves as a major hub for economic and cultural activities. As the most populous county in Minnesota, it encompasses numerous cities, including Minneapolis, the state's largest city. Hennepin is widely known for its diverse population, thriving arts scene, top-notch healthcare facilities, and educational institutions. Now, let's delve into the specific topic of "Hennepin Minnesota Notice to Debt Collector — Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication" and explore the different types of such notices. 1. Hennepin Minnesota Notice to Debt Collector: When an individual residing in Hennepin County falls behind on their debts, they may receive a notice from a debt collector. This notice could be an initial attempt to collect the debt or a subsequent communication regarding the outstanding payment. 2. Causing a Consumer to Incur Charges for Communications: Debt collectors are prohibited from engaging in deceptive or unfair practices while attempting to collect debts. They cannot mislead consumers by concealing the purpose of their communication, which may lead to the consumer incurring unnecessary charges. 3. Concealing the Purpose of the Communication: Debt collectors are required to clearly disclose the purpose of their communication, ensuring that consumers are aware of the nature of the call or message. Concealing the purpose could include making contact under false pretenses or withholding information that may impact the consumer's decision-making process. When a debt collector fails to adhere to these regulations, consumers have legal rights to protect them from unfair and deceptive practices. It is important for consumers in Hennepin County to be informed about their rights and what actions to take if they encounter situations where a debt collector conceals the purpose of their communication, causing them to incur charges. If a consumer receives a notice under these circumstances, they should promptly document the communication, including any charges incurred and details of the interaction. This documentation will be valuable if the consumer decides to file a complaint or take legal action against the debt collector. Consumers should be proactive in understanding their rights by reviewing relevant laws and regulations, such as the Fair Debt Collection Practices Act (FD CPA) and the Minnesota Debt Collection Act. Seeking legal advice or consulting with consumer protection agencies can also be beneficial for individuals facing debt collection issues in Hennepin County. In conclusion, when dealing with debt collection, it is crucial for consumers in Hennepin, Minnesota, to be vigilant about their rights and understand the responsibilities of debt collectors. By staying informed and taking appropriate action when necessary, consumers can protect themselves from deceptive practices and ensure fair treatment in the debt collection process.

Hennepin County, located in the state of Minnesota, serves as a major hub for economic and cultural activities. As the most populous county in Minnesota, it encompasses numerous cities, including Minneapolis, the state's largest city. Hennepin is widely known for its diverse population, thriving arts scene, top-notch healthcare facilities, and educational institutions. Now, let's delve into the specific topic of "Hennepin Minnesota Notice to Debt Collector — Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication" and explore the different types of such notices. 1. Hennepin Minnesota Notice to Debt Collector: When an individual residing in Hennepin County falls behind on their debts, they may receive a notice from a debt collector. This notice could be an initial attempt to collect the debt or a subsequent communication regarding the outstanding payment. 2. Causing a Consumer to Incur Charges for Communications: Debt collectors are prohibited from engaging in deceptive or unfair practices while attempting to collect debts. They cannot mislead consumers by concealing the purpose of their communication, which may lead to the consumer incurring unnecessary charges. 3. Concealing the Purpose of the Communication: Debt collectors are required to clearly disclose the purpose of their communication, ensuring that consumers are aware of the nature of the call or message. Concealing the purpose could include making contact under false pretenses or withholding information that may impact the consumer's decision-making process. When a debt collector fails to adhere to these regulations, consumers have legal rights to protect them from unfair and deceptive practices. It is important for consumers in Hennepin County to be informed about their rights and what actions to take if they encounter situations where a debt collector conceals the purpose of their communication, causing them to incur charges. If a consumer receives a notice under these circumstances, they should promptly document the communication, including any charges incurred and details of the interaction. This documentation will be valuable if the consumer decides to file a complaint or take legal action against the debt collector. Consumers should be proactive in understanding their rights by reviewing relevant laws and regulations, such as the Fair Debt Collection Practices Act (FD CPA) and the Minnesota Debt Collection Act. Seeking legal advice or consulting with consumer protection agencies can also be beneficial for individuals facing debt collection issues in Hennepin County. In conclusion, when dealing with debt collection, it is crucial for consumers in Hennepin, Minnesota, to be vigilant about their rights and understand the responsibilities of debt collectors. By staying informed and taking appropriate action when necessary, consumers can protect themselves from deceptive practices and ensure fair treatment in the debt collection process.

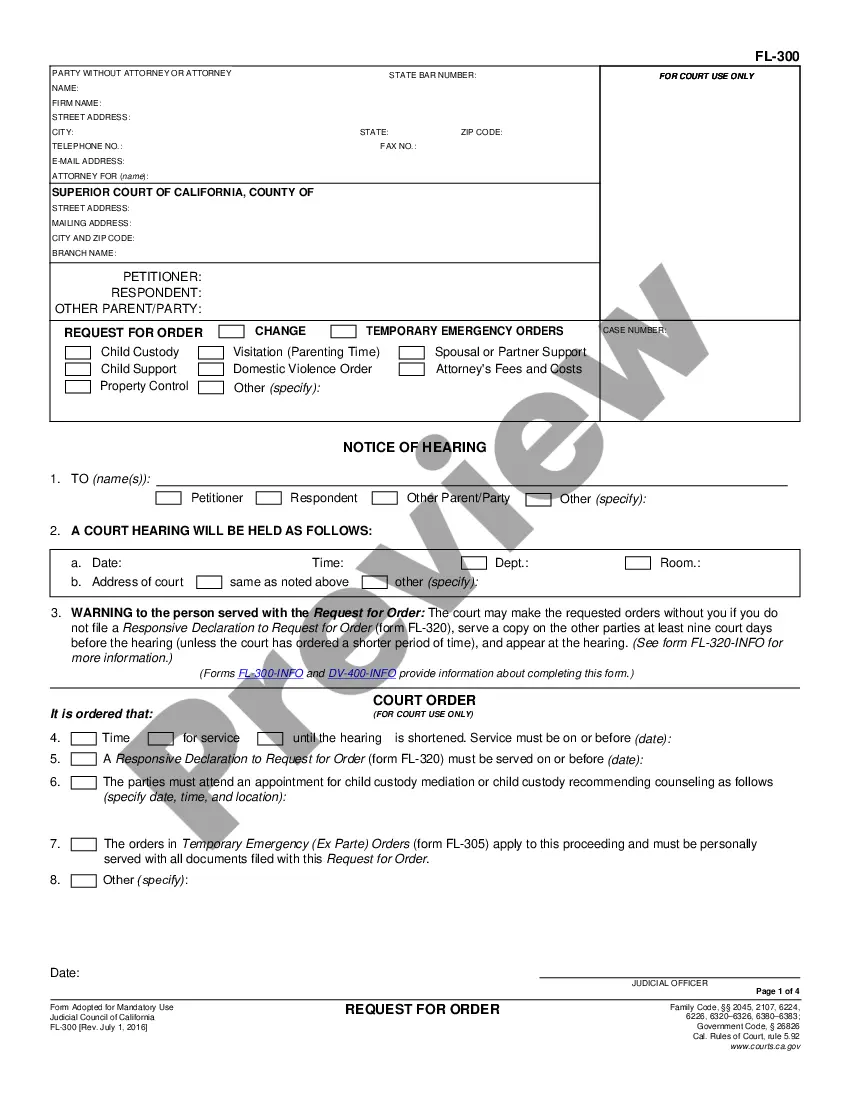

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.